Hear first-hand from Codat client, Plastiq, and their business customer, Sunbasket.

We recently sat down with Plastiq, a B2B payments company, and Sunbasket, one of Plastiq’s customers, to discuss their challenges and the future of B2B payments. Read on to get a rare insight into the world of small businesses, or watch the webinar on-demand here.

Dedicated to helping people lead their healthiest lives, Sunbasket offers its customers meal plans containing only the highest quality seasonal and organic produce from the very best sources. The San-Francisco-based business has been operating since 2014 and has over 800 suppliers ranging from small, family-run farms to larger corporations.

According to VP, Corporate Controller, Todd Smith, this is where things get tricky for Sunbasket. The payment functionality of each supplier varies markedly, as do their requirements for how and when they get paid. For instance, many insist on terms of <10 days, and some can’t accept credit card payments. Juggling these demands places a great deal of strain on Todd’s team.

This is one of the reasons Sunbasket turned to Plastiq, a payments automation platform and cash flow enablement suite committed to providing SMBs with greater control over how they pay and get paid. Outlining the company’s mission, Aditya Mishra, VP, Product Management, explains:

“Plastiq exists because we want to help companies like Sunbasket achieve their growth potential and manage their cash flow properly… Our core strength is the flexibility we’re able to give our customers. It helps companies manage their liquidity preferences and cash flow based on their internal processes.”

The reality for small businesses

Commenting on the current SMB landscape, Aditya adds:

“We keep hearing the same things from many of our customers. As they ramp up with Plastiq, they are doing hundreds and hundreds of transactions on a weekly basis. It becomes super difficult for them to manage reconciliation.”

This is a challenge that Todd is all too familiar with. “There are too many transactions for us to possibly take care of manually,” he explains.

Committed to helping businesses do more with less, Plastiq continues to invest in workflows, automation solutions, and integration capabilities to address the pain point of manual reconciliation.

Aditya identifies integrations as “table-stakes” and “a critical priority for us.”

This sentiment is echoed by Todd, “My biggest objectives are scaling my team, streamlining payment processes, minimizing privacy risks, and synchronizing everything with all the different financial systems we have.”

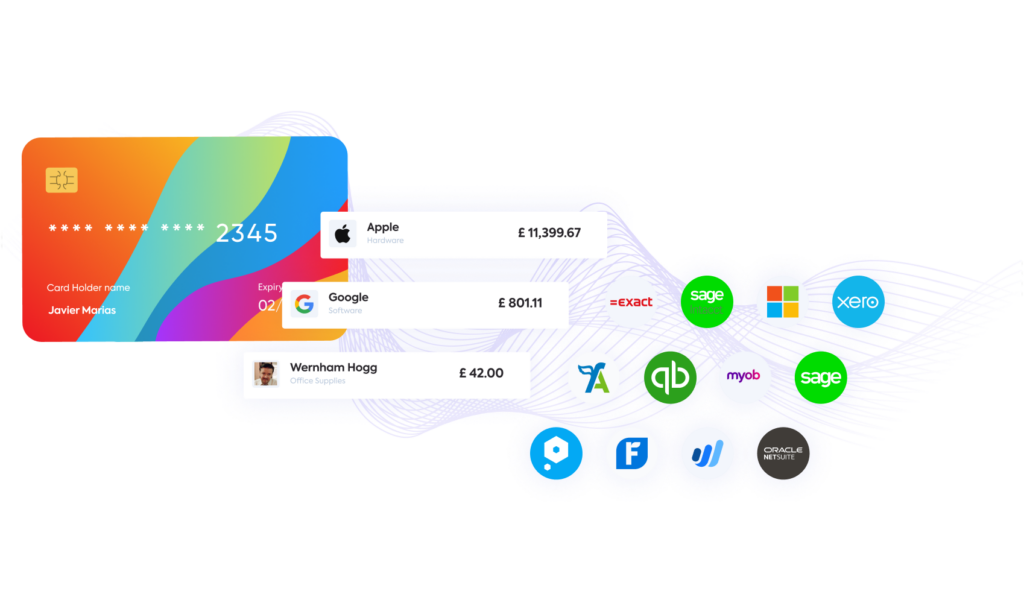

Plastiq relies on Codat’s bi-directional business data APIs to power its accounting integrations. This enables Plastiq to automatically import bills and supplier information from its customers’ various accounting platforms, including Xero and Sage Intacct, and push payments data back for faster, easier, and more accurate reconciliation.

With Codat handling the technical complexities of integration, Plastiq has a solid foundation of clean, standardized, and reliable data to build a winning product. As a result, Plastiq’s customers avoid hours of manual data entry, reduce the risk of human error, and gain greater insight into their financial position on an ongoing basis.

As Plastiq continues to innovate by blurring the lines between AP automation and a working capital solution, Codat continues to support the product by adding new platforms and deepening existing integrations.

Speaking with Todd, it’s clear that a lack of connectivity hampers small business growth and productivity. For business owners to thrive in an increasingly digitized world, the systems they rely on must speak to each other. At Codat, we’re incredibly proud to be working with Plastiq to ensure this is the case for their customers.

Are you looking to transform B2B payments for your SMB customers? Complete the contact form below to speak to a Codat expert or start building for free today. Get started today.