Summary

- Small and medium-sized businesses are increasingly selling and spending via multiple platforms and in multiple ways.

- These businesses need to connect all of this activity to their accounting platforms.

- There are four main ways that this data gets sent to accounting platforms:

- Manually

- Via third-party workflow automation tools

- Via third-party accounting automation tools

- Via a platform’s native accounting sync feature

- As accounting integrations are particularly complex, platforms are increasingly building feature-rich, native accounting sync.

More cash flows, in more ways, in more places

Many independent merchants, start-ups, and other small businesses have spent the last few years finding new ways to do business. More businesses are selling things online, in more places, and in new ways.

To illustrate, in 2021, Amazon Marketplace grew to almost 10 million sellers accounting for 65% of Amazon’s total GMV. That number was 38% ten years ago. (It’s not like Amazon’s direct business has been doing badly.) Other platforms tell similar stories. Etsy added 3 million sellers in 2021 alone. Shopify’s Q3 2021 “subscription solutions revenue,” which is roughly correlative to new merchants using the platform, was up 37% year over year.

As software continues to transform the way money flows in and out of businesses, new platforms, products, and features emerge. Buy-Now-Pay-Later, for example, or business loans provided by and paid back at the point-of-sale, like Stripe Capital or PayPal Working Capital.

Accounting is only getting more complicated

While more options are great for business, one negative side-effect is the increasing financial admin burden. The Square debit card, for example, allows users to debit directly against their balance in Square – handy for merchants, a nightmare for accountants.

Without integrated products, small businesses face a growing burden of error-prone manual data entry. In the worst case, some simply sacrifice comprehensive bookkeeping, leading to cash flow problems or difficulties accessing finance.

This is an increasing concern for platform providers themselves, who not only want to prevent their products from creating internal friction but also have a vested interest in their customers’ overall success. The more successful the end-user’s business, the more cash flows through it, and the higher the platform’s gross volume and revenue.

From manual entry to seamless sync

This article offers an overview of the different types of accounting connectivity – from the manual entry that is currently dominant, through emerging options for automation, to the “gold standard” – feature-rich, native accounting sync.

The key point is that accounting isn’t like other integrations. Sending a note to Slack every time you make a sale is simple, accounting for that sale (and all its associated fees, taxes, and SKU-level detail) is not so much.

An overview of the different types of accounting connectivity

| Pros | Cons | |

| Manual data entry | Flexibility and control for users. | Time-consuming, bad for productivity. The platform is less convenient to use and sees less usage. |

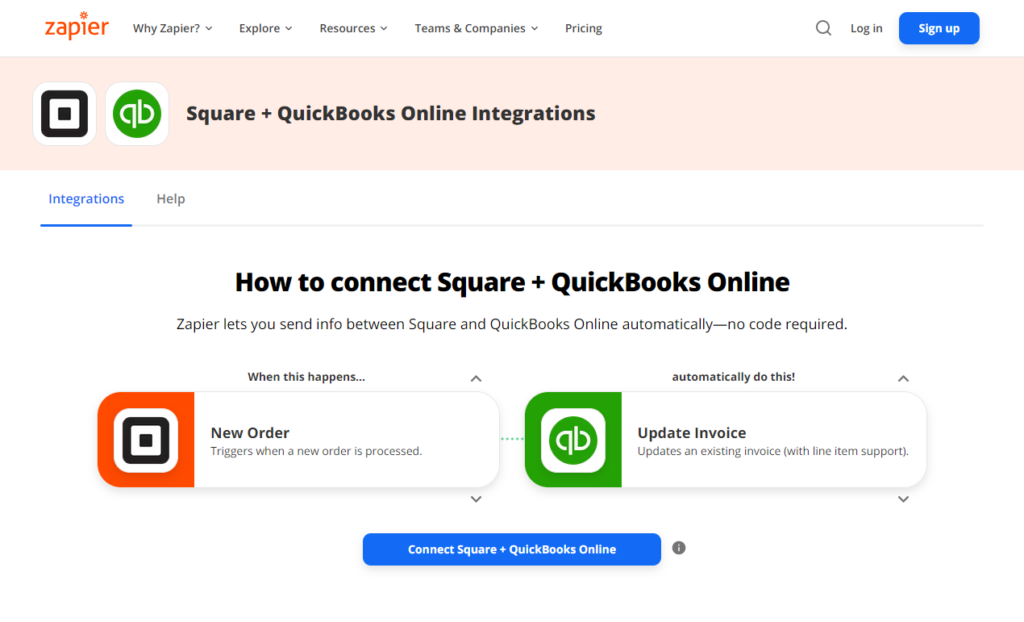

| Workflow automation tools (e.g. Zapier, IFTTT, Tray.io) | User experience is consistent with other integrations. Options for white-labeling and embedding the platform. | Thin and frail connectivity is not sufficient for automating accounting tasks. Limited accounting integrations generate bad reviews and harm the customer experience. May impose additional costs for users. |

| Accounting automation tools (e.g. Greenback, Amaka, Synder) | Accounting-specific connectivity that addresses customer pain points. High-level of customer support. | Forces users to pay a third party for a service they would rather receive from the platform. Makes it easy for customers to churn. Cedes control of an important part of user experience. Introduces third-party risk. |

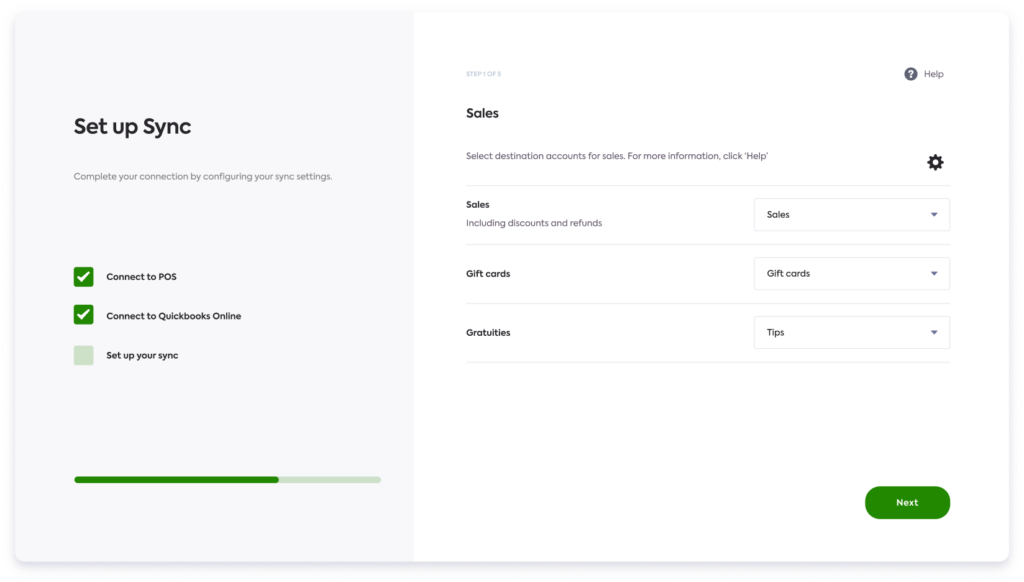

| Native accounting sync | Accounting-specific connectivity that addresses customer pain points. The platform can realize or monetize added value in a way that makes sense for its business. Customers are measurably less likely to churn. Encourages usage, and increases share of volume. | Requires in-house development. |

Manual entry

Manual entry is gradually dying out. Leading this change are younger, digitally-native small businesses (eCommerce merchants, tech start-ups, etc.) with more complex requirements, e.g., innovative business models, omnichannel revenue, and unorthodox approaches to employee pay and compensation.

There are still advantages to manual entry. Some who run small businesses need flexibility. This is especially true for anyone who keeps their accounts in spreadsheets or uses simple plain text accounting. However, as the general standard of accounting connectivity improves, the advantages of manual entry will further diminish relative to the sheer time it takes.

Workflow automation tools

No-code and low-code workflow automation tools can be an option for small business owners and finance professionals trying to fill the gaps between their platforms.

These tools effectively make APIs easier for non-developers to use by overlaying a no-code interface where users can orchestrate rules-based workflow automation. For example: when Shopify records a sale, update the customer’s record in the CRM. While these tools are primarily marketed directly to end-users, some partner with platforms themselves to spin up embedded, quasi-native integration marketplaces.

By democratizing the use of APIs, these tools can serve numerous use cases. They do well where only simple connections are required. Where workflow automation tools fall down are the subset of use cases that represent business-critical, complex tasks. Many of these tasks require specific cross-domain expertise, accounting being a particularly stark example. The best evidence of this is the growth of accounting-specific automation tools.

Accounting automation tools

Accounting automation tools provide businesses with purpose-built connectivity between their accounting platform and popular commerce or expense platforms like Amazon, Square, or Brex.

These tools recognize the complexity of accounting and provide integrations with specific features to address customer pain points. Greenback, for example, has separate products for syncing commerce and expense data to accounting systems. The latter involves features like SKU matching, itemized export, taxes, and fees identification, and options for scheduling the sync and configuration of expense data. This is a much more robust and useful form of accounting connectivity than can be achieved with generalized workflow automation.

However, read reviews of these tools, and you will notice a consistent theme. Positive reviews almost always mention the Support team. It seems that while the tools are good, they cannot automate enough processes without a lot of help from accounting experts, many of whom are qualified accountants.

It makes sense that these products are limited. As third parties, accounting automation tools are highly reliant on the behavior of a growing list of platforms and their APIs, neither of which they have any control over. Trying to sync any platform to any accounting platform creates an exponentially increasing list of complex connections. This has created an opportunity for the platforms themselves.

Native accounting sync

Another recurrent theme of accounting automation tool reviews is a user’s surprise at the necessity of the tool itself. Accounting automation is also not free. Users are paying third parties anywhere from $20/month and up for functionality they expect to be native. This is value that can be more effectively captured by platforms. It is especially useful in highly competitive and relatively low-margin sectors such as point-of-sale and many other parts of the payments stack.

A native accounting sync feature has a natural advantage. It can be developed precisely for the needs of users syncing data from the specific platform. Not only does this lead to a better customer experience, but it also reduces churn. At Codat, we’ve seen this first-hand working with a point-of-sale provider. Integrated customers are half as likely to churn.

More and more of the platforms that engage with the financial operations of SMBs are building their own native accounting sync, rather than leaving their customers to attempt workflow automation or seeking third-party support. At the cutting edge are the spend management platforms: Brex, Ramp, Payhawk, Airbase, and so on. These platforms generally have feature-rich connections to the likes of QuickBooks (Online and Desktop), Xero, FreshBooks, Sage Intacct, and Oracle NetSuite.

This makes sense when you consider who buys spend management platforms – Finance and Operations teams – precisely the people who are not going to settle for a lightweight, unreliable accounting integration. However, while it makes sense for spend management platforms to prioritize native accounting sync, other platforms have in the past been put off by the high complexity and costs of in-house development.

This is starting to change. Costs and complexity are rapidly declining with the development of universal APIs. Codat’s API provides a single standardized interface for deep, highly configurable connections to an ever-growing list of accounting platforms. By abstracting away the multitude of little differences between different accounting platforms and their APIs, Codat is making it easy for every platform to offer high-quality, native accounting sync.

Codat provides business data APIs for SMB lending and embedded accounting automation. Our products connect banks and fintechs to all the major accounting, banking, eCommerce, and payments platforms small businesses use, enabling them to build features that save small businesses time and get them faster access to capital. Contact us using the form below or create an account to start building today.