Find out more about Financial Ratios and how they are calculated.

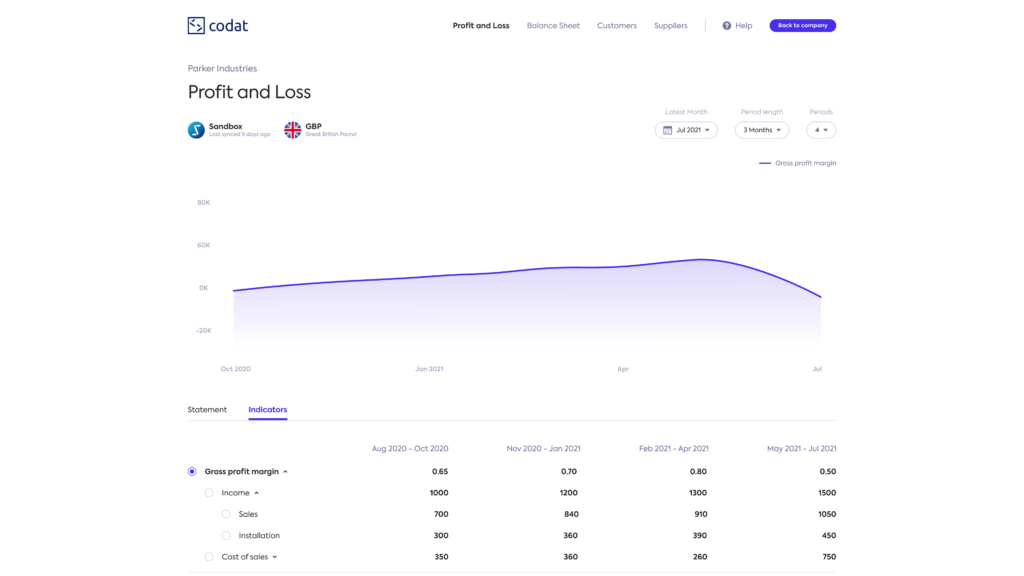

Anyone assessing and analyzing their SMB customers with our Lending API can now access Financial Ratios in Codat.

With Financial Ratios available “out-of-the-box,” Codat clients can further minimize manual data processing, whether underwriting loans, assessing merchant risk in onboarding, analyzing potential acquisitions, or making any other financial assessment of an SMB.

What are we launching today? ?

This Financial Ratios release is the first step in building out a comprehensive set of metrics and ratios available directly via Codat.

From today, you can access the following Financial Ratios for all customers with linked accounting data:

- Gross profit margin

- EBITDA

- Debt service coverage ratio

- Current ratio

- Quick ratio

- Free cash flow

- Working capital

- Fixed service coverage charge

These metrics can be viewed in our Portal, so you can get started quickly using Codat to transform the way they assess and analyze SMBs.

How are Financial Ratios calculated? ?

Codat’s Financial Ratios rely on the standardized and normalized data that your SMB customers share via our Lending API. Codat uses this data to calculate Financial Ratios with common, industry-standard definitions. The underlying formulae themselves can be viewed in our Docs.

The real power of the Financial Ratios you can access via Codat comes from the unparalleled quality of the underlying data. Codat not only provides real-time, standardized connectivity to your customers’ accounting, eCommerce, PoS, and banking data (providing far more detailed and current information than something like a credit report) but processes that data to make it even more usable and useful.

Our Data Integrity feature automatically cross-references accounting and banking information, and account categorization normalizes raw accounting data to a single chart of accounts (ready for seamless, automatic transfer into our clients’ templates, for example). These machine learning features benefit from Codat’s operation at scale across multiple sectors and geographies, helping to ensure that Codat gives our clients an edge in assessing SMBs with more accurate and up-to-date Financial Ratios and metrics than their competitors.

What’s coming next? ?

Following this initial release, more Financial Ratios and other sets of analytical data are being built. In the coming months, we will release ratios and metrics, including:

- Net profit margin

- Operating profit margin

- Return on assets ratio

- Return on equity ratio

- Cash ratio

- Debt to assets

- Interest coverage

- Debt to equity

- Asset turnover ratio

- Inventory turnover ratio

- Working capital turnover ratio

- Days sales outstanding

- Days payables outstanding

We will be going beyond Financial Ratios as we build out a range of analytical metrics across banking, sales, and expenses.

As ever, our public Product Roadmap provides the most up-to-date view of what we are working on and lets you provide feedback and vote on features.

Eimear Donnelly, Product Manager – Data