As scaling SMBs outgrow basic accounting systems, having ERP integrations at the ready can help you avoid heavy losses.

In today’s unpredictable economy, many fintechs and financial service providers are looking to shore up resources by decreasing customer acquisition costs (CAC) while increasing their lifetime value (LTV). One of the best ways to achieve this is to ensure you’re retaining your most valuable, high-growth SMB customers. After all, studies show that 77% of B2B customer revenue comes from current clients, rather than new ones.

The problem? As your high-value customers scale and their needs become more complex, they often outgrow the features of their current tech stack—from their payroll platform to their financial reporting software. So, how can you avoid a similar fate? It requires careful forward planning.

When building financial products for the SMB market, how your product connects to the other financial systems your customers use is a crucial consideration. And since the software market in key areas like accounting, eCommerce, and payments is heavily fragmented, it’s a particularly challenging one.

In a competitive space like financial technology, the integrations you build now—and those you prioritize on your roadmap—can have long-term implications for your business.

Building the right integrations

The most straightforward way to prioritize the integrations you build is to survey your current customer base on the financial platforms they already use. However, it’s also important to consider how customer demand may change over time. For example, suppose you integrate with accounting platforms that are popular among smaller businesses (like QuickBooks Online and Xero) but not the ERPs favored by larger companies (like Oracle NetSuite, Microsoft Dynamics, and Sage Intacct). What happens when some of your high-growth customers inevitably move on to these specialized platforms?

In this post, we break down why you need to look beyond coverage and user volume alone and consider churn risk and prevention as a key part of your integration plan—and then make sure you’re building the ERP integrations that growing companies are looking for.

The data on SMBs, ERPs, and integrations

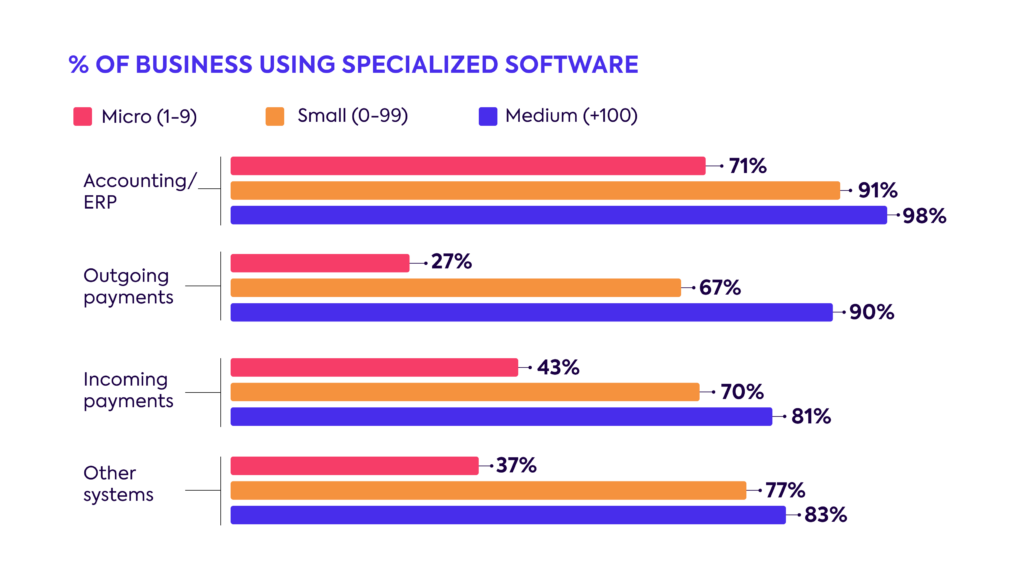

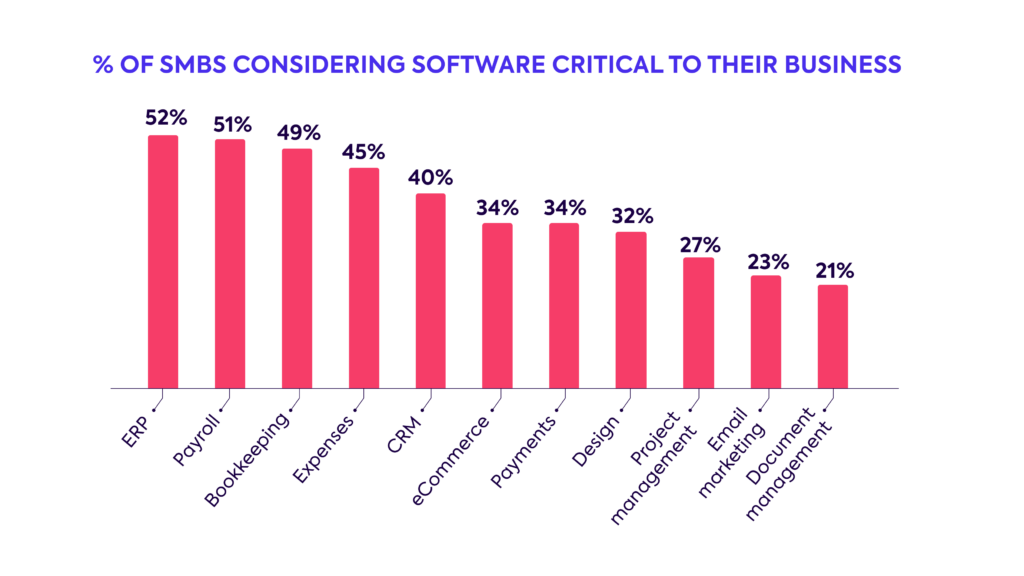

In a recent survey of over 500 small to mid-sized companies, we found that ERP software was the most commonly listed as a key part of their tech stack, with 52% deeming it critical to their business. Additionally, we found that companies were more likely to adopt specialized software as they grew, with 98% of those with 100+ employees using advanced accounting and ERP systems.

In other words, there’s a clear correlation between the size of a business and the likelihood that it relies on specialized software like an ERP to manage essential financial tasks.

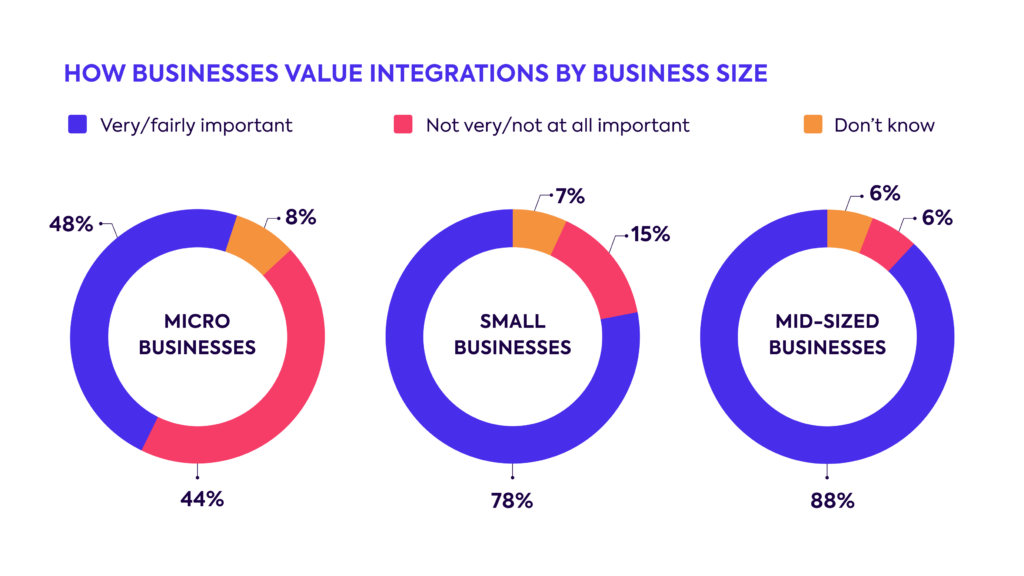

Larger businesses also tend to care more about a platform’s connectivity. The same survey found that businesses with 100+ employees were more likely to value integrations when assessing a new tech platform, and interoperability was the third-highest purchase driver for their tech stack after cost and functionality.

Companies valuing integrations also switched providers at a rate of 35%—75%, more than the survey average—suggesting that connectivity is a highly motivating factor in today’s SMB software market.

Interested in learning more about what businesses think about their digital tools? Check out the state of small business software report.

Taken together, these findings suggest that, as growing SMBs evolve their tech stack, they’ll optimize for interoperability—and they’re more likely to choose their central ERP over other financial platforms that don’t integrate with it.

That’s because ERPs aren’t only considered critical to an SMB’s operations, but they also require a considerable (time and cost) investment upfront. Their modular features are typically customized to a business’s needs and impact many employees across several different departments. ERPs are inherently sticky because they’re inconvenient and costly to replace—and they handle some of a business’s most vital functions.

If you want to keep a promising, ERP-ready customer as a partner, you need to offer a solution that supports them throughout their lifecycle and continues to provide the same level of connectivity as they move upstream.

Integrating with ERPs can help you retain your customers and grow your revenue

As growing SMBs transition from entry-level accounting systems to more specialized ERPs, they’re likely hoping to avoid other changes to their tech stack to keep disruptions to their operations and customers to a minimum.

The good news is your customers have already partnered with you. So if your platform is in a position to service their new needs with readymade ERP integrations, you’re sure to hold onto what is now a larger account with a higher-value partner.

There are few junctures in a business relationship that present such a simple, straightforward opportunity to boost a customer’s lifetime value and expand your overall revenue potential.

Building an ERP integration

You may be wondering if ERP integrations are so profitable, why don’t more fintech providers (among them, your competitors) offer them?

Building integrations to ERP platforms in-house is particularly challenging, time-consuming, and expensive.

That’s because each ERP system behaves differently and has a vast database that requires you to build past just the API. This process can be exceedingly technical and call for skilled engineers with experience in several different languages, as well as an understanding of complicated accounting principles.

What’s more, ERPs like Oracle NetSuite and Microsoft Dynamics offer a range of features and customizations, so your customers will likely expect more from the integration. For example, in spend management, a NetSuite integration might involve custom fields or amortization schedules that simply don’t exist with Xero. Often, you’ll need to set or ignore specific fields to prevent your data pushes from failing.

Want to learn more about what an Oracle NetSuite integration entails? Check out our full guide.

Keep in mind, too, that larger businesses are savvier buyers with more robust procurement processes, so they’re not going to settle for a NetSuite integration offering the bare minimum. They’ll want to confirm your NetSuite integration proactively offers all the bells and whistles.

Wondering whether it’s more cost-effective to build and maintain integrations in-house or outsource the effort to a third-party provider? Our cost to build calculator helps you understand how long it could take and how much it could cost to build the integrations you need from scratch.

Streamlining ERP integrations

Partnering with a business data API provider like Codat can help you not only avoid the costs and headaches of an initial ERP build but also the ongoing effort of maintaining and scaling your ERP integrations. That’s because we’ve already built an array of turnkey integrations that are kept at peak performance—so all you need to do is build once to our platform to unlock instant connectivity.

Among other advantages, integrating through a third-party API offers greater:

Efficiency ?

You tap into many accounting and ERP integrations at once, and they’re updated automatically, eliminating the need for incremental builds and endless upkeep.

Savings ?

Between engineering time, company resources, and the need for specialist consultations, a Codat can save you hundreds of thousands in integration costs.

Clarity ?

Codat simplifies complex accounting outputs in a single, standardized data model while offering granular insights, making the data easier to use and understand.

Expertise ???

You get constant access to a team whose sole purpose is to keep up with the latest integration trends, issues, and edge cases—so you don’t have to.

To learn more about building effective ERP integrations—with or without a universal API—download our complete guide to accounting integrations or check out our recommendations for identifying a best-in-class partner and getting the most out of your integration strategy.

Key takeaway

Your integration plan shouldn’t just be about the companies you service now, but the companies they’ll become down the line.

To retain your highest-value customers and continue providing value as they scale, you need to be able to integrate with the specialized ERP platforms they’ll grow into—and to leverage every available solution to ensure seamless, industry-leading connectivity.

Scale faster with Codat

If you want to learn more about our robust, turnkey accounting and ERP integrations, get in touch with a member of our team—or sign up for a free account to try them out for yourself.