Find out how you can optimize your product suite and reduce churn with native accounting integrations.

Studies show that SMBs spend 60-80% of their time on manual accounting tasks that could be fully automated. This is particularly true when it comes to the accounts payable process. It may be hard to believe, but 80% of all SMB invoices and 40% of all B2B payments are still settled via paper check, something that is all the more surprising when you consider that this is the case for less than 15% of consumer transactions.

SMBs need accounting automation

The lack of automation and connectivity in the bill pay process materially hurts small businesses. For instance, when financial data is siloed across multiple platforms, doing something relatively simple—like checking an invoice against a purchase order or a payment—involves jumping between apps and manually cross-checking information. As a result, business owners and finance teams are forced to spend considerable time and effort on monotonous manual data entry rather than higher-impact analytical tasks. Unfortunately, this often results in human errors leading to inaccurate records, or worse, delayed or duplicated payments.

In addition, overly complex validation processes place SMBs at a greater risk of fraud and make it almost impossible to gain real-time visibility into company-wide finances. This renders accurate cash flow forecasting and budget planning all the more challenging. It’s no real surprise, then, that 4 in 5 finance leaders believe their company’s outdated AP process is holding them back and costing their business time and money!

Bill pay platforms benefit too

It’s clear that SMBs would benefit considerably from greater visibility, accuracy, security, and speed in the AP process. For bill pay platforms, one way this can be achieved is by using accounting integrations to push AP data directly into an SMB’s accounting system and automatically reconcile their payments. But, what do bill pay platforms themselves stand to gain from offering this functionality? Quite a lot as it turns out.

Accounting automation substantially reduces the likelihood of churn, as customers can manage more financial tasks in their AP app and thus tend to spend more time using it. It also makes for a better user experience and, as we all know, that can only be a good thing.

With accounting integrations in place, bill pay platforms can also expand into adjacent markets, tap into new revenue streams, and build broader and stickier customer relationships. For instance, partnership opportunities with accounting software providers could open up a significant new distribution channel.

How to build it

This all sounds great in theory, but how do you actually go about building this functionality? Check out our insider tips below.

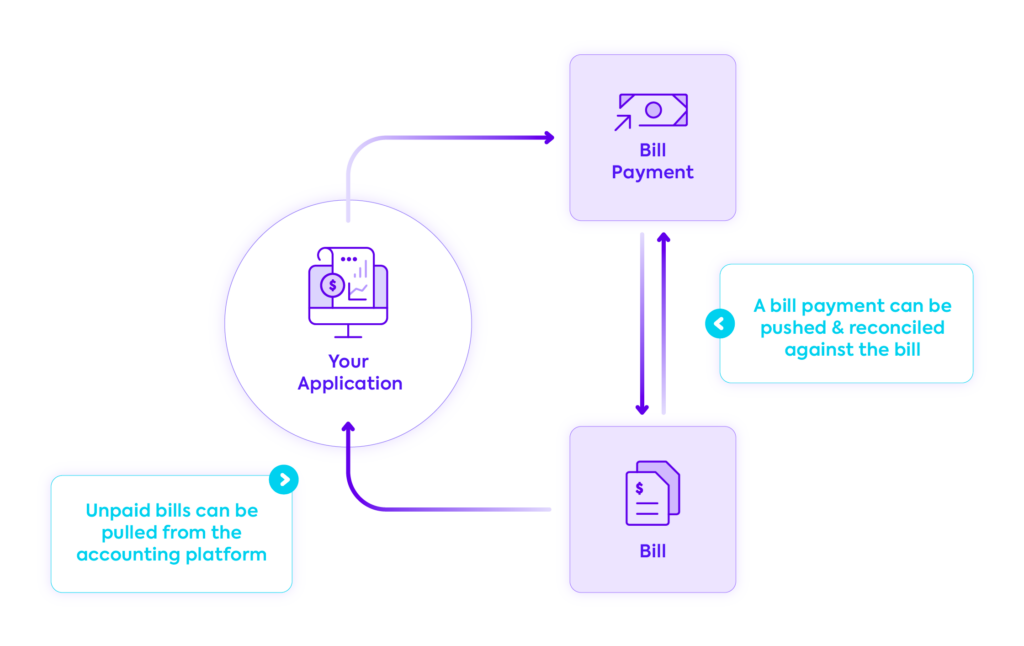

To enable accounting automation, bill pay platforms can:

- First, pull unpaid bills from their customers’ accounting platform, then itemize the record of goods purchased from or services provided by a supplier.

- Enable a vendor bill to be created within their application and then synchronized to customers’ accounting platforms.

- Retrieve a list of accounts that can be mapped, enabling customers to dictate which account their payments should be reconciled from.

- Once a payment has been made, a bill payment can then be pushed to the customer’s accounting platform and reconciled against the bill, marking it as paid.

If you decide to build the integrations required yourself, here are some considerations to keep in mind:

1. Go in with a plan 🗺️

An essential step when tackling accounting automation is laying out a solid plan. This means clearly defining business goals, analyzing who will use the integrations (and why), and establishing the resources and skill sets needed to build them.

2. Understand the SMB tech stack 🥞

It’s important to have a firm grasp of the market and the most popular financial platforms used by SMBs—especially the ones holding the required data. There are many ways to accomplish this, from customer surveys to market research. Codat also offers helpful guides that break down the heavily fragmented SMB accounting and commerce software markets by geography.

3. Check the feasibility of each integration ✔️

Certain platforms may not have APIs suitable for integration—or they may have certain use case restrictions, partnership or registration requirements, and specific approaches to authorization.

4. Assemble an expert team 🦸

Accounting integrations (and accounting data) are complex, and building them in-house requires a team of specialists, including product managers, technical architects, engineers, and quality assurance consultants—as well as experts with in-depth knowledge of bookkeeping principles and accounting data behavior.

5. Estimate the total cost 💸

Taking your final team into account, costs for an initial build should cover approximately 4 weeks (for a basic integration) or 12 weeks (for a more complex integration)—multiplied by the number of integrations needed to cover a substantial share of the SMB market. Keep in mind that maintenance will require its own, additional budget.

6. Develop models for data standardization, categorization, and storage 💻

Data assets and their behavior can vary depending on the platform, meaning development teams have to map and standardize different attributes with each new integration as they scale. Accounting data can be especially tricky since each SMB organizes accounts in its own, unique way. Simply put, data standardization is something you need to think about if you’re planning to build multiple accounting integrations—and you’re unlikely to ever need just one.

Buy vs. build

Fortunately, you don’t have to take on this significant challenge alone. Turnkey APIs offer standardized connections to multiple accounting systems through a single integration, making it easy for you to get native accounting integrations up and running quickly.

At Codat, over 200 clients, including leading B2B payment platforms such as Plastiq, Comma, and Melio, are already using our bi-directional API to reconcile their merchant customers’ data into their accounting software.

Our integrations are robust and time-tested, enabling you to offer the depth and breadth of coverage your business customers need – instantly. In addition, we handle the complexities of integrations, including registration, authorization, standardization, and ongoing connectivity.

Create an account to start building today or complete the form below to speak to a Codat specialist.