The ultimate guide for neobanks and spend management providers looking to implement bill pay solutions.

Bill pay, also known as accounts payable (AP) automation, offers a golden opportunity for neobanks and spend management providers to move toward more sustainable revenue models and diversify income streams.

As with any business opportunity, its growing appeal is and will continue to attract a flood of new players to the market. If you’re entering this competitive landscape, know this: your success hinges on delivering a product that not only addresses myriad pain points for your customers—i.e., small to medium-sized businesses (SMBs)—but also stands out as the best solution out there.

In this second installment of our two-part series on the rise of bill pay, we’ll cover how neobanks and spend management providers can set themselves up for success with an exceptional bill pay solution in a soon-to-be crowded marketplace.

To learn more about the rise of bill pay and why it’s a winning bet for neobanks and spend management providers, read part one of our bill pay series.

Start here: What do SMBs really need?

Like with any financial product, the key to creating a standout bill pay solution lies in having a keen sense of SMBs’ challenges and their unique needs so your product can solve them, and so the first step is to conduct an in-depth needs assessment that maps their challenges to needs and possible solutions.

Below are some examples of the challenges your customers may face and the features you could build to help overcome them.

| SMB problem | Feature solution |

|---|---|

| A high volume of transactions | Batch payment functionality to help users pay easily and all at once |

| Ongoing cash flow challenges and cumbersome manual processes | Ability to schedule payments in advance and visibility into invoice due dates |

| Managing multiple suppliers, each with their own terms and payment preferences | Built-in supplier onboarding flows |

| Complex or large organizational structures resulting in lengthy approval processes | Customizable multi-level approval settings, workflows, and admin requirements |

How can you build a great bill pay product?

Now that you know what you’re trying to solve with this solution, you can start thinking about how to best achieve this with your product. Below, we’ve shared a few tips to help you build a great bill pay product.

Define the minimum viable product

Before you aim for lofty goals, it’s wise to scope out exactly what the minimum viable product (MVP) and ideal customer profile (ICP) look like for this project. Here are some questions that will help you narrow things down:

- Are you focusing on a specific industry or business size?

- Will your solution cater to businesses with an in-house finance team, or is it designed for entrepreneurs without financial expertise?

- How will you ensure your bill pay solution is integrated with the other financial tools businesses use?

- What’s more important to you, attracting new customers by offering something more appealing than your competitors, boosting spending among your current clientele, or pursuing a different strategy altogether?

For bill pay, your MVP should have basic functionalities that address the core needs of businesses, such as invoice management, payment scheduling, and transaction tracking. For instance, users need to be able to create or pull an invoice in your platform or through the accounting package, make payments, and have that reflected in the accounting system.

Integrations, flexibility, and real-time data flow

One way to solve multiple pain points for customers is by ensuring your bill pay solution is integrated not just with your own suite of products, but also with other systems that SMBs rely on, such as their accounting software. This will extend your product’s utility.

In addition to an integrated experience, real-time data flow is crucial to SMBs. If they pay a bill from your platform, they expect to see that reflected in their accounting platform instantly—an expectation that goes back to having visibility into cash flow.

Meanwhile, flexibility can help businesses optimize their spend management. So, offer a variety of payment options that accommodate SMBs’ diverse needs and preferences. Think beyond traditional bank transfers or ACH payments, and try to align payment methods with different revenue models. This way, you’re not alienating any of your customer segments.

Take, for example, Brex Payables, which prides itself on offering the controls every AP team needs to smoothly manage spending, whether it’s through invoices or purchase cards. It’s designed to be flexible for all kinds of business expenses. Notably, Brex uses artificial intelligence (AI) to handle every stage of an invoice cycle, including matching, approving, and coding, giving businesses a clear, real-time view and control over their spending, regardless of the payment method. Brex’s approach also allows users to set spending limits that are tailored for each vendor or project, which puts them in complete control of their finances.

Challenges to look out for

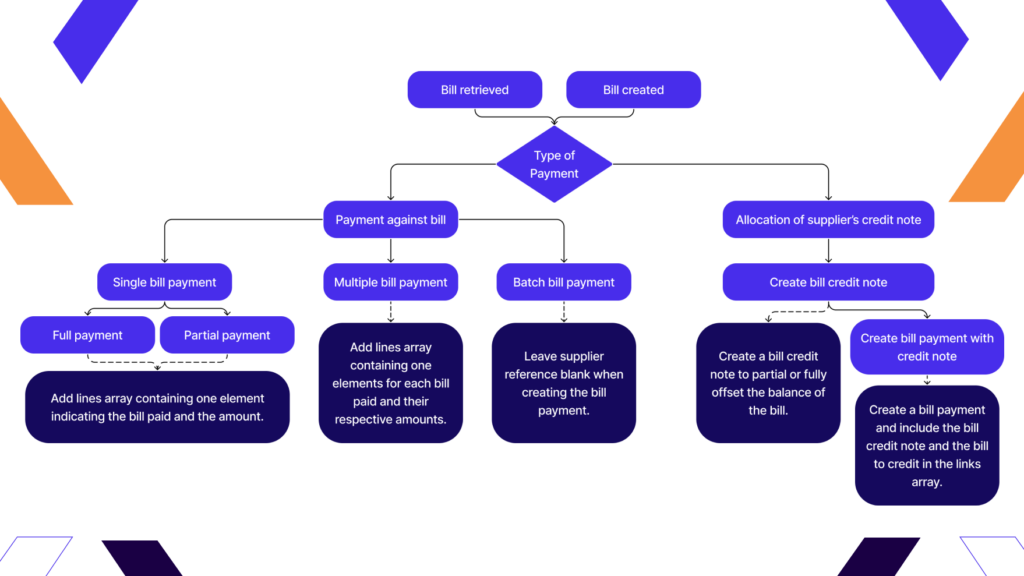

At first glance, creating an AP automation solution might seem straightforward. On the surface, it’s simply a matter of pulling bills (payable invoices) and vendor details from accounting software and pushing back information on bill payments. In reality, this process is significantly more complex.

Below are just a few of the various scenarios you need to be able to handle when recording bill payments in an accounting system:

- Distributing a single payment across several bills

- Applying credit notes to bills

- Allocating a payment that partially covers a bill

The difficulty is that you are responsible for ensuring that each of these situations is uniquely represented in the accounting system.

Additionally, you have to plan for the diversity of accounting systems used by businesses, as this often varies by their size, maturity, industry, and location. Your bill pay infrastructure must be compatible with a wide range of accounting platforms that most of your customers use. If you have a diverse customer base, this could mean you’d have to build multiple accounting APIs, each with its own nuances and complexities.

The problem with building in-house AP integrations

Building an integration for AP, especially when planning multiple integrations, presents three main challenges:

? Diverse payment methods: Integrating different payment methods, such as bank transfers and credit cards, requires posting to specific endpoints based on the payment source. This complexity increases the scope of integration design, leading to potential errors and extended development time.

? Handling foreign currency payments: Managing multi-currency transactions adds another layer of complexity, as you have to carefully consider the transaction currency, the accounting platform’s nominal account currency, and the payment source currency. To add an additional layer of complexity, different platforms will handle this in different ways, so you’ll need to adapt the plan depending on the accounting system you’re integrating with. Representing the currency incorrectly can lead to discrepancies in the accounting platform, resulting in users losing confidence in your solution.

? Variation between platforms: Accounting platforms vary significantly in their requirements for fields within a bill, such as the transaction date and whether it’s mandatory. Also, the approach to handling bill credit notes differs across platforms, complicating the integration process. This variability increases the level of analysis you need to do before building an integration, which prolongs the development time and increases the likelihood of errors for users when you go live.

Fortunately, there’s an easier way for you to offer bill pay quickly to your customers without the hassle of investing heavily in resources to build integrations yourself—that’s where Codat can help.

Codat makes things easier

With Codat’s Sync for Payables, you don’t have to worry about the complexities of building integrations, ensuring data accuracy, or offering users a seamless experience. Our API lets you go to market quickly, knowing you have everything you need to offer the best product to your customers.

Codat handles all technical nuances, drawing on our team’s extensive experience and insights from developing solutions for leading neobanks and spend management providers in the industry—we’ve also spent significant time figuring out precisely what data is needed for a reliable integration.

The great news? Codat already offers integrations with the major accounting software businesses use, from Xero and QuickBooks to NetSuite and Sage Intacct.

Below are some of the benefits you can expect from using Codat for your AP solution:

✅ You can streamline your development process so you don’t have to deal with the tall order of creating individual integrations for every accounting platform your customers use. Instead, you can use a single data model without needing to create libraries and handlers for issues like token refresh and request throttling.

✅ When it comes to offering multiple payment options, Codat simplifies the integration of different payment methods by handling the logic behind selecting the correct endpoint, allowing for a seamless integration process.

✅ You get a pre-built, conversion-optimized authorization journey, which significantly reduces engineering efforts and ensures a smooth setup experience for end-users. Our API also ensures that payments are recorded to the right accounts in businesses’ accounting systems by providing a list of accounts available in our API to query.

✅ Codat supports bi-directional data flow, which allows you to reconcile payments back to your customers’ accounting platforms. This keeps their accounting records up-to-date and reduces the need for manual data entry.

If you’d like to see Codat in action, contact our team using the form below to schedule a demo.