Discover how an accounting integration could drive efficiency and profitability.

The financial landscape is changing rapidly, compelling industry stakeholders to change with it or risk being left behind. At the heart of this evolution are application programming interfaces (APIs). APIs are bits of software code that create seamless ecosystems of interconnected data and transform how financial services operate through better data accuracy and real-time insights and by enabling automation, along with other benefits.

Executives are increasingly prioritizing the adoption of APIs, with 58% acknowledging it as a top priority across industries. Meanwhile, 68.6% of developers say API usage has increased in financial services in recent years. And over the next three years, the majority of new B2B APIs in the banking sector will transition from connecting internal systems to linking banks with external networks.

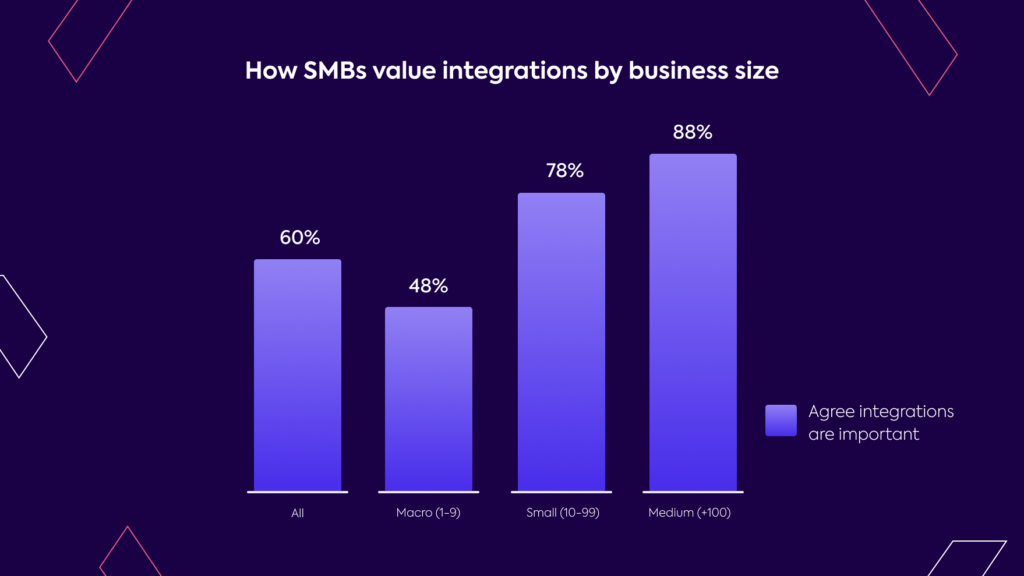

Financial service providers aren’t alone in this transition; their business customers are also on board. Our research shows that as many as 60% of small and medium-sized businesses (SMBs) consider system integrations a key factor in their purchasing decisions.

With accounting software playing a central role in many SMBs’ operations, accounting integrations are often seen as a top priority by fintechs and financial institutions. In this article, we’ll cover everything you need to know about using an accounting integration, including the benefits and considerations involved in the decision to build or buy one.

What is an accounting integration?

An accounting integration, powered by an API, allows financial service providers to connect seamlessly to their business customers’ accounting systems to automate the flow of real-time financial data.

With accounting integrations, businesses can automate certain tasks and improve operational efficiency, while service providers can enhance the accuracy of financial decisions and offer better customer experiences.

For example, an accounting integration can connect a lender’s loan origination system (LOS) with a business customer’s QuickBooks account. In turn, the lender is able to automatically pull the customer’s detailed financial data to facilitate a streamlined underwriting process. For businesses, accounting integrations can automate routine tasks such as manual data entry, resulting in streamlined, accurate financial operations.

Should you build or buy your accounting integrations?

The build-versus-buy debate is quite common in the context of integrations. On the one hand, developing an in-house integration could give you more control and customization options. However, many financial service providers don’t have the bandwidth or internal expertise to effectively build and maintain an accounting integration—especially one that’s flexible enough to scale and keep up with market changes.

Challenges with building a native integration

Unless you have the budget and the resources to continuously keep up with tech changes in the long term, building an accounting integration in-house might not be your best bet. Here’s why:

1️⃣ Resource-intensive process: Accounting integrations require a team of experts, from developers to product managers and analysts, with a deep knowledge of accounting principles. To build and maintain accounting integrations successfully, you’d need to dedicate entire internal teams to the job.

2️⃣ Keeping up with coverage: SMBs rely on a wide range of financial platforms, and you should connect with most, if not all, of them to properly cover your customer base and gather their financial data seamlessly. Maintaining this level of coverage can divert significant resources away from your core products.

3️⃣ Complexities involved with diverse data models: Every accounting platform has its unique data model that varies in representation, data relationships, and behavior. Your approach to each integration has to change accordingly. The process of standardizing all of the data can quickly become time-consuming and expensive for you.

4️⃣ Difficulties at scale: As you grow, you’ll need to make a higher volume of API calls and build more integrations for different accounting platforms. Ensuring your integrations’ infrastructure can accommodate these demands will require continuous attention. Meanwhile, you’d rack up technical debt while API updates sidetrack you from your primary business goals, often with endless edge cases that slow down your product release times.

Third-party accounting APIs offer a pre-built alternative. To start, they’re much easier, faster, and less resource-intensive to implement than an in-house build, getting your integrations to market more quickly and keeping your focus on your core technology and business operations. When you work with a reliable third-party provider, you also reap the benefits of accessing a wide range of integrations with a single build, use case expertise, and outsourcing tech support to handle the inevitable upkeep and bug fixes.

6 things to look for when choosing a third-party integration

Once you’ve decided to explore a third-party integration, you have to navigate the maze of providers to find a solution that best fits your business needs. However, integration platforms aren’t all cut from the same cloth. So, asking the right questions can set you up for success. Be sure to look for these six essentials to get the most out of your accounting integration:

1. Live, continuous data access for enhanced data quality 🔁

Any business decision based on incomplete and unreliable data can cost you time, money, and resources. Fortunately, accounting APIs help improve data quality by automating routine tasks and the real-time flow of information, reducing some of the common errors that happen with manual data entries.

But, some accounting APIs offer higher-quality data than others. Good solutions prioritize key aspects of data quality like completeness, accuracy, timeliness, and consistency over just the ability to process large volumes of data. For financial service providers, this translates to benefits like more comprehensive and reliable visibility into customers’ financial data, better lending decisions, and the ability to offer more personalized product experiences.

So, when you’re shopping for an accounting API provider, be sure to ask questions like how frequently they sync data, whether the connections they establish are continuous or need to be reauthorized with every data pull, how granular their datasets are for each covered accounting system, and how reliably they return complete datasets.

2. Scalability that adapts to your business growth 🪴

Scalable systems are equipped to handle whatever demands come their way, and they manage this transparently.

As your customer base expands and different accounting systems gain market share, your accounting integration vendor must effectively manage these changes. They need to keep up with emerging trends and systems or handle the increasing volume of API calls you need to make as your business grows.

If they don’t, you’ll likely face significant issues such as poor usability, limited connectivity, and heightened security risks, among others. All these challenges could affect your ability to effectively serve your expanding customer base, jeopardizing your market position and future growth prospects.

3. Specialized products for specific use cases 🧐

Given the diverse applications of APIs, it’s crucial to select a vendor with a deep understanding of your specific needs. This is where a universal API might fall short for your business. The term ‘universal’ suggests a one-size-fits-all solution, but the challenge of embedding connectivity into your product varies significantly based on the purpose of the integration. For instance, crafting an integration for credit decisioning differs significantly from automating a business’s bookkeeping. Plus, depending on how you’ll be using the API, you’ll have different requirements for the format and structure of the data that’s useful to you. Universal APIs don’t cater to these nuances.

It’s important to remember that it’s not just about solving data accessibility challenges; it’s about ensuring the accessed data is genuinely useful for addressing your needs. Therefore, it’s crucial to seek a vendor offering a suite of specialized business data APIs tailored to tackle your requirements.

4. Data security for you and your customers 🔐

When it comes to APIs, data security is crucial, and even more so with accounting integrations that handle sensitive financial information. A compromised API can result in a data breach, putting both customer information and your business at risk.

To be confident in an accounting API provider’s security position, check if they have a System and Organization Controls (SOC) compliance certification, a gold-standard measure of data security. An SOC 2 report details an API provider’s internal controls regarding security, confidentiality, data processing or transmission integrity, privacy, and availability. With this information, you can gain valuable insights into the provider’s compliance with trust services criteria and data protection capabilities.

5. Accounting expertise🧾

Since APIs have various uses, you want to ensure that the one you choose is able to address your organization’s needs. But not all API vendors are specialists; their solutions may integrate with many different accounting systems, but aren’t necessarily experts in accounting data models.

So, look for an API that’s designed by a team of experts who grasp the nuances of accounting data, accounting principles, and regulations affecting your customers and your organization. Additionally, consider the provider’s API software development expertise since developers spend around 30% of their time coding APIs and 17% debugging and manual testing. This is crucial for the success of APIs in financial services and to ensure you have a robust, compliant integration tuned to your use case.

6. Depth and breadth of coverage 🤿

Not all businesses use the same accounting platform. To offer an integrated experience to all of your customers, your accounting integration needs to connect with numerous accounting systems, from QuickBooks and Xero to Oracle Netsuite and Sage Intacct.

But here’s the challenge: many accounting API solutions focus on specific accounting systems while neglecting others. So, while they may offer you coverage of a portion of your business customers, they lack connections to a broader range of accounting systems, which could exclude other customers.

Although Intuit leads the U.S. accounting market with QuickBooks, there’s rising competition from Sage Intacct and Oracle NetSuite to capture business in the mid-market. Moreover, nearly a quarter of the U.S. market is fragmented among dozens of boutique providers. Over in the UK, it’s a different, but still fragmented, story. There, Xero is ahead, but only with a 24% share of SMBs. The rest of the UK market is divided among various other accounting software options.

In light of these variations, it’s clear that it’s crucial to find an accounting integration that offers depth and breadth of coverage to connect seamlessly with diverse accounting systems.

Versatility of Codat’s APIs

Codat cuts through the complexities of accounting integrations, meeting your business needs with ease. Our suite of specialized business data APIs connect financial service providers with the various financial accounting systems their business customers use every day, facilitating use cases like better lending decisions and accounting automation.

Standardize accounting data

Codat integrates with leading accounting platforms such as Xero, QuickBooks, Sage Intacct, Oracle NetSuite, Microsoft Dynamics 365, as well as newer platforms like Wave, MYOB Essentials, and KashFlow—among others. Moreover, Codat standardizes the data from each platform, making it more actionable for your platform and allowing you to gain deeper insights and tailor financial products for your business customers accordingly.

Feel confident about security

Codat’s API is secure by default, adhering to industry-recognized standards like SOC 2 TSP and ISO27001. Plus, Codat uses advanced AES-256 data encryption. So, whether you’re a global bank seeking a customized service or a fintech looking to scale, Codat has you covered. Built for specialized use cases, Codat’s APIs offer end-to-end solutions that are not only faster to implement than an in-house build, but they offer measurable return on your investment.

Make the most of your customers’ accounting system with Codat

Codat’s APIs aren’t just an easy-to-implement, straightforward solution; they’re also thoughtfully built for the unique needs of banks, lenders, PoS systems, expense management platforms, accounts payable software, and payroll providers.

Get in touch if you want to see Codat in action and learn how it can transform your operations.