Building the must-have integration for corporate card and cross-border payment providers just got easier

Codat’s Bank Feeds API now supports NetSuite, Exact NL, QuickBooks, Sage, Xero & FreeAgent.

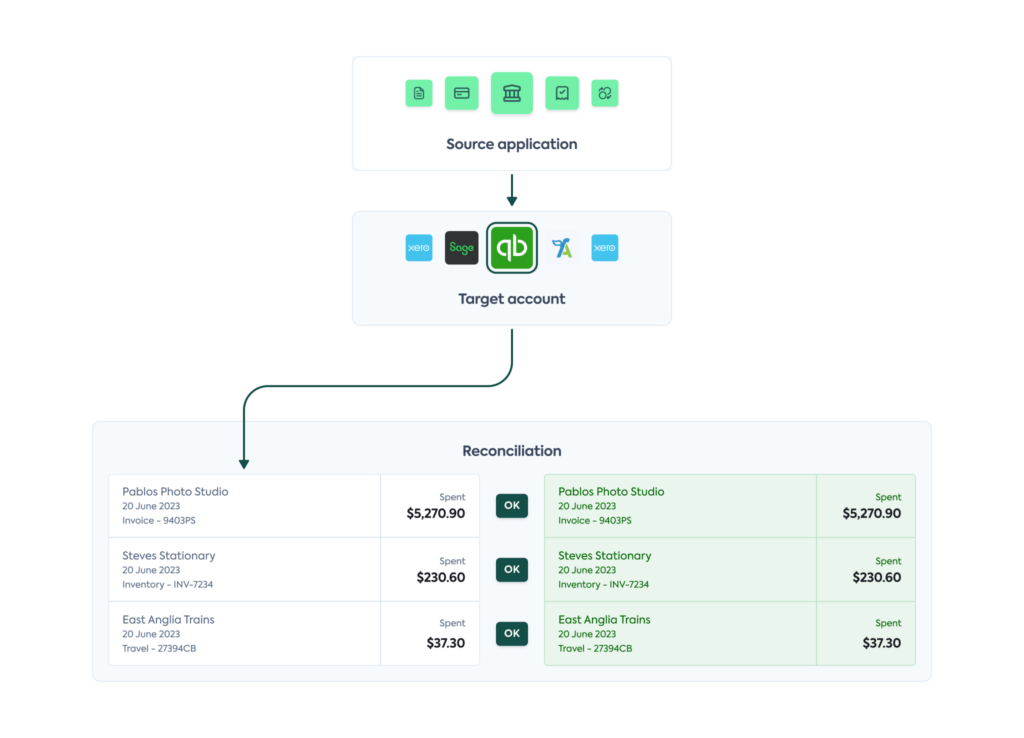

An automated bank feed is now a standard feature of all of the major accounting and ERP systems and one of the most valued by small and medium-sized businesses. The term ‘bank feed’ describes the automatic daily syncing of payment transaction data to accounting systems – including details like payment date, amount, and description – which replaces the need to upload a monthly CSV file of bank transactions or enter them individually.

The feature has a significant impact on business owners, saving them 25 hours on average each month, according to Xero’s 2023 survey. It also ensures information is more regularly updated in the accounting systems, offering better visibility and control of finances. According to reports, 61% of small business users report they would stop using or switch their accounting software if the feature was taken away, and 71% of Xero partners say it’s their favorite feature of the software.

Who needs a bank feed?

Despite the name, it’s not just banks that need a bank feed. Because the feature has become so widely available and adopted for business checking accounts, small businesses now expect the same functionality in any tool that involves sending or receiving money, including credit cards, prepaid cards, and cross-border payment accounts. Providers we’ve spoken to tell us that the lack of a bank feed has resulted in them losing new customers to competitors and struggling to maintain and grow share of wallet.

The trouble is, if you’re not a bank, it can be difficult to even access the APIs needed to build this feature for customers. Many bank feeds are now serviced by Open Banking Providers (meaning that payment account providers must be a supported data source in order for their customers to access the functionality), or accounting platforms have built direct integrations with the largest banks. Therefore, a significant number of the most popular accounting & ERP platforms don’t have open APIs. This means that new, innovative start-ups, and non-traditional accounts, like those from FX providers, are stuck trying to persuade a financial software behemoth to invest their own engineering resources to build the integration.

Codat’s Bank Feeds API solves this problem by enabling any provider to build a bank feed to all of the major accounting and ERP systems, with a single integration, in as little as 23 days.

Today, we’re announcing that Codat has added support for NetSuite and Exact to our Bank Feeds API, alongside QuickBooks Online (US), Xero, Sage, and FreeAgent.

For existing clients, going live with additional integrations is as easy as editing one line of code.

Don’t take our word for it. Leading business credit card provider, Capital on Tap recently tested and launched an additional integration using the Bank Feeds API in under two weeks.

For new clients, the extended coverage means our simple, step-by-step tool kit to build a bank feed integration will now enable them to support customers using any of the leading accounting platforms, including their highest value customers using more complex ERP systems like NetSuite or Sage Intacct.

We have invested in creating the industry-leading user experience, for small businesses and developers using our API. Here’s how:

Optimized client experience

We have designed the Bank Feeds API so that our clients can get the highest quality bank feed integration to market in the shortest time.

Faster development thanks to standardized data 🚀

The Bank Feeds API offers a standardized set of endpoints that work across all supported accounting platforms, so there is no need for our clients to account for the variation in how bank feeds need to be handled in each different platform.

Reduced integration complexity with pre-built account mapping 🗺️

One of the most complex parts of a bank feed integration to build is the ability for users to select which transactions should appear in which bank account in their accounting records. It’s a multi-step process that involves fetching the list of accounts, working out which ones are eligible for bank feeds, storing the mapping that has been selected, and a number of other steps.

We offer a hosted, white-labeled mapping user interface which means our clients don’t have to build this complicated functionality themselves. It’s available out of the box and meets all of the quality requirements of accounting platforms, such as Xero’s certification process.

Flexibility to create a truly native experience 🤸

For clients who prefer to embed the mapping journey within their own user interface for a truly native experience, Codat offers flexibility and choice through mapping endpoints that can be used as an alternative to the mapping UI.

Logic to handle multi-currency built-in 💱

Codat’s Bank Feeds API has been designed with cross-border payment providers in mind. For example, the bank accounts that the user can select are pre-filtered so that only those with a matching currency are shown, and where the currency selected is not yet enabled in the accounting platform, Codat handles this automatically.

The smoothest user journey for your customers

In order to harness all the benefits that a bank feed can offer, our clients need to get the maximum number of customers successfully setting up their integration. Our experience supporting over 200,000 small businesses to share and sync their financial data has enabled us to design a user connection journey that maximizes conversion.

For example:

- We have removed the need for users to flip between screens and minimized the number of clicks needed, to create the simplest possible flow.

- We have decreased the potential for user error in the connection process by only surfacing accounts eligible to connect.

- We have reduced the need for pre-configuration in the accounting platform to avoid the user hitting errors as they begin the process.

See it in action below.