Research shows that the data in an SMB’s books is actually more up-to-date than what’s in their publicly filed accounts or tax returns.

At Codat, we talk to a lot of banks and lenders looking to improve their origination processes. They’re interested in using accounting data to help them make faster, more confident decisions, but they often ask us how they can be sure that the data is as accurate and up-to-date as possible. After all, it’s up to businesses themselves to keep precise books, so failure to do so may lead to significant gaps or even errors in their financial profile.

It’s an important consideration. If you base credit decisions on outdated or inaccurate financial insights, you may end up funding unsuitable businesses—or rejecting promising ones that could bring in substantial revenue.

To answer this question and gain insight into the bookkeeping practices of SMBs, we surveyed 700 small and medium-sized businesses in the US and the UK. Continue reading to uncover the results.

SMBs update their own accounting data regularly

Most SMBs update their accounting records more regularly than you may think. Of the surveyed SMBs, 72% update their accounting system at least quarterly.

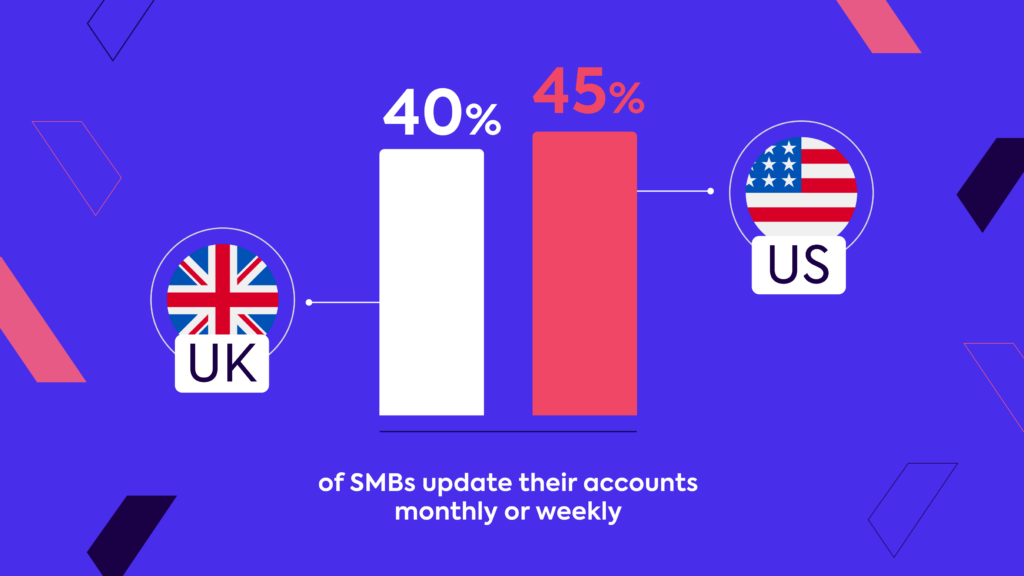

This trend is slightly more prevalent in the UK than in the US, with volumes working out to 75% and 69%, respectively. In fact, over 40% of surveyed SMBs tend to their books monthly or weekly, meaning their accounting data provides a remarkably current view of their cash flow activity and financial health.

Which businesses keep the most up-to-date books?

Unsurprisingly, small and medium-sized businesses that outsource their accounting to an accountant or bookkeeper are able to maintain even more up-to-date financial records. Of these businesses, a majority—75% in the UK and 70% in the US—have their accounting updated for them at least once per quarter.

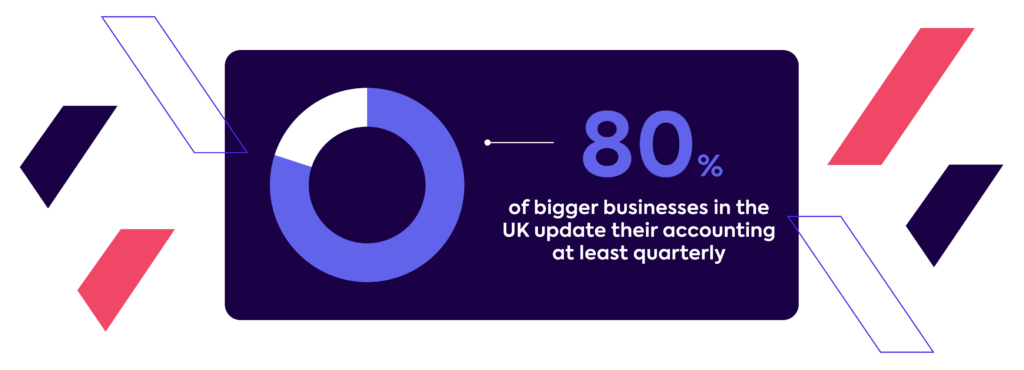

In addition, the vast majority of bigger businesses (i.e., those with annual revenue above $250K and/or with 10 or more employees) update their books at least quarterly. In the UK, this is true of 80% of bigger businesses; in the US, numbers hover around 68%.

UK businesses with a VAT-taxable turnover of over £85K are obligated to file their VAT return quarterly and will likely update their accounting system as part of this process. It’s, therefore, no surprise that the UK leads in this area.

Accounting data vs. publicly filed accounts and tax returns

Many lenders look to publicly filed accounts and tax returns to offer a view of an applicant’s profit and loss or assets and liabilities. While there’s often a strong level of confidence in this information as its typically verified by an accountant before being submitted, the data itself can be over a year out of date.

That’s because, in the UK, the majority of businesses are only required to file accounts once a year. In the US, while businesses are required to file an annual tax return, this is not always adhered to—as evidenced by the 19 million individual and business tax extension applications filed in 2022 alone.

Making the best credit decisions depends on having the latest, most precise information on hand. But relying on static, out-of-date data can make this challenging, particularly during times of economic uncertainty when a business’s financial position can change rapidly. This is also true when evaluating high-growth businesses that have experienced rapid success. Despite their last tax return or filed accounts not reflecting their current growth, these applicants may still present a promising opportunity for your business.

How this impacts your credit decisions

Filed accounts and tax returns offer a single snapshot in time, making it incredibly difficult for lenders to accurately assess the creditworthiness of a business when relying on this information in isolation. This can result in lenders approving unsuitable businesses (and putting their bottom line at risk) or rejecting promising ones (and missing out on opportunities to drive revenue).

Don’t believe us? Our partner, Wiserfunding, specializes in credit risk intelligence for SMBs using financial, non-financial, and macroeconomic data. They recently conducted research to show how relying solely on filed accounts could hinder your ability to identify opportunities when assessing SMBs. Among other things, they discovered:

- 58% of SMBs were materially more creditworthy than their filed accounts indicated when up-to-date accounting data was considered

- 16% of SMBs were materially less creditworthy than their filed accounts indicated when up-to-date accounting data was considered

- A newly established business with no filed accounts could be risk assessed with accounting data, which would not have been possible otherwise

Optimize your accounting data with industry-leading integrations

Codat can help you take your credit assessments to the next level.

We not only offer direct, real-time connections to the accounting software your customers use, but we also integrate their bookkeeping data seamlessly with other financial insights to fuel faster, smarter lending decisions. With Codat, you can:

- Automatically calculate financial ratios and metrics, so you can predict and measure loan performance in a matter of seconds

- Instantly cross-reference data from accounting, ERP, commerce, banking, and other platforms to help flag inaccuracies and detect possible fraud

- Easily categorize financial statements with machine-learning models trained on banking and accounting data from hundreds of thousands of SMBs

Building real-time accounting data into your loan origination process and ensuring you’re working with the latest information and technology—instead of relying solely on static, stale data sets—will help you make the right decisions that drive your business forward.

Get started

To learn more about Codat’s accounting integrations and how we help banks, lenders, and other financial service providers enhance their decisioning process, reach out to one of our SMB data experts—or register for a free account to see our platform in action.