Discover the pivotal role accountants play in guiding the financial decisions of small and medium-sized businesses.

Accountants are increasingly pivotal in guiding the financial decisions of small and medium-sized businesses (SMBs). A recent report by Spotlight Reporting revealed that 65% of accounting firms see themselves as progressive or hybrid firms delivering extensive advisory services.

Given their substantial influence, payment providers, especially those dealing with foreign exchange (FX) or cross-border payments, perceive accountants as valuable referral sources and influencers in purchasing decisions. After all, accountants often heavily influence the financial tools and providers SMBs choose to incorporate into their operations.

Our discussions with industry professionals backed by a comprehensive survey of 140 accountants based in the US and UK have helped us understand what accountants really seek from payment providers and how platforms can fulfill these expectations.

Keep reading to discover the factors shaping accountants’ decisions when recommending payment providers to their clients. From the importance of price competitiveness and transparency to the need for seamless integration and robust support, explore the essential features that influence accountants’ preferences.

Understanding accountants’ selection process

Understanding and recommending different financial tools has become a key aspect of the value accountants offer their clients. Just think about the thousands of accountants who show up at conferences like Xerocon every year to keep tabs on the latest financial technology!

According to Russell Frayne, Director of Transformation at Gravita, most accountants have what they call a “core platform” of financial tools that they recommend to all their clients.

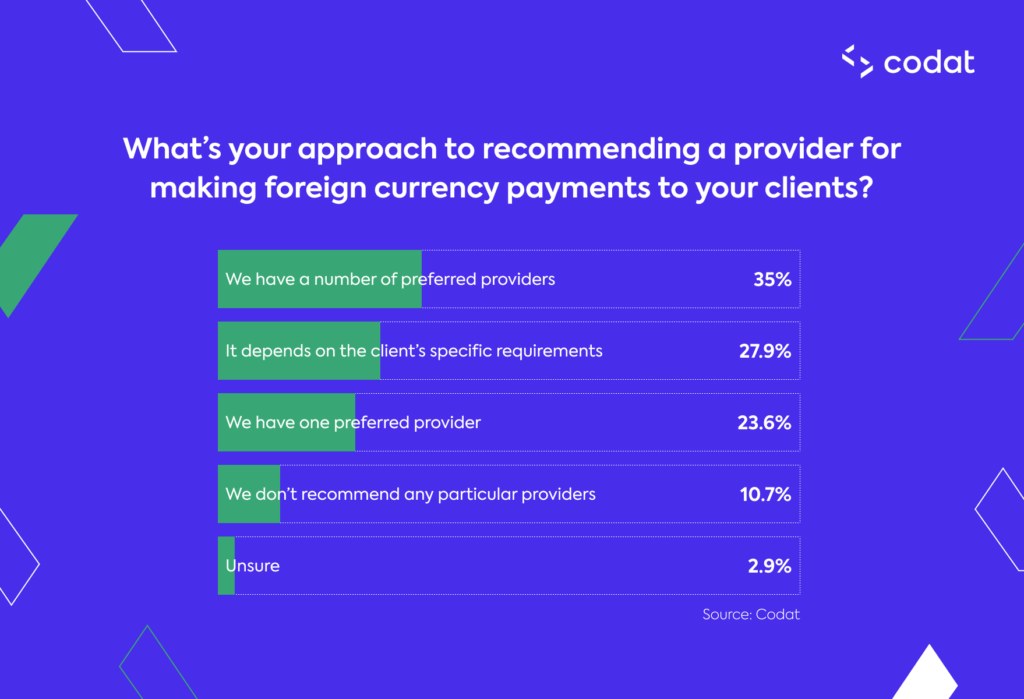

It serves as their basic toolkit, making it easier for them to train their staff and help their clients effectively. Our research very much supports this. More than 58% of our survey respondents consistently recommended one or several preferred foreign currency payment providers to their clients.

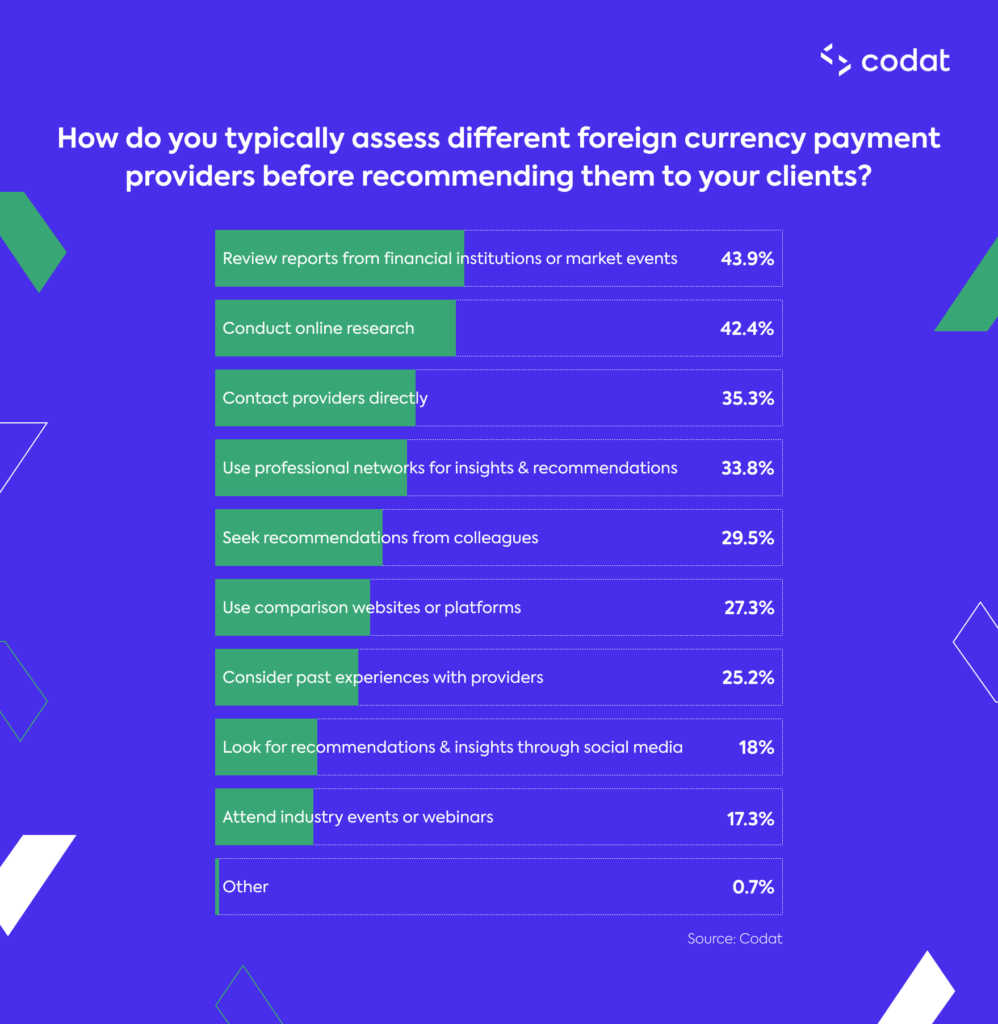

When it comes to determining the tool that secures the top spot, accountants are influenced by a wide variety of factors, including industry reports from financial institutions or market analysts, comprehensive online research, direct engagements with providers, and professional network consultations.

Additionally, social proof and word of mouth significantly influence their assessment of different providers.

Essentials for cross-border payment providers

In choosing a cross-border payment provider, brand recognition, pricing, and transparency reign supreme. While price competitiveness is paramount, accountants emphasize the need for clarity in fee structures to avoid unforeseen costs.

For Russell, clearly articulating the unique problems cross-border payment providers can solve for SMBs is key to winning their business:

“In today’s saturated market, a provider simply stating that they offer certain services isn’t enough. There may be multiple vendors who offer the same services, turning it into a pricing competition. This approach is not ideal when dealing with an accountancy firm. Instead, providers should focus on providing unique solutions to the core problems of their clients.”

– Russell Frayne, Director of Transformation at Gravita

Ultimately, without differentiation, providers may find themselves in a pricing war they can’t win.

How cross-border payment providers can stand out in a competitive landscape

1. Streamlined integration 🔁

The seamless integration of payment solutions with existing financial software is paramount for accountants, with 94% of respondents emphasizing its importance. By eliminating manual workarounds and ensuring end-to-end connectivity, providers can enhance efficiency and minimize errors, particularly in foreign currency transactions.

2. Transparency and support 🤝

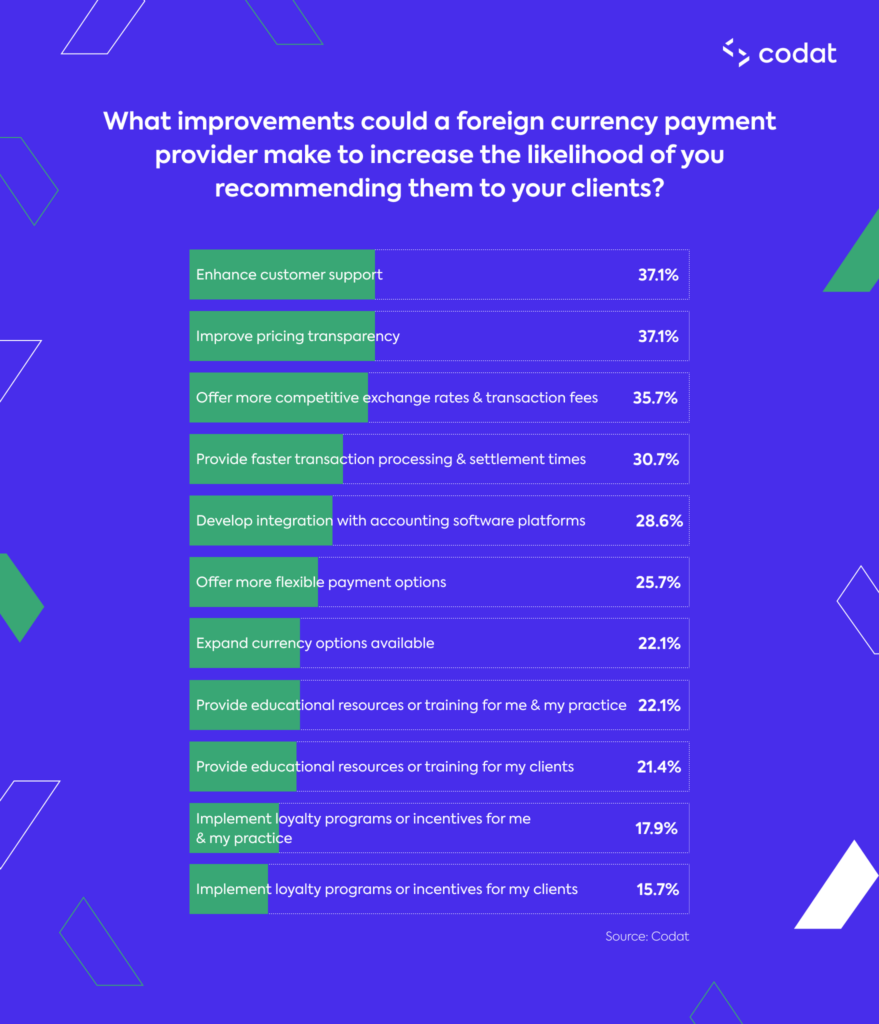

Providers must prioritize pricing transparency, customer support, and competitive exchange rates to cultivate trust and foster long-term partnerships. Research indicates that hidden fees have a profound negative impact on user satisfaction, emphasizing the importance of transparent pricing models. Additionally, implementing proof of concept or pilot programs can offer users firsthand experience, bolstering confidence in the service.

3. Education and training 📖

Over 43% of our survey respondents stressed the need for training and educational resources to help them understand how to use the payment solution. By offering comprehensive support to clients, providers can streamline the implementation process, accelerate user adoption, and accelerate their time to value.

Russell believes that providing support to clients to help them understand, use, and roll out the solution is more important than training them on FX hedging strategies, especially for large accounting firms. While the latter may be interesting for a long-term partnership, it requires a high level of trust in the relationship upfront. Otherwise, providers may risk encroaching on the accountant’s responsibilities.

There’s immense potential for solution providers to partner with accounting practices to reach SMBs at scale. Nevertheless, achieving success in this partnership necessitates a deep understanding of accountants needs. Providers should provide more than just a service; they should strive to build a relationship based on trust and value, which prioritizes fair pricing, seamless tech integration, and solid support for client rollouts. By fulfilling these expectations, providers can stand out in a crowded market and create mutually beneficial relationships that foster mutual growth and long-term success.

How Codat helps

Codat helps providers like Nium, Currencies Direct, Ebury, and Fexco level up their user experience with deep accounting connectivity. Our specialized products for accounting automation, like the Bank Feeds API and Sync for Payables, help cross-border payment providers bring higher-quality integrations to market faster through a single, easy-to-use API.

Get in touch with our team of specialists with the form below to see how Codat could help.