Learn about the surprising link between accounting connectivity and share of wallet in foreign exchange.

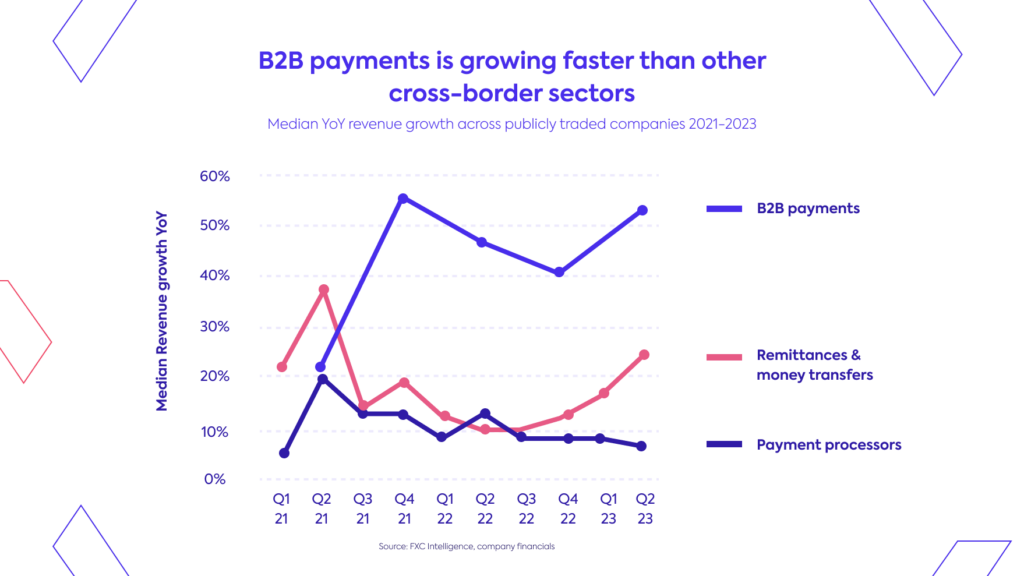

In the world of foreign exchange, B2B payments has recently emerged as a critical battleground.

Despite economic challenges, the segment is delivering consistently high growth. Research shows that Payoneer’s B2B AP and AR segment has experienced 39% annual volume growth, accounting for over 10% of the company’s overall volume. Similarly, Wise’s business revenue saw 56% year-on-year growth, outpacing the 47% growth seen in its consumer segment.

The success of B2B payments in forex has prompted a wide range of providers, from established institutions and traditional FX platforms to digital challengers, to explore avenues for further growth. In this article, we evaluate the competitive landscape and examine the tactics leading providers are using to establish market differentiation.

Understanding the competitive dynamics of the industry

Established industry players are improving their B2B cross-border payment offerings and showing early signs of success. One example of this trend in practice is American Express Global Pay, a cross-border payment solution designed for US-based SMBs. The solution enables businesses to pay suppliers in over 40 countries, and new users even enjoy a 90-day fee waiver as an added incentive to use the service.

In addition, traditional FX providers, who have historically offered relationship-focused value propositions around hedging and FX risk strategies for larger corporates, are recognizing the opportunity to appeal to mid-market businesses with a lower-touch digital offering.

Although mid-market businesses don’t require the same level of service as larger corporates, providers that can find ways to serve them profitably stand to make significant commercial gains. This intense competition for market share has given rise to a dynamic where differentiation efforts hinge on delivering an exceptional user experience.

How innovators plan to stand out in the crowd

Neil Peiris, Chief Product Officer at Wise, believes that market differentiation can be achieved through three key factors: speed, ease of use, and pricing. Out of these three factors, most providers tend to favor user experience rather than being drawn into a race to the bottom on price.

The importance of a seamless user experience can’t be overstated. Research suggests it has a strong influence on customer retention, with as many as 61% of SMBs refusing to return to a provider if processes aren’t effortless enough.

Brand loyalty isn’t exactly synonymous with B2B payments. In fact, businesses usually rely on at least two or more payment platforms. As a result, foreign exchange providers often end up with a large inactive customer base or customers that only process a small percentage of their total foreign payments with them. This negatively impacts profitability per customer.

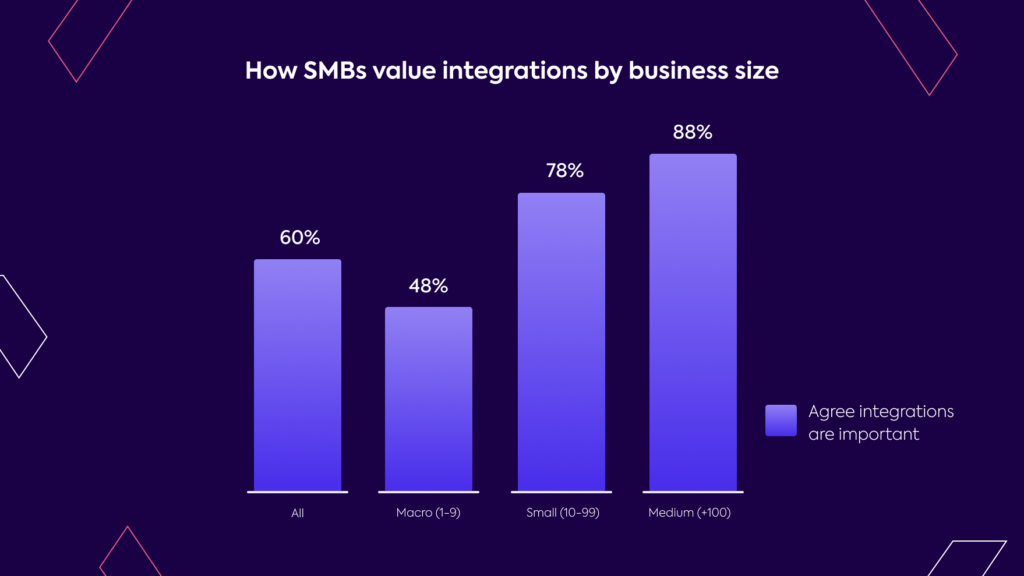

The specific drivers of a flawless user experience can be challenging to define in terms of concrete features or customer expectations. However, research from Codat shows that a strong indicator of a positive experience is how integrated the user flow is with the rest of the business’s financial operations. This is also supported by Swift, which ranks “integrations” as the third most crucial purchase driver for SMBs. At the same time, leading FX provider Equals singled out accounting integrations as their most requested feature.

The biggest opportunities for competitive differentiation

After identifying that connectivity to business financial software can improve competitive differentiation, the real challenge lies in determining where to start.

The term ‘accounting integration’ could refer to many different workflows, which would require a different technical solution. In addition, the process becomes more complex when dealing with the many different software platforms used by customers. Codat’s research with providers like Currencies Direct, Fexco, and Nium has identified two key solutions to enhance user experience and streamline the integration process. Let’s explore these solutions below.

1. Automating payment runs

Automating payment runs is a common challenge faced by businesses. According to research, a major inefficiency and source of frustration for accounts payable teams making batch payments is the process of uploading supplier payment details, often in the form of a spreadsheet. Something relatively minor, such as a single digit or space in the wrong place, can cause the entire batch to fail, requiring the user to start the process all over again.

To avoid such issues, businesses can integrate their accounting or ERP systems to fetch supplier payment details directly from their financial software. This simple integration can save a significant amount of time per payment run, resulting in substantially reduced labor costs.

2. Streamlining post-payment reconciliation

One of the challenges faced by foreign exchange providers is simplifying the bookkeeping process for their SMB clients. Often, cross-border payment providers overlook the accounting work involved in recording foreign currency transactions. This becomes a bigger problem when businesses are dealing with multiple currencies and reconciling payments, especially for SMBs that process large payment volumes. These businesses are the most valuable customers for cross-border payment providers, as they rely on interchange fees as a primary source of revenue.

However, implementing a bank feed can significantly reduce the workload. A bank feed is an automated transaction feed from the payment provider directly to the customer’s accounting software. This approach eliminates the need for manual data entry and makes it easier to reconcile transactions as all the necessary details are automatically fed into the accounting software. This includes:

- Payment amount

- Date

- Counterparty

- Payment reference

The bottom line

Integrations are already becoming an industry standard, and soon, their absence will be a notable disadvantage. Of FXC Intelligence’s top cross-border payment providers in the venture-backed category, over 40% already have some kind of integration with accounting software providers.

As competition in the B2B FX payments sector evolves, providers who can integrate and streamline their processes will be best placed to unlock new growth opportunities.

How Codat can help

Leading cross-border payment providers are already using Codat to grow transaction volume by providing a fully integrated payment experience.

With Codat’s Bank Feeds API and Sync for Payables solutions, cross-border payment providers can automate payment runs and streamline post-payment reconciliation, saving their customers countless hours and making their solution the preferred payment method. The best part? Codat takes care of all the complexity. Providers build just once to Codat to sync data to and from any supported accounting and ERP package into a single, standardized model.

Get in touch with Codat’s experts to see the benefits of effortless accounting integrations using the form below.