Accounting integrations and bank feeds can help you add valuable services, reduce churn, and build a wider economic moat for your business.

The payments industry is becoming an increasingly competitive and crowded space.

Companies that want to win in this market need to be able to differentiate their solutions and provide clear value-adds that further ingrain their services in their SMB customers’ day-to-day operations.

Below, we discuss the leading challenges payment processors and facilitators face as they continue to grow their footprints. Then, we explore the latest solutions for customer retention and growth.

The current payments landscape

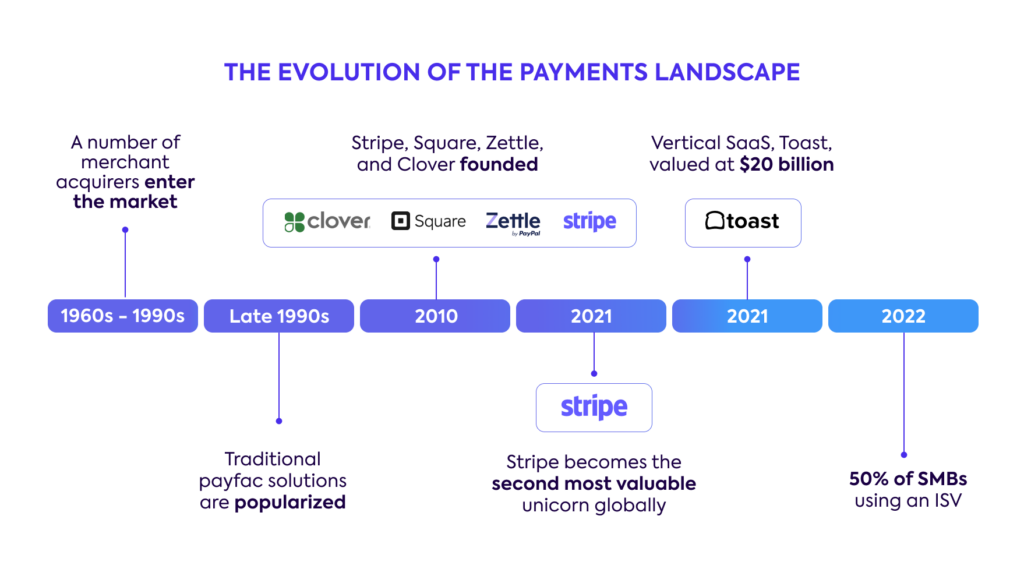

Merchant-acquiring banks like Chase Paymentech have traditionally dominated the payments space.

But in recent years, payment technology companies like Square, Clover, and Stripe—which offer a smooth user experience, competitive pricing, and value-adding features—have disrupted the market and found a substantial foothold among SMBs. Now, these companies are themselves facing steep competition from smaller integrated software vendors (ISVs) with a vertical focus.

In a 2022 survey, McKinsey found that only 38% of SMBs used incumbent, legacy software for payments; nearly 50% had already adopted an ISV, and another 15% were planning to transition to an ISV in the foreseeable future.

Although first and second-generation ISVs have successfully enticed many customers away from traditional banks, the latter’s services are still required for holding accounts, and they still command a sizable role in the industry.

With so many different providers in the mix vying for customers, even the most successful payments platform can only expect a small sliver of the pie. That said, there are actionable steps they can take to avoid common pitfalls and increase their overall market share.

The top three challenges in payments

Across the board, both merchant-acquiring banks and payment technology companies face some common challenges:

- Customer churn is high

- Margins are thin

- Merchant onboarding is manual and inefficient

Let’s explore each of these challenges in greater depth.

1. High customer churn ?

Payments is a highly commoditized industry. Research shows that only two payment technology companies, PayPal and Square, see double-digit use, with the majority of providers covering just 1% to 3% of the total market.

In such a fragmented space, SMBs have their pick of providers—and given limited opportunities for interaction, loyalty isn’t really a concern. They’re interested in the best possible deal, and they won’t hesitate to switch providers if a competitor offers lower prices or a better product fit.

Historically, the answer to this customer churn challenge has been lengthy contracts that lock SMBs in for multiple years. However, this is no longer a reliable way to secure revenue, as there are clear signs that regulators are beginning to crack down on this strategy. For example, in October 2022, the Payments Services Regulator in the U.K. introduced contract limits for card terminals—a ruling that will undoubtedly have providers looking for alternative ways to retain their customers.

2. Razor-thin margins ?

Payment processors and facilitators operate inside notably thin margins. The Interchange Fee Regulation in the E.U. caps fees at 0.2% of the transaction value for debit cards and 0.3% for credit cards, and this is often shared between multiple players.

As a result, the greatest ability to scale often occurs through acquisitions and consolidation—for example, when Elavon, itself a subsidiary of U.S. Bancorp, acquired Sage Pay in late 2019.

3. Inefficient onboarding ?

Back-office processes like underwriting tend to rely on outdated, manual workflows. Merchants must gather the required documentation, share it with the payment platform, and then wait for their application to be processed and analyzed by the underwriting team.

On average, it can take as long as 10 to 14 business days to be approved. This slow process may mitigate the risk of fraud and chargebacks, but it makes onboarding long and painful, ultimately leading to a poor user experience and a critical barrier to customer acquisition.

Moreover, in an industry where every transaction counts, even a two-week delay can mean many missed opportunities for revenue.

Why payment platforms need to adopt more value-adding services

During times of economic uncertainty, as SMBs consolidate their tech stacks, any opportunity to become more ingrained in their day-to-day operations can provide a competitive advantage.

The more services a customer adopts, the higher the switching costs, and the less likely they are to churn, creating a wider economic moat around a payment platform’s long-term profits and market share.

According to one study, 70% of SMBs use at least one value-added service from their payment processor and express interest in purchasing additional services in the future. Of these, 33% were interested specifically in accounting solutions. A number of industry commentators are also taking note of this trend.

“Increased competition and commoditization is causing these companies to scramble for alternative business models. The smartest ones are not dropping card payments entirely but using them as a wedge for higher margin, stickier, and complementary products like software, lending, and value-added services.”

Matt Brown, Fintech Investor

One popular value-add is bank feeds, which push incoming and outgoing transaction data from a payment provider or bank account to a customer’s accounting software. Bank feeds not only ensure merchants are working with accurate, up-to-date transaction data, they’re an important element when it comes to automating essential but time-consuming tasks like bookkeeping and reconciliation.

Due to thin margins, payment technology companies need to be both customer and cost-centric. Using turnkey, API-first solutions can be an efficient, cost-effective way to expand their services when limited hours or resources prevent them from building and maintaining integrations in-house.

That means buying, rather than building these capabilities can help payment processors save time and money while accelerating their time to market.

Wondering whether it’s more cost-effective to build and maintain integrations in-house or outsource the effort to a third-party provider? Our cost to build calculator helps you understand how long it could take and how much it could cost to build the integrations you need from scratch.

Improving the underwriting process to lower costs

A shorter onboarding experience makes it easier for payment technology companies to tempt merchants away from the competition—and lower their own operational costs in the process.

Introducing operational efficiencies to reduce the time per application slashes the costs while boosting merchant satisfaction.

Accounting integrations can speed up the underwriting process by providing a broad view of real-time financial statements, profit & loss (P&L), and balance sheets.

Understanding if customers are paying their taxes and suppliers on time is a good indication of financial health and any associated risks. From there, payment companies are able to make smarter underwriting decisions in a shorter time frame, with less back-and-forth customer communication.

How Codat can help

With Codat’s business data APIs, payments companies can retrieve and synchronize business data from customers’ financial systems in real-time, with minimal effort. Among other solutions:

- Our powerful Bank Feeds API pushes bank transaction data seamlessly from payment providers to a target bank account in a customer’s accounting software.

- Our Lending API tool enriches customers’ financial data, so it can be plugged into merchant underwriting models within minutes and drive faster onboarding.

If you’re ready to take the next step, check out our guide to building best-in-class accounting automation.

Or, to learn more about our platform, get in touch with our business data specialists, and discover what our universal API can do for you.