PoS providers can look to value-adding features like accounting integrations to limit customer churn and open up new revenue opportunities in a tough market.

Point-of-sale (PoS) systems are often regarded as one of the most important technologies in modern retail, handling everything from payments processing and inventory management to sales data analytics. Still, PoS providers face significant hurdles when it comes to revenue growth and customer churn.

In part, this is just the nature of the market, as the retail and hospitality sector is known for its relatively low margins and short business lifespans. But the situation is compounded by the current economic climate, which is causing many merchants to reevaluate their digital tools.

In this post, we explore these pain points in more detail, different ways providers can overcome them, and how exactly they can contribute to their bottom line.

Three challenges facing PoS providers

Many of the challenges faced by PoS providers are directly related to the challenges faced by their merchants. Essentially, a PoS provider’s success depends on their customers’ success. So, what pain points present the greatest challenges to both PoS providers and their merchants?

1. High customer churn

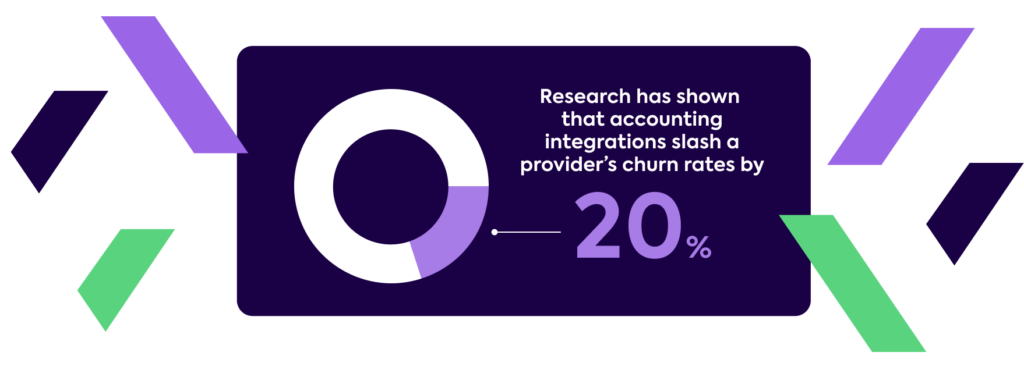

High churn rates come with SMB territory, especially in retail and hospitality. Some of this churn is involuntary, with PoS providers losing around 20% of customers yearly due to business failure. In other cases, merchants choose to switch PoS systems, with steep price competition and standard usage fees leading them to seek out the most bang for their buck.

2. Slim margins

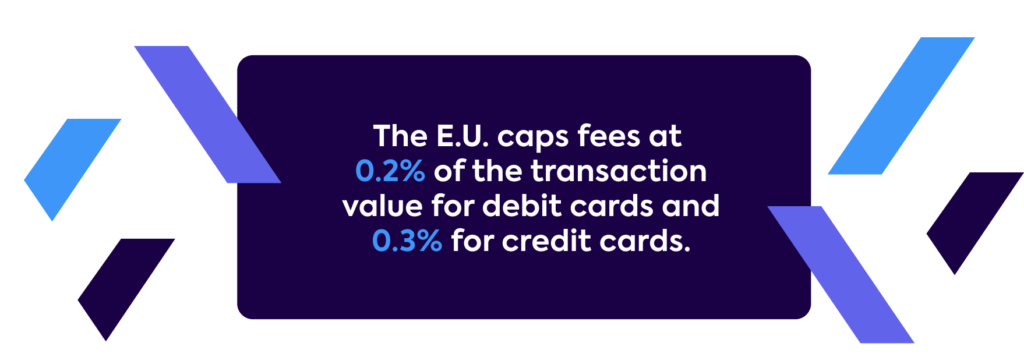

Retail SMBs are particularly low-margin businesses due to high outgoings, staffing turnover, and market competition. Likewise, point-of-sale providers operate inside notably thin margins.

With extremely restricted revenue opportunities from the facilitation of payments itself, providers are increasingly adopting complementary products like software, lending, and value-added services to ensure income growth.

Building extra features like payroll and invoicing services can help a provider stand out in the market and become more ingrained in their customers’ operations—but these capabilities only add value if their data can be synced with one another and reconciled against a merchant’s general ledger. Otherwise, they may as well be on a different platform.

3. Economic headwinds

In response to economic turbulence, businesses are tightening their belts. Our research shows that 40% of SMBs have made recent changes to their tech stack due to the economic conditions.

Considering its importance to a merchant’s operations, it’s unlikely a PoS system would be cut from the tech stack altogether. But it could easily be traded in for a model that eliminates the need for additional software. This means that as merchants look to cut costs, providers must be able to prove their worth to retain customers.

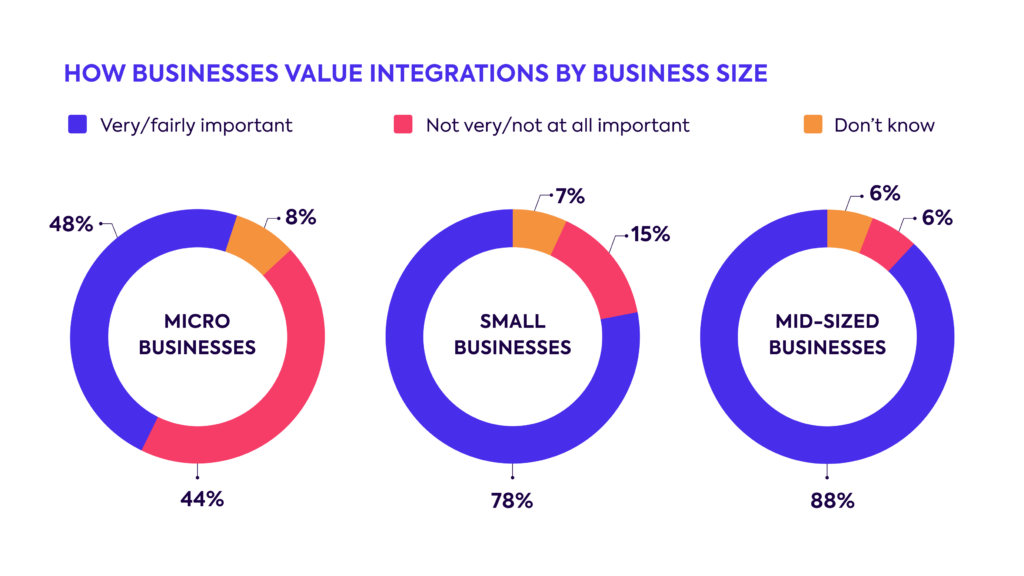

Recent research from Codat revealed that integrations are a top 3 purchase driver for SMBs assessing software providers and that their value only increases among larger businesses. Other reports reveal a similar trend. For instance, lack of connectivity and poor user experience is the most frequently cited reason for SaaS buyer’s remorse and in the restaurant industry specifically, integrations dictate an impressive 86% of all PoS purchases.

How to use accounting integrations to boost PoS revenue

Fortunately, building accounting integrations to automate the flow of transaction data is one initiative that can help to mitigate the impact of all 3 challenges. But how, exactly, can providers offer these integrations and use them to generate revenue? There are several different options available:

The marketplace approach 🛒

Most PoS providers offer their merchants an app marketplace, which hosts useful tools like accounting integrations. In this model, the accounting integrations themselves are built by middleware software providers like Amaka, Shogo, and A2X, which list their apps directly. Once a merchant installs an app, they pay the middleware vendor a monthly fee for use.

Advantages:

- The marketplace gives merchants a choice between multiple options.

- It’s an easy way for PoS platforms to quickly expand their functionality.

Disadvantages:

- Most of the revenue is captured by the middleware vendors, rather than the PoS provider.

- The PoS provider has no control over pricing or merchant experience.

- Merchants are often unaware of which add-ons they need.

- The resulting support model causes overlap issues and can lead to “support ping pong” between different service teams and lengthy onboarding processes.

Adopters:

Square and Toast are two examples of PoS providers using this approach to capture new business and create new revenue streams among existing clients.

The acquisition tool approach 🧲

Most PoS providers are primarily payments businesses, with revenue derived from interchanges. Due to their position in the payments stack, they can offer software features as a loss leader to acquire customers and grow volume. In this case, accounting integrations are a native part of the PoS platform.

Advantages:

- Seamless, native sync encourages stickier customer relationships.

- It helps attract and onboard more new customers.

Disadvantages:

- It’s most suitable for PoS providers who are also payment providers.

- It’s a missed opportunity to boost revenue, as merchants are willing to pay for this feature.

Adopters:

Zettle by PayPal uses the acquisition approach as primarily a payments application.

The pricing tiers approach 🪜

In this model, accounting integrations are delivered as a native part of the PoS platform. However, monetization is indirect. Rather than merchants paying for the accounting integrations, integrations are only accessible on a higher pricing tier and therefore act as an incentive to upgrade.

Advantages:

- It aligns with a business’s broader growth strategy.

- It helps ensure larger customers are on more expensive plans.

Disadvantages:

- Providers may miss opportunities to raise revenue from smaller merchants who would pay more for accounting integrations but don’t need or want other premium features.

Adopters:

Clover offers accounting integrations as part of a tiered subscription plan, designed to fit different business budgets and needs.

The add-on pricing approach ➕

In this model, accounting integrations are a native or semi-native part of the PoS platform, with a merchant paying for them as an add-on feature. PoS platforms may build these integrations themselves, but they’re more likely to select a middleware provider to be their exclusive partner.

This approach presents a significant revenue opportunity for PoS providers considering that SMBs typically pay external bookkeepers around $150/month to carry out similar tasks or an initial set up fee of $2,000 + $83/month for a single integration.

Advantages:

- The PoS has more commercial control over accounting integrations on offer.

- It’s a simple value exchange for the PoS platform and the merchant.

Disadvantages:

- Depending on the implementation and the partner, there are limits to how much a PoS provider can control factors like the user experience and commercials.

Adopters:

Lightspeed Accounting and Loyverse are two examples of PoS providers using this approach, offering accounting integrations as an add-on option alongside eCommerce and marketing integrations and advanced features like employee management.

The ideal model for most PoS platforms is the native, add-on pricing approach, as it offers providers higher revenue margins and greater opportunities for customization and control.

Should native accounting integrations be built or bought?

Given all of the benefits native accounting integrations offer for merchants and service providers alike, why aren’t they offered with more PoS systems? Simply put, they’re hard to build.

PoS providers that do decide to build these integrations in-house find that they can customize how accounting data is collected and stored within their app—but they also pour a lot of time, energy, and resources into both the initial build and ongoing maintenance.

Moreover, accounting APIs and data models are notoriously complex, so unless providers have specialist staff, it takes them even longer to sort through and standardize the data. Of course, they must then repeat this process for every new accounting platform and integration as they expand their services.

Luckily, there are now turnkey, easily embeddable products that allow PoS providers to offer native accounting integrations with minimal hassle and at a minimal cost.

To ensure a best-in-class product that scales with their business, providers should look for vendors that offer a versatile, business data APIs and robust solutions to the aspects of integrations that trip so many up, such as:

- Handling multiple taxes and tax rates

- Handling different payment methods and storefronts

- Tackling refunds, disputes, and chargebacks

How Codat can help

Codat’s Sync for Commerce solution makes it easy for PoS platforms to get started with simple, built-in accounting integrations that delight their SMB customers and drive their business.

To learn more about how they work, get in touch with our expert team—or sign up for a free account to see our platform at work.