Explore how neobanks and spend management providers are tackling profitability challenges through product diversification, including bill pay and business lending.

Neobanks and spend management providers face a conundrum: how to best address the market’s needs while scaling up profitably. On one hand, the neobank market seems promising, with an annual growth forecast of 54.8% from 2023 to 2030, largely driven by increasing demand for convenience.

However, many of them still face challenges. For instance, our research revealed that 35% of neobanks and 33% of spend management providers are experiencing increased burn rates, and 38% don’t anticipate raising new capital in the near future.

That said, with the rise of bill pay solutions, providers may have finally cracked the code to profitability. Providers now recognize the need for differentiation and owning a greater share of the spend lifecycle. More importantly, they understand that it can be achieved by solving a broad range of customer problems in one unified solution. And that’s where product diversification comes in.

In this article, we’ll explain how and why product diversification paves a strategic way forward for neobanks and spend management providers to secure a more financially viable future.

The move toward sustainable revenue models

As neobanks and spend management providers mature, many actively diversify their revenue streams on their path toward sustainability. Businesses are expanding their offerings beyond traditional options, transitioning from interchange as a primary source of revenue to multiple streams by including premium features like bill pay or business lending products in their spend suites. This way, they’re not just tapping into new revenue sources but also reducing reliance on a single product.

And the data backs it up: Codat’s recent survey revealed that 34% of neobanks and 43% of corporate card providers are launching new products beyond their core focus.

Specifically, 34% of neobanks and 38% of corporate card providers said they were launching new products to expand their addressable market.

You can already see this shift in motion across the industry. For instance, Revolut has evolved from its beginnings as an overseas spending solution to offer business accounts and lending services—including an AI-driven “Billpay” tool that allows companies to automatically import invoices from their accounting systems, extract essential details, and make transfers easily with the necessary approvals. Similarly, Wise is expanding its offerings beyond point solutions, like international money transfer services to provide borderless business accounts and bill pay in an effort to capture more business spend.

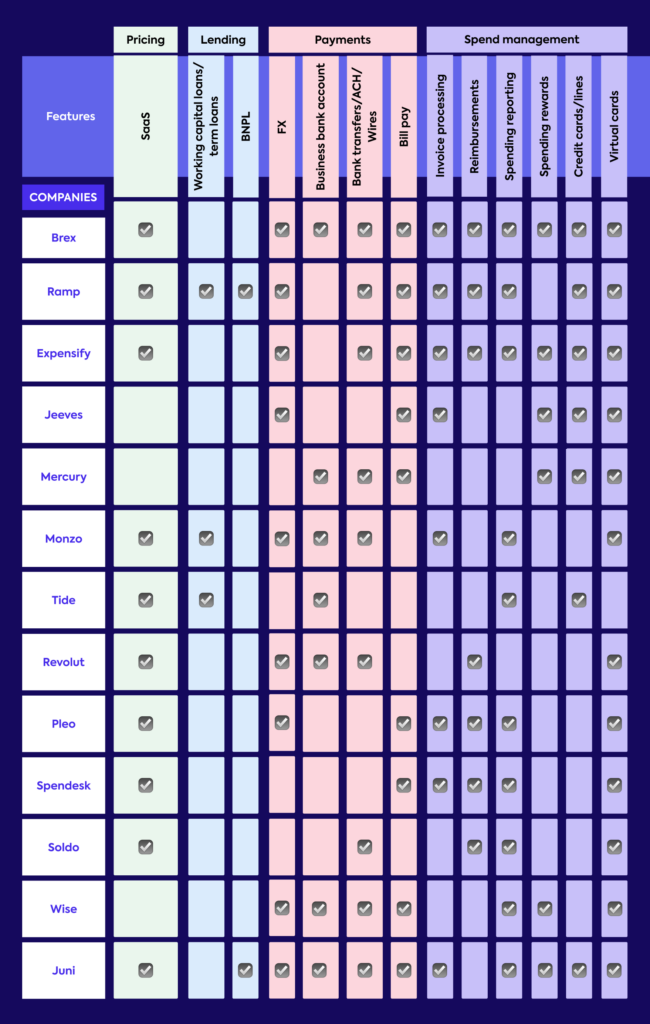

Take a look at the chart below to better understand the competitive landscape and the products currently offered by various providers:

All this to say, neobanks and spend management providers are already in the process of addressing a wider range of customer needs in their quest for a lasting, lucrative revenue model.

Betting wide with product diversification pays off

Product diversification is one of the key strategies used by neobanks and spend management providers. Spreading the bets in multiple products benefits both the providers wanting to boost revenue and small and medium-sized businesses (SMBs) who are looking for more innovative products that ease cash flow challenges. Here’s why betting wide with product diversification pays off:

1. Addresses SMBs’ financial challenges and market changes

The market is shifting rapidly, and SMBs are increasingly seeking to streamline their operations by consolidating their vendor relationships, especially when it comes to technology. According to recent research, 84% of IT professionals said they would like to use fewer vendors to meet their companies’ technology needs.

We recently spoke with Damian Brychcy, the CEO of Capital on Tap, about how providers are responding to this trend:

Clearly, there’s a significant opportunity here that providers can capitalize on through product diversification, particularly with the intent of solving multiple problems for SMBs.

The solution? If you’re a provider, consider introducing employee expense cards that handle both expense payments and bill payments (payables) to offer a more integrated financial solution. This way, you could:

- Simplify financial management for your business customers by giving them the ability to pull bills and pay them via their card;

- This will open the door to introducing new payment methods, such as Automated Clearing House (ACH), wire transfers, or Bacs Direct Credit (BAC), across a wide range of transaction sizes.

While this approach might take interchange fees out of the mix—fees that neobanks have heavily relied on over the years as a source of revenue, resulting in a profitability challenge—it opens up the possibility of charging fixed fees to process these larger transactions. For example, a business customer might be reluctant to make a $100,000 payment on a card that charges a high percentage of transaction fees, but they’ll likely be willing to pay a fixed fee to ensure an ACH transaction goes through—a crucial differentiator at a time when swipe fee transparency is very important to customers.

2. Unlocks new opportunities and revenue streams

As spend management providers expand their offerings, either by facilitating larger transactions or building new products, they also unlock new opportunities and revenue streams. Take, for instance, bill pay. Providers will generally see larger payments or transactions through bill pay compared to employee expenses, as SMBs leverage it for expenses like rent, inventory, etc, instead of just travel costs such as plane tickets or fuel.

In turn, these services also lay the groundwork for higher-value embedded finance solutions such as B2B Buy Now, Pay Later (BNPL) and tailored working capital loans based on the outstanding balance across bills—so you can essentially further expand your offerings. Ramp is an excellent example of this strategy in practice. Their introduction of Bill Pay in 2021 successfully paved the way for its new finance offering, Ramp Flex. This offering pays vendors upfront and gives customers the option to repay Ramp in 30, 60, or 90 days.

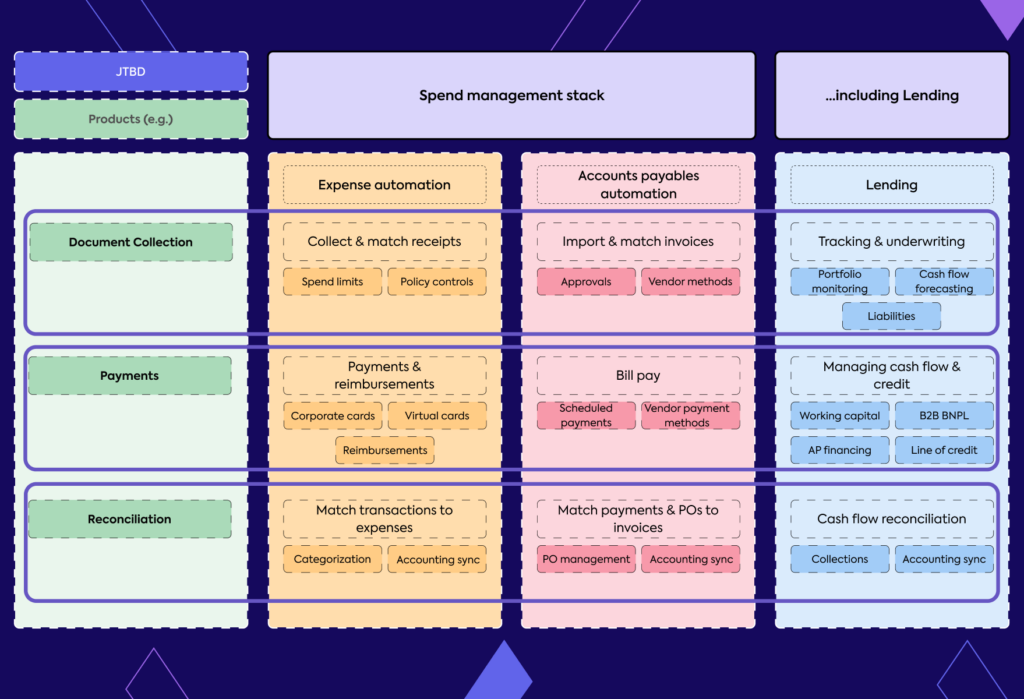

By owning the visibility over business spend across expenses and payables, you’re ideally positioned to offer SMB customers credit exactly when it’s needed. Take a look below to understand the current spend management stack and how it could be broadened with lending:

Own more of the spend cycle with Codat

In the end, product diversification for neobanks and spend management providers isn’t just about addressing immediate financial challenges, but also about focusing on long-term gains such as new revenue streams and enhanced customer value. By embracing comprehensive solutions like employee expense cards and other payment methods, providers can own more of the spend cycle.

But we know building these solutions isn’t simple, and that’s where Codat can help. If you’re interested in learning more about how Codat can make it easier to expand your offerings efficiently and effectively, get in touch!