Learn about the challenges payment providers face when launching merchant capital offerings and actionable strategies to overcome them.

Over the past few years, payment platforms have been in a race to become the go-to operating system for small and medium-sized businesses (SMBs). In this pursuit, many platforms have introduced a strategy of product diversification by expanding into related areas to provide a complete set of services for SMBs, with the ultimate aim of boosting growth and reliance on their platform. Smart move, right?

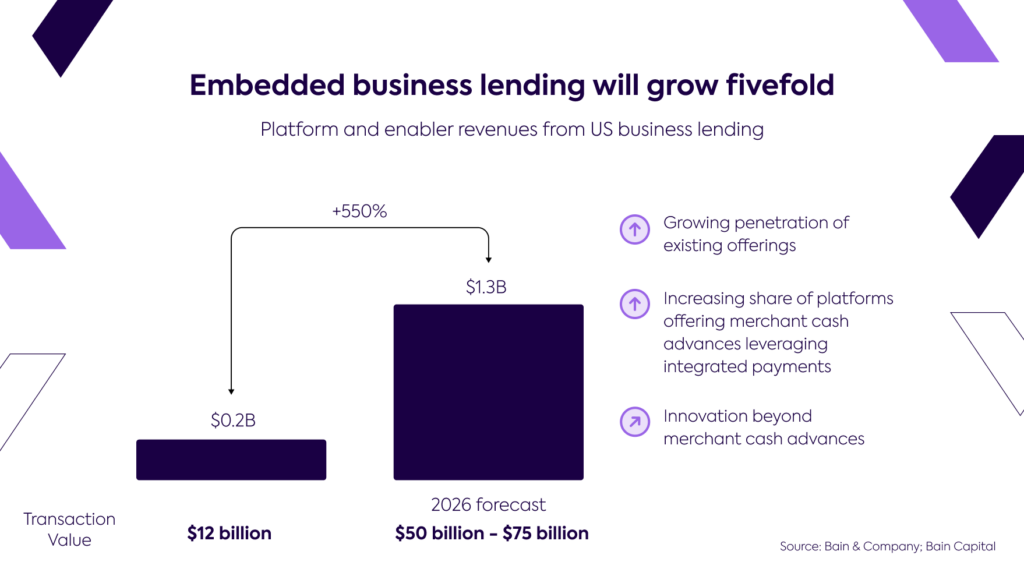

Merchant capital has emerged as a particularly promising product investment area in 2024, according to insights from Bain Capital. Their report highlights a significant uptick in B2B loans transacted via embedded finance, with projections indicating exponential growth in the coming years. This surge in embedded B2B lending, estimated to reach between $50 billion and $75 billion by 2026, underscores the potential of merchant capital solutions.

How merchant capital is driving growth and revenue diversification

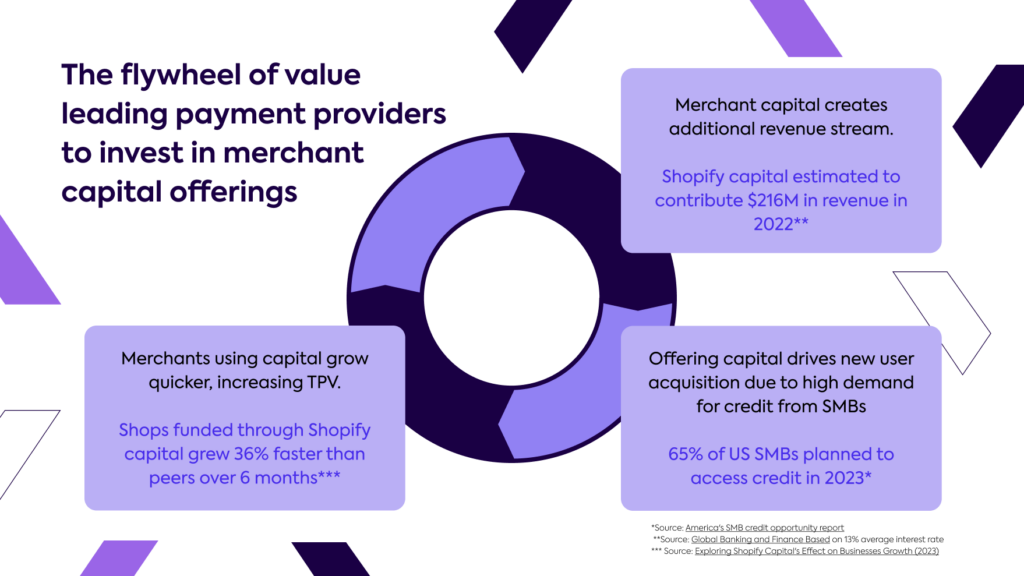

Leading the charge in this space are industry titans like Adyen, Toast, and SumUp, all of whom have recently introduced merchant capital solutions. Their bet on merchant capital isn’t just about providing funding; it’s a strategic move aimed at driving growth and fostering deeper relationships with merchants.

By offering access to capital, these providers are empowering businesses to expand their operations while also increasing payment volumes and reducing churn rates. This symbiotic relationship between platform providers and merchants creates a virtuous cycle of growth and prosperity.

Additionally, merchant capital represents a lucrative revenue stream in its own right. With higher margins than traditional payment services, it offers a significant opportunity for revenue uplift. According to BCG, platforms that offer cash advances, bank accounts, and card issuing can expect to see a revenue increase of up to 70%. This diversification mitigates the risks associated with over-reliance on a single revenue channel, ensuring stability and sustainability in an unpredictable market.

Challenges and opportunities

Despite its immense potential, providers implementing merchant capital solutions face several barriers to widespread adoption and scalability. One such challenge is the restrictive eligibility requirements imposed by providers, often necessitating a minimum trading history of six months. This limitation not only hinders access to capital but also overlooks creditworthy merchants with substantial off-platform data to support their financial stability.

Additionally, the low take-up rates observed in the market underscore the need for a more tailored approach to capital offers, as merchants are often deterred by the discrepency between the size of capital offers and the requirements of their business, highlighting the need for a more nuanced assessment of eligibility and loan sizing.

Below, we assess these two critical challenges in more detail and highlight the importance of leveraging off-platform data to overcome them.

1. Restrictive eligibility requirements

Consider the typical scenario: a merchant is required to use a payment solution for a minimum of six months before even being considered for capital funding. While this may seem like a reasonable timeframe to gather transaction data and assess creditworthiness, it fails to recognize the other sources of this information that already exist. This approach falls short of unlocking the true potential of merchant capital—for both businesses and payment platforms.

The truth is that many ineligible merchants possess a wealth of off-platform data that speaks volumes about their creditworthiness.

After all, longevity with a payment provider doesn’t necessarily equate to the age of the business itself. With merchant churn commonplace in the point-of-sale arena, it’s evident that time alone isn’t always indicative of a business’s stability. Moreover, a change in payment providers could coincide with a period of growth and significant changes within the business, leading to more urgent capital needs.

How to tackle this challenge

Fortunately, there’s a solution: off-platform data. By harnessing the power of accounting and open banking data, providers can paint a far more comprehensive picture of a merchant’s financial health, enhancing the accuracy of eligibility assessments.

Specifically, providers can use open banking data to produce cash-based profit and loss insights. Banking data categorization, like Codat’s, can help you to identify and discount non-operational income, like intercompany transfers, to give you a more accurate view of total operating income.

2. Low take-up rates

The allure of embedded lending solutions is undeniable, with 64% of SMBs expressing interest in integrated financial services. Yet, despite this overwhelming demand, the market grapples with another persistent challenge: low take-up rates.

Leading providers we’ve spoken to estimate that less than 5% of merchants who have been pre-qualified for capital and receive an offer go on to accept it.

At the heart of the issue lies a fundamental disconnect between the size of capital offers and the needs of businesses.

Codat’s own research shows that point-of-sale (POS) lenders often base their offers on a single revenue channel (POS transactions), typically representing just a small fraction of a business’s total revenue. This one-dimensional approach fails to account for the unique dynamics of businesses, resulting in offers that may not align with their actual funding requirements and demonstrate a lack of understanding of their business.

According to a Forbes report, 22% of SMBs consider funding limitations like this to be the biggest drawback of their financing method. This underscores the importance of relevant and appropriate offers based on a holistic understanding of a merchant’s financial situation.

How to tackle this challenge

By using off-platform data to view total revenue, payment providers can increase the size of the loan offer and, therefore, the likelihood of acceptance.

When merchants share their accounting data through Codat, standardized Profit and Loss and Cashflow Statements can be generated, showing revenue across all channels.

Additionally, features like the Loan Report, generated from accounting or open banking data, make it easy to identify other credit taken out by the merchant, giving payment providers greater confidence in offering a higher amount.

How Codat helps

Codat is dedicated to helping payment platforms offer more value to merchants by making data connectivity easier. Our Lending API is specifically designed to help providers increase loan sizes and offer merchant capital to a broader range of businesses by providing access to off-platform data, such as accounting and open banking data.

By allowing merchants to connect their financial systems through a seamless authorization process, Codat provides capital teams with a complete view of their trading history, including bank transactions and financial statements. This enables your teams to gain a better understanding of total revenue and financial stability, which in turn helps them feel more confident in offering larger loans.

Get in touch using the form below if you want to see Codat in action and learn how it can transform your merchant capital solution.