Discover what motivates small businesses to share data with financial providers and what providers can do to increase this openness to data sharing further.

In the context of small business credit, Open Finance has the potential to dramatically improve customer experiences and slash costs for lenders, but this is dependent on the willingness of small businesses to share their data with providers.

We recently did some research into the attitudes of UK SMBs to Open Finance and, in particular, data sharing with financial providers. Here are the key takeaways…

For the purposes of the research report, all SMBs in the market for credit, i.e. those who have indicated they are open to borrowing, are defined as “potential borrowers”.

Are SMBs willing to share their data? The short answer is yes

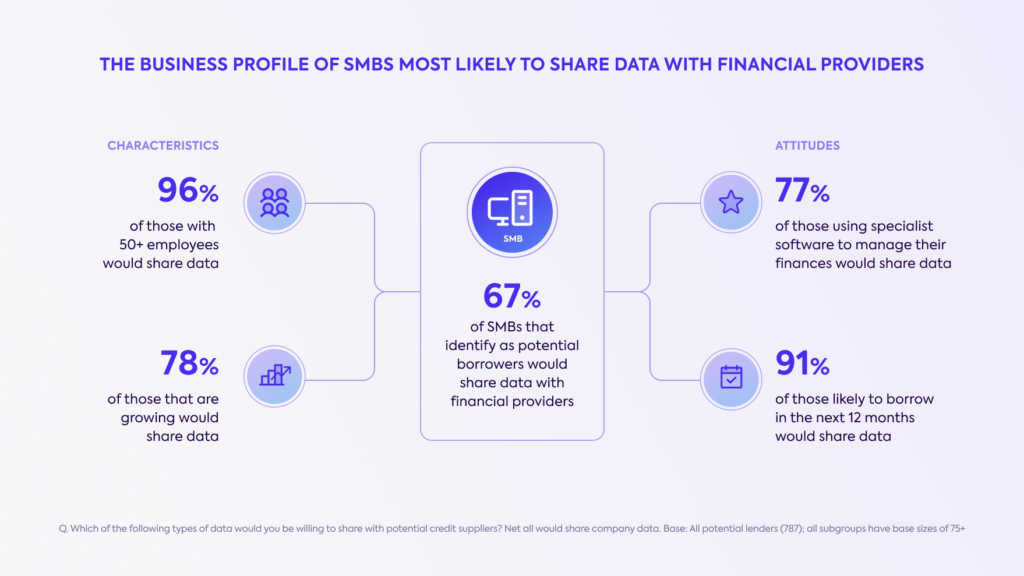

According to the research, two-thirds (67%) of small businesses that identify as potential borrowers say they would be willing to share data with credit suppliers. This figure increases to 90% of SMBs with more than ten employees, and to 96% for those with more than 50 employees. In other words, the larger the business, the more open they are to sharing data with credit providers.

What types of SMBs are more likely to share data?

As well as typically being larger in size, businesses willing to share data tend to be dealing with a high volume of transactions and they are using specialist systems to manage their finances. This profile of business is more likely to have finance or IT specialists on board and feel the pain of managing the volume of data generated by their businesses more acutely.

Growing businesses are more open to sharing their financial data — 78% of this group would share data compared with 67% of all SMBs surveyed. More generally, willingness to share data is also correlated with receptiveness to using new forms of finance — amongst businesses that said they were open to alternative lenders, 90% said they would share their financial data with credit providers, 23 % points higher than the overall average.

At the other end of the spectrum, sole traders and micro businesses tend to lack awareness and understanding of Open Finance and how sharing their data helps them.

Only 20% of sole traders have used Open Banking (vs. 81% of mid-sized firms) and 24% of micro-SMBs found the benefits of Open Finance appealing — a whole 37% pts less than those with more than 10 employees.

Although large in number, the sole trader and micro businesses segment is less critical to credit providers because they are less open to borrowing and when they do borrow, they borrow less. The average value of a loan taken out by sole traders is 10 times less than the average loan taken out by mid-sized businesses. So, while increasing awareness among sole traders and micro businesses would bring some benefits, the biggest market opportunity for credit suppliers is maximizing openness to data sharing among the 10+ employee SMB segment.

What motivates SMBs to share their data?

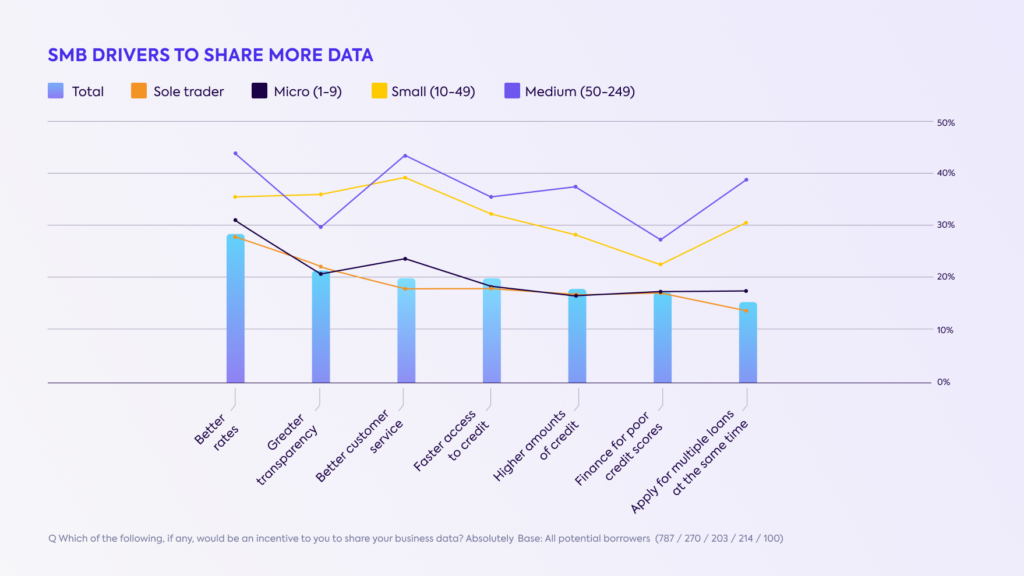

Better rates on loans is the most popular incentive to share data with credit providers, selected by 29% of SMBs, followed by more transparency in the decision-making process, chosen by 22%.

Attitudes to sharing financial data in return for access to better lending products and services — such as better rates and quicker service — vary significantly between different sizes of SMBs. Once again, the appeal grows along with business size.

Only 19% of sole traders find the value exchange of faster access to credit in return for data appealing. Among micro businesses (1-9 employees), that number increases to 38% and continues to grow to 61% and 70% for small (10-49 employees) and medium (50-249 employees) companies respectively.

Solving the issue of access to credit for larger SMBs is most critical because these businesses contribute significantly more to GDP than micro businesses. Companies with over 10 staff represent 5% of all businesses, but contribute 31% of turnover in the economy.

The key takeaway is that SMBs are open to sharing their data in return for improved lending products — namely better rates. The appeal of data sharing grows with business size and is correlated with an immediate interest in accessing credit. This makes sense — motivation to share data for better lending products will naturally be lower when a lending product isn’t an imminent business requirement.

How can financial service providers further increase SMB openness to data sharing?

While two-thirds of SMBs are already open to sharing their data, there’s still room for improvement. By focusing on the areas outlined below, providers can further increase the likelihood of customers sharing data, and therefore increase the quality of data available to them to make better credit decisions.

Focus on building trust and being transparent about data management

When asked about their apprehensions around sharing data digitally with credit suppliers, data management, security, and control represented the top concerns amongst SMBs.

Specifically, the primary data and security concerns are knowing who has access to their business data, losing control of data, the inability to know what data has been shared, and an uneasiness with the extent of information lenders can see.

Furthermore, data security is also the second largest concern amongst those who worry about alternative lenders. When asked what, if anything, could be done to help alternative lenders build their trust, half of sole traders/micro businesses said they wished them to make clear limits around how they are going to use their data while 43% of small/mid-sized businesses said the same.

Transparency about data usage, therefore, plays a big part in building trust, and so does clear and effective communication of the value exchange. In particular, financial service providers should focus on communicating the value of data sharing for their customers, what will be done with the data provided, and what actions the customer needs to take.

For more tips on building trust and transparency, read our best practice guide.

Increase awareness of Open Finance and alternative financing options

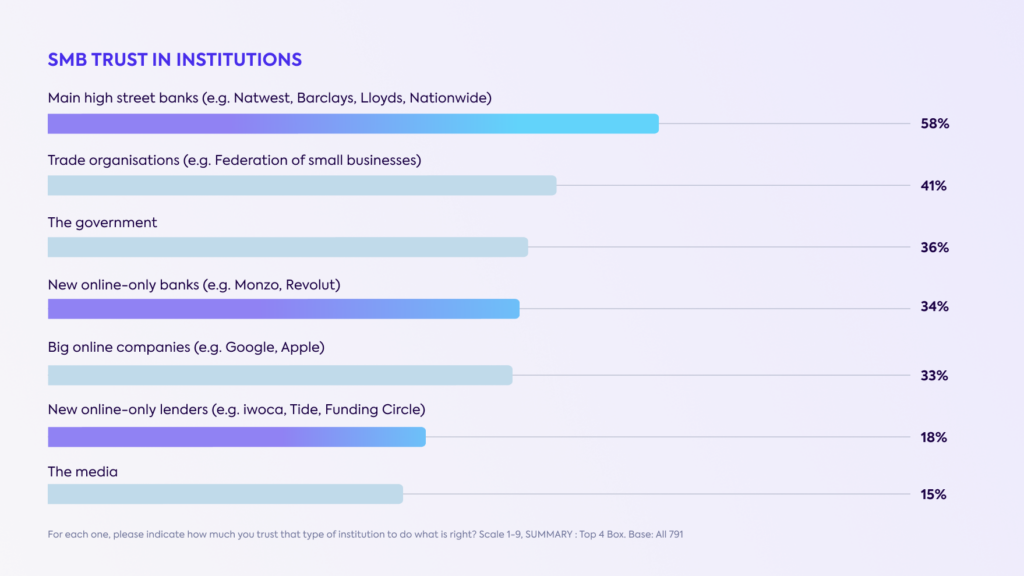

While there is a relatively high level of institutional trust in the main high street banks (58%), trust in online-only lenders is much lower (18%), which impacts the likelihood of SMBs sharing their financial data.

Amongst those surveyed with low levels of trust in alternative lenders, the top reasons cited were unfamiliarity, with 58% selecting this answer, followed by concerns about data security (55%) and a perceived lack of regulation (44%). Campaigns designed to educate SMBs and increase awareness of alternative financing will not only result in new customers through the door but will also impact the propensity to share data once they become more familiar with them.

Similarly, those who are aware of and understand Open Finance are more likely to have tried using it while those that are less aware are more likely to be conservative and mistrusting.

According to the research, 57% of SMBs that have heard of Open Banking have gone on to try it. Likewise, 67% of those that have heard of automatic digital data sharing for better credit provisions have gone on to try or consider integrating systems (27%/40% respectively).

Increasing awareness of Open Finance therefore will lead to greater numbers of UK SMBs sharing their data and opening their systems. The onus is on credit suppliers as well as the government to act now and set the right conditions for change by providing education, introducing awareness campaigns, and implementing new policies to drive SMB data sharing forward.

Learn more

Interested in more insights into the state of SMB finance in the UK? Read the report, Closing the small business funding gap: The next frontier for Open Finance, for access to more survey findings, learnings, and key takeaways.