Expense management has seen a wave of well-funded new entrants disrupt the space. One feature of all these fast-growing products is a focus on building high-quality accounting automation. Finance teams prefer to see spend go through cards that will not create hours of additional work thanks to poor or partial accounting integrations.

Without the right integrations, SMB finance teams can spend days every month on processes like bank reconciliation. A bank feed alone is not enough. To meet customers’ needs, corporate card providers need to send data to accounting software for both sides of reconciliation.

| Bank feed | Sends a list of bank transactions to a bank account represented in accounting software |

| Accounting integration | Sends categorized expense information to mapped accounts in the general ledger |

| Bank reconciliation | The process of comparing bank transactions and accounting records to check for discrepancies |

What is bank reconciliation?

Bank reconciliation is the process of comparing transactions in the general ledger with transactions in a bank statement. The goal is to ensure that both sets of records match.

This is a crucial bookkeeping process. Missed transactions and errors can have costly repercussions and harm a business’s ability to understand its cash flow, report taxes, access finance, etc.

Financial service providers are less likely to provide capital to companies with poorly-reconciled books. Assess, Codat’s product for business underwriting, even has a feature that checks the match percentage of bank transactions and accounting records. Lenders need this feature because if a loan applicant’s bank and accounting records are not reconciled, there may be hidden risks.

What does bank reconciliation look like for SMBs?

Accountants and finance teams often undertake a bank reconciliation monthly as part of “closing the books.” There should be no outstanding unmatched transactions at the end of a bank reconciliation.

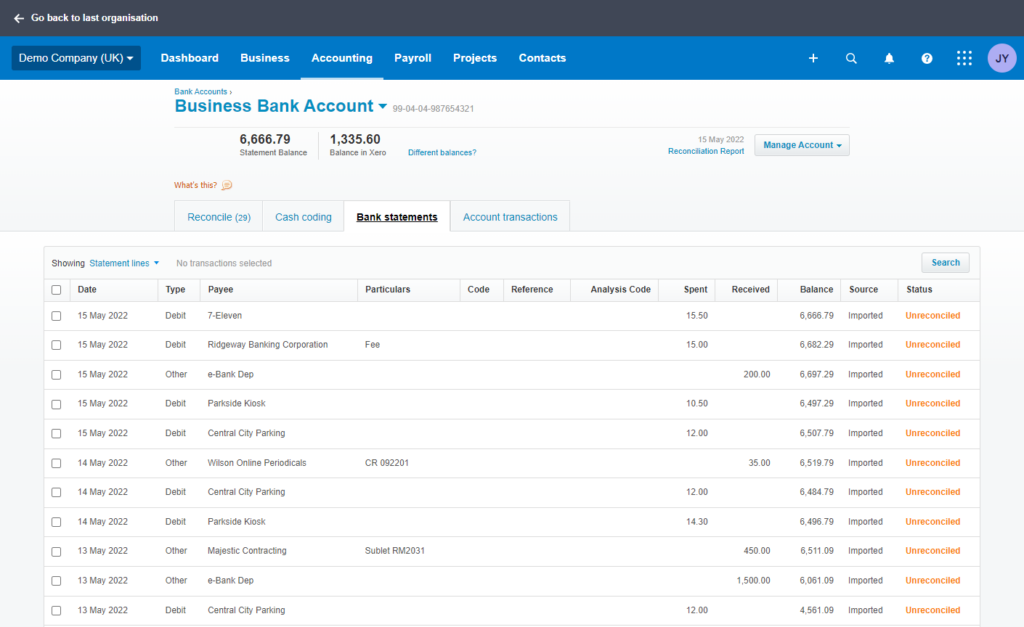

Before accounting software came along, bank reconciliation involved manually cross-referencing each transaction from a paper bank statement against entries in the general ledger. These days the process has been digitized but is still fundamentally the same. Most accounting software products have a “bank reconciliation” feature that guides the user through the process of comparing the two sets of records.

Small business accountants and finance teams spend hours every month manually processing a list of bank transactions and matching them against transactions recorded in their accounting software. Entrepreneurs and other small business owner-operators frequently prefer to perform bank reconciliation themselves to maintain a clear picture of everything going on in their business.

What are bank feeds?

A bank feed is a connection between a bank account and accounting software. A bank feed sends incoming and outgoing transaction data to the accounting software as a list of transactions.

As accounting software gained popularity, small business owners and their accountants started to look at ways to improve bank reconciliation. One of the easiest ways to achieve this was to automate the upload of bank transactions. Businesses began to download their bank statements in a common format, e.g., an OFX or CSV file, and then upload them to their accounting software.

This reduces errors as it ensures the amounts always match bank statements. It also saves time by removing the need to enter these transactions manually. However, the process is far from ideal. It takes time to export files, especially as they often need to be reformatted before upload. More recently, banks and other financial institutions have started looking at ways to use APIs to automate the process, giving rise to the bank feed.

What about the other half of bank reconciliation?

Bank feeds represent an important and positive step towards automating bank reconciliation. However, they only solve a part of the problem. Why is this?

- A bank feed only shows that spending has taken place. It does not affect profit and loss and balance sheets.

- A bank feed only shows that money has been spent or received. It does not show how that money was earned or how it was spent.

Small businesses are increasingly using bank feeds alongside additional accounting integrations that provide the other set of records required for bank reconciliation. This is because all that contextual information is required in accounting before accounting records can be cross-referenced with bank transactions. Often, a business owner or accountant creates accounting records manually by entering expense data into relevant accounts. While modern accounting software has made this much more manageable, it’s still a time-consuming and problematic process.

Why is the other half of bank reconciliation important?

The real strength of bank feeds is the immediacy and accuracy of the transaction data they provide. Accounting records complement this with crucial context and metadata. Without sufficient context, businesses cannot close the books. Some of the critical tasks that cannot be performed using bank feeds alone include:

Spend reporting

When a financial controller sees a spend transaction on a bank statement for £100.00 at a large retailer, they don’t necessarily know how to categorize the spend. The purchase could be of office supplies, client gifts, cost of goods sold, or even future inventory that should be reported as an asset.

Tax & reclaiming VAT

In most jurisdictions, some expenses are treated preferentially by the tax code, and others are not. In the UK, for example, it is possible to claim back VAT on certain expense categories and purchases (such as IT equipment and professional services).

Based on bank feed data alone, a bookkeeper cannot see which expenses are taxed at which rate or what proportion of an expense is tax that could be reclaimed. This can cause delays in closing the books and overpayment of tax.

Receipt collection and storage

It is necessary to collect and store receipts for business expenses. It reduces employee fraud and ensures compliance with tax reporting requirements and other laws. As bank feeds do not attach receipts to transactions, receipts are attached and stored in expenses represented in accounting.

If you provide a corporate card and are looking to become your customers’ favorite way to spend, high-quality accounting integrations are a must-have feature. Codat can help you ship better integrations without the costs and complexity of building from scratch.

To find out how, either get in touch or explore our documentation. You can also create an account to build and test your integration without paying anything until you’re ready to launch and scale.