By embracing connectivity and integrating with your SMB customers’ accounting systems, you can streamline underwriting, minimize risk, and grow your overall revenue.

With loan default rates on the rise and high-quality applications declining, banks and credit providers can no longer rely on top-line growth to drive revenue. Instead, in today’s economic climate, many are seeking impactful ways to cut costs.

Cost-to-income ratio is a key metric used by banks and lenders to measure profitability and operational efficiency, and given the current economic conditions, it’s under closer scrutiny than ever before. Averages for banks in the U.S., U.K., Europe, and beyond have hovered around or above 60% in recent years, and industry experts at KPMG predict that individual banks will need to decrease their ratio by 10% or more if they want to stay ahead of current trends.

There are many measures you can take to trim your budget and improve your margins. Some of the most common target overhead and operational costs by closing branches, discontinuing low-margin product lines, and slashing office expenses.

However, when it comes to operational measures, embracing connectivity to integrate with customers’ accounting software is an effective way to move the needle on cost-to-income ratio because it increases profitability across multiple fronts:

- It spurs efficiency during onboarding and underwriting, reducing the direct costs incurred while collecting, processing, and evaluating application data and making a credit decision

- It ensures ongoing data access during loan servicing, reducing the direct costs incurred while managing borrower relationships and maintaining existing accounts

Below, we examine how accounting integrations optimize these essential processes and minimize your cost-to-income ratio.

Driving efficiency in onboarding and underwriting

KPMG sees major opportunities for improvement in the middle and back-office processes that typically rely on slow, manual workflows. Chief among these are onboarding and underwriting.

As it stands, relationship managers spend a substantial amount of time chasing and packaging documents, uploading them to internal systems, and preparing and reviewing applications. Automating these tasks would not only accelerate their time to decision but eliminate many time-consuming manual tasks —not to mention the damage incurred by needless human errors.

So, how much do banks and lenders stand to gain from automating their onboarding and underwriting flows? Let’s break down the numbers.

Assuming a relationship manager’s salary is at least $93,000 per year (based on the Radford Global Compensation Database), with a work schedule of 40 hours per week, then their time is worth ~$44.71 an hour.

If the above onboarding and underwriting processes take 3 hours per application, and a bank or lender processes 100,000 applications per year, then that would result in $13.41 million or more in labor costs alone. To put that into perspective, that’s equal to the annual time and salary of roughly 144 relationship managers.

The benefits of introducing operational efficiencies to reduce the time per application are huge, resulting in significant cost savings. Discover below how accounting integrations can help you upgrade this process dramatically and refocus your team’s critical resources on higher-impact tasks.

Reducing servicing costs

The efficiencies and cost savings of integrated accounting extend to loan servicing processes in several significant ways.

First, having ongoing, automated access to financial data means your team can significantly reduce the amount of time they spend manually reviewing loan details, maintaining account records, and reaching out to customers for updated documentation.

What’s more, relationship managers no longer have the responsibility of manually reviewing the status of their entire book. Instead, automated alerting can be used to instantly flag customers who are at risk of defaulting, violating their terms, or any other suspicious activity—making it easy to track and prevent potential loss.

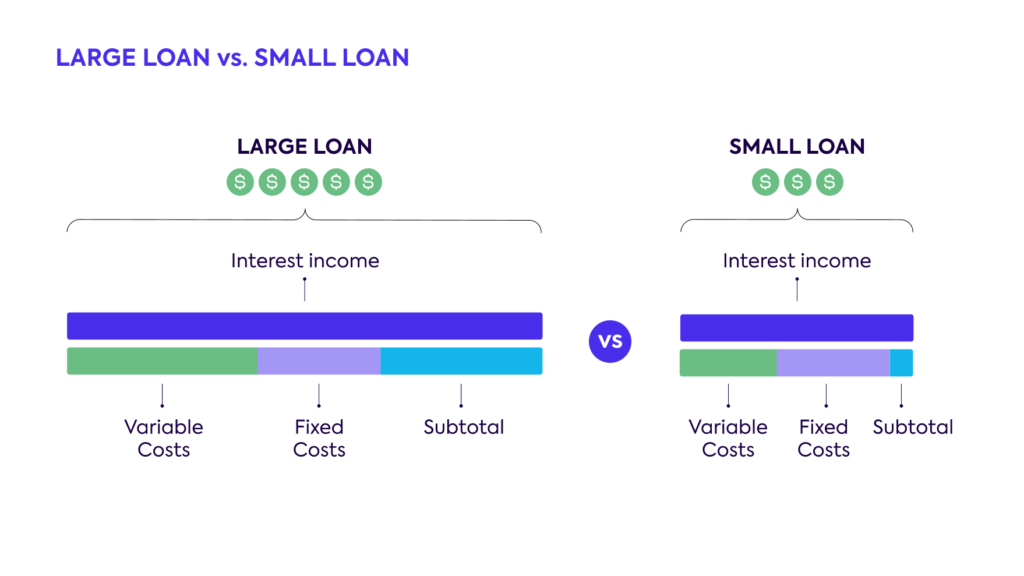

In addition, the majority of low-value loans typically go completely unmonitored despite their potential to negatively impact loss rates. This is because the added time and expense of ongoing maintenance results in incredibly thin margins for banks and lenders. However, automating this process by eliminating the need for manual document collection and using real-time data alerting to flag suspicious activity can enable credit providers to catch the early warning signs of default and ultimately avoid losses without incurring additional costs.

Multiplied across hundreds or thousands of loans, even a small difference can have a big impact on your bottom line.

The financial impact

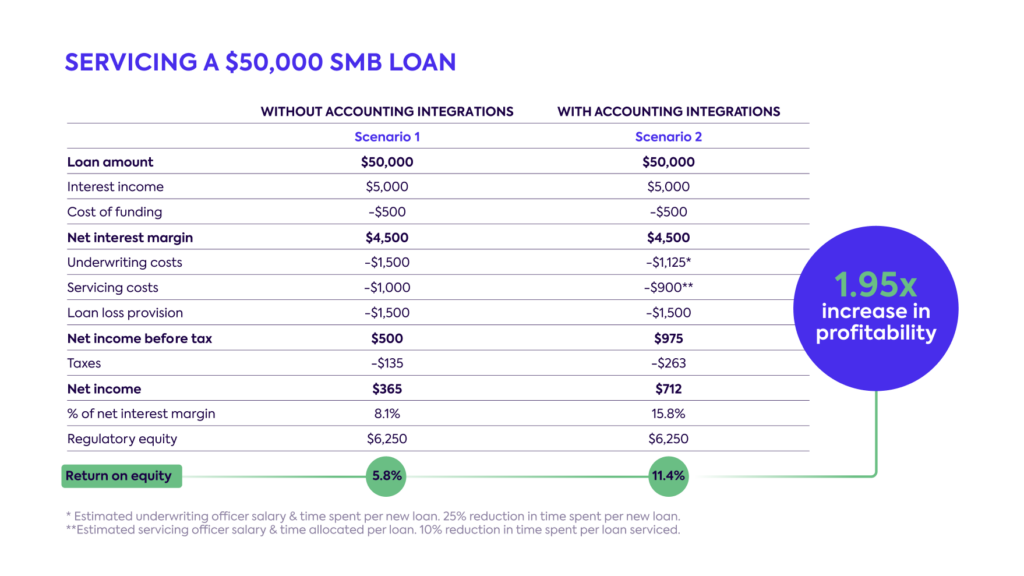

To illustrate these points, we built a financial model that tracks the end-to-end impact on a $50,000 loan with and without access to accounting integrations.

We found that underwriting time and costs decrease by 25%, while servicing time and costs reduce by 10%, leading to a 1.95x total increase in the return on equity.

We kept the assumed loss rate constant across both scenarios to skew conservative in our modeling. But at Codat, many of our client’s real-life results suggest that real-time access to verified financial data actually leads to lower loss rates, as well.

For example, the financing platform Ampla uses Codat to stream data from their SMB customers’ accounting and commerce systems and automate their credit-risk management program. As a result, they cut their cash deployment timeline to under 48 hours while reducing their overall loss.

“It starts with the data. The better your data, the smarter your underwriting, the lower your loss rate, and the more extensive and affordable your capital solutions.”

Jim Cummings, Chief Operating Officer, Ampla

Increasing revenue without increasing costs

On top of that, more efficient underwriting means banks and lenders can process more loan applications in a given period—potentially increasing the total number of funded loans and driving further revenue opportunities. This makes taking on smaller loans more operationally viable for lenders, since reduced underwriting costs help them achieve economies of scale and generate a favorable ROI. In addition, increased confidence in the data and the ability of applicants to repay means that lenders can extend more credit, resulting in higher revenue from the interest paid.

For example, BNPL solution Playter reduced their underwriting time from 10 hours to 10 minutes by pulling verified financial data into their credit decisioning platform. That allowed them to take on more SMB applicants and quickly grow their business to new heights.

“We’ve been able to scale at speed knowing that we have up-to-date and accurate data.”

Jamie Beaumont, Founder, Playter

Getting the most out of your accounting integrations

If accounting integrations can help you streamline your operations, lower your cost-to-income ratio, and propel your business, then mobilizing them through a provider like Codat can amplify those results exponentially.

That’s because we’ve already built seamless accounting integrations for you, and all your team has to do is build once to our platform to unlock a world of financial data connectivity. By leaning on a turnkey, all-in-one API, you gain additional:

Speed 🏎️

Codat offers many accounting integrations at once, so you avoid the need for incremental builds and ongoing maintenance. That frees up critical time for not only your account managers but also your development team.

Clarity 👀

Accounting data can be challenging to navigate and understand, but Codat simplifies complex data outputs and irregular attributes into a single, standardized format, so it’s easier to actually use.

Intelligence 🧠

With proactive and automated alerting, Codat enables smarter credit decisions and eliminates needless risks.

Scalability 🏗️

With broader, deeper financial data, banks and lenders can feel confident expanding their market to thinner-file businesses and upselling current accounts, generating new revenue streams and stickier customer relationships.

If you want to learn more about building effective accounting integrations—with or without an expert third-party provider—you can download our integration strategy guide or read our recommendations for finding and identifying a best-in-class provider.

The bottom line

Integrating with your SMB customers’ accounting systems is the smartest way to ensure your cost-to-income ratio is on point to confront our evolving economy head-on.

Automating your lending processes and having real-time access to your customers’ financial data doesn’t just mean faster funding for them. It means simpler, more efficient processes, lower costs, and greater revenue opportunities for your business.

About Codat

Codat provides business data APIs for SMB lending and embedded accounting automation. Our products connect banks and fintechs to all the major accounting, banking, eCommerce, and payments platforms small businesses use, enabling them to build features that save small businesses time and get them faster access to capital.

If you want to learn more about how our platform works, get in touch with a member of our team—or sign up for a free account to try our solutions out for yourself.