Discover how lenders can transform banking data from a moderately useful indicator of creditworthiness into a powerful decisioning workhorse.

In the fast-paced business lending industry, making smart use of the banking data collected from customers can be a crucial differentiator.

Yet, gaining access to this data is just the first step. To translate this wealth of information into actionable insights and informed lending decisions, providers must meticulously format and categorize the data they receive before it can be analyzed. Though indispensable, this process often proves to be a time-consuming and complex endeavor. Unfortunately, the harder it is to process data, the more likely lenders are to use less of it. This, in turn, leads to them imposing stricter credit limits to reduce their risk exposure.

To tackle the challenge at hand, lenders need to find ways to further automate the processing and formatting of data and extract more insight from it. By doing so, they’ll not only avoid time-consuming, repetitive tasks but also more accurately predict future cash flows.

This article explains the steps you can take to use banking data to its full decisioning potential. Specifically, we explore how you can use it to improve underwriting efficiency and ultimately accelerate growth.

How the status quo falls short

Whether collected via email or open banking, banking data has long been the backbone of basic verification tasks such as confirming a business’s name or ensuring that a director holds the necessary ownership stake. It’s also key to understanding how much revenue a business generates from its regular operations, how much it spends on operating expenses, and any other debt obligations it has.

Now, with providers like Plaid, Finicity, and TrueLayer, lenders can even monitor cash flows in real time, enabling them to predict defaults better and set dynamic lines of credit. And since banking data is sourced directly from the systems of record (i.e., the applicant’s bank account), lenders can be confident that they’re receiving accurate information.

The downside? Banking data’s lack of contextual information often obscures the full financial picture. Firstly, it’s worth noting that, on average, a business uses four different bank accounts. If lenders only base their decisions on the primary bank account, they may not have a complete and accurate understanding of the applicant’s financial position.

Even if lenders do consider multiple bank accounts, they still face the challenge of categorizing income and expenses. After all, how can you actually differentiate between operating expenses, intercompany transfers, and debt obligations just by looking at a bank statement? This lack of clarity makes it challenging to accurately assess cash flow.

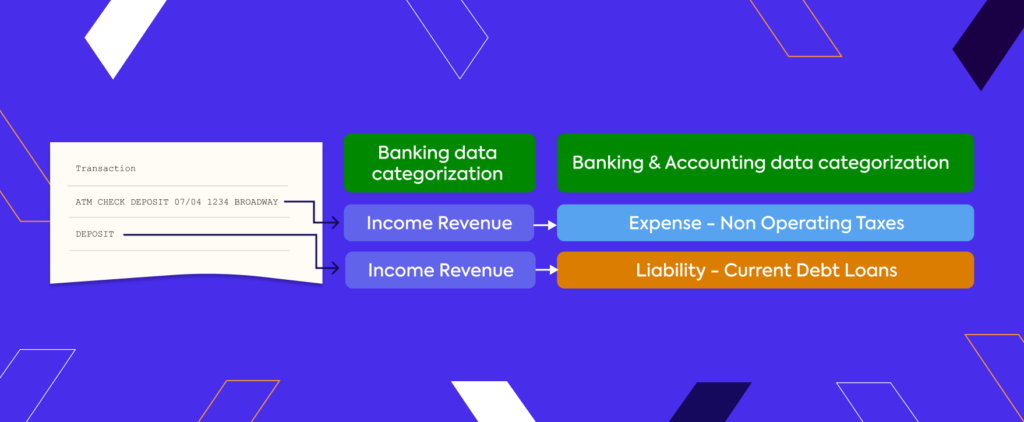

Consider this example: When cash is deposited into a bank account via an ATM, it appears on a bank statement simply as a deposit. Lacking more information, an underwriter would likely label it as “revenue,” but that label may not fully reflect the nature of the transaction. It could be revenue from customers, a cash infusion from a shareholder, or even a form of non-revenue income like a loan.

To overcome this, underwriters often have to manually sift through and categorize incoming and outgoing payments or reach out the applicant to get more information. This not only drives up the cost of underwriting but also limits lenders’ ability to scale—a challenge that is magnified in high-volume use cases requiring regular risk monitoring, like corporate card underwriting. Fortunately, there’s a better way.

3 ways lenders can make the most of banking data

So, how can you transform banking data from a moderately useful indicator of creditworthiness into a powerful decisioning workhorse? There are a number of measures you can take:

1. Work with a third-party categorization provider to classify transactions 🔎

Fortunately, you don’t need to categorize banking data to validate accuracy all on your own; a categorization provider can do the hard work for you. Providers like Codat use alternate datasets and machine learning models to streamline the classification of transactions into their appropriate financial categories.

This automation turns banking data into a structured, insightful format that offers a more detailed view than merely looking at transaction values. By enriching transaction data, categorization providers offer deeper insights into businesses’ financial activities, capturing the nuances that raw numbers alone might miss.

2. Build real-time profit & loss statements from transaction data 📊

To dive deeper into the data you have, build financial reports like cash-based profit-and-loss statements using the categories assigned to bank transactions.

Moreover, when the banking data is in a format that seamlessly aligns with your underwriting criteria, it can be easily compared to other businesses in your portfolio. Ideally, these reports are automated to refresh in real-time as businesses spend, offering you a live feed of their cash flow. That’s where solutions like Codat come in handy.

3. Get a complete picture of borrowers by comparing other data sources 🖼️

Implementing the two suggestions above will ensure that banking data provides useful insight into an applicant’s business transactions. To take this insight to the next level, lenders should consider supplementing this information with accounting data.

Accounting data contains the complementary context necessary to better categorize ambiguous transactions. For instance, it could help an underwriter identify a $20,000 loan that could otherwise be mistaken for revenue. Imagine the compounded costs and the risk associated with that happening multiple times.

By incorporating accounting data, lenders also open up the opportunity to further enhance their credit models with additional data.

Codat makes it easy to optimize banking data for informed credit decisions

Taking these measures is easy when you leverage a solution like Codat. Codat unites and connects open banking and accounting datasets on a single platform and takes the hassle out of, categorization, enrichment, and analysis. Lenders use Codat to gain the clearest insights and incredible efficiencies during the underwriting and decisioning processes and beyond.

For instance, Codat’s Bank Statements feature seamlessly integrates and enriches transactions from banking connections with accounting records. It accurately assigns financial categories and payment provider details, which supports liquidity assessments, financial obligation evaluations, cash flow trends, and revenue analysis.

The feature includes detailed account information, transaction records, account balances, and categorized statements from various data sources in one endpoint, providing a complete financial overview to help make informed decisions. What’s more, if not all of your clients can connect their accounting data, our categorization engine based on bank transaction data alone will improve over time to give you better predictions across your entire client base.

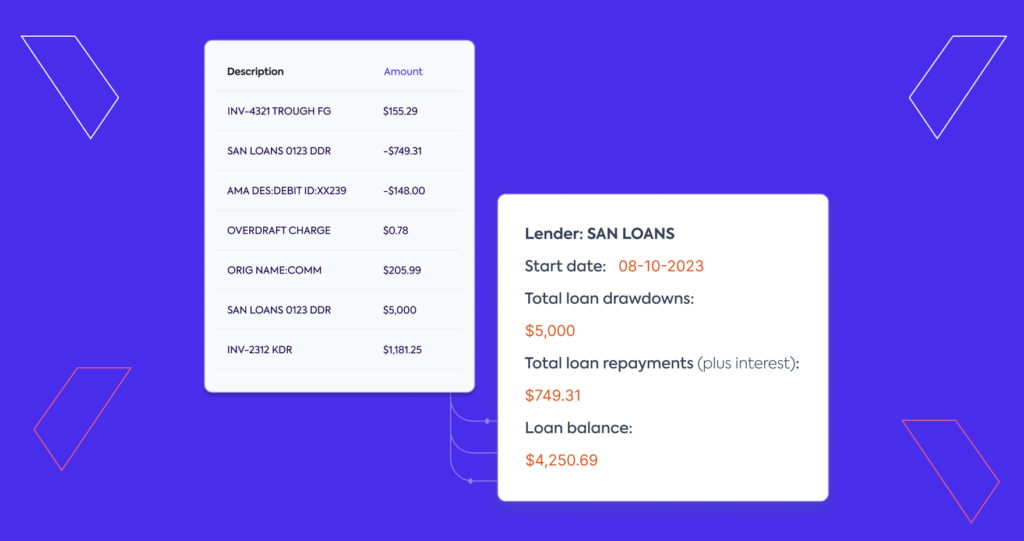

Additionally, Codat’s Loan Report feature provides lenders with instant insights into applicants’ outstanding loans and repayment history, streamlining the underwriting process by revealing repayment behaviors and loan stacking. This process starts when customers connect their financial accounts, allowing Codat to automatically identify and summarize outstanding loans and repayment details. With this overview, lenders can quickly assess borrowing capacity and make educated credit decisions.

In a nutshell

To sum it up, the benefits of using Codat include:

- Continuous access to borrowers’ banking data, ledgers for payables and receivables, and sales, orders, and inventory

- Ability to connect to multiple data sources through a single, streamlined user journey

- Automated categorization of transaction and financial data, as well as P&L and loan reports, that can easily integrate with major decision-making systems

- A deeper understanding of a business’s profitability, solvency, and efficiency, including reports that help reveal if a business has multiple loans or pending tax liabilities

The points noted above just scratch the surface of what you can do with Codat. Simply put, our technology transforms the underwriting process, making it easier, better, and faster for lenders.

To experience firsthand how Codat can simplify the underwriting process, get in touch using the form below.