Save your customers time and money by automating the payroll process.

Payroll is usually a business’s most significant outgoing expense. It’s also a complex task, spread across HR and finance departments that need to account for different data points like sick days, overtime, taxes, health benefits, and 401k deductions. It’s no wonder, then, that 59% of SMBs choose to outsource at least some part of their payroll process.

The global payroll industry was valued at $22.7 billion in 2021 and is expected to reach $41.9 billion by 2030. But even though demand for these services is high, according to Ernst & Young, 78% of SMBs think the experience could be improved. That’s because seamless in-platform integration is not common among payroll providers. For example, SMBs using accounting platforms like QuickBooks or Xero have historically had to export their data from their payroll provider and then manually import it into the accounting platform. This time-consuming process complicates an already complex task.

To provide SMB customers with the best payroll experience and keep them from moving to other platforms, payroll providers should leverage the power of integrations. This is especially true in a post-pandemic world.

How the pandemic changed the way SMBs think about payroll

The pandemic laid bare a lot of the inefficiencies that plague the payroll process. Many SMBs found themselves short-staffed and running into even greater payroll processing delays. Another issue was a lack of flexibility, as companies with on-premise or legacy payroll systems found it much more difficult to adapt to work-from-home policies. The pandemic also necessitated the ability to adapt quickly to changes regarding policies like furlough and sick pay.

These new challenges, coupled with payroll’s existing complexities, have forced SMBs to search for providers that can adapt to the dynamic climate of today’s world of work.

But why is payroll so complicated in the first place, and what steps can payroll providers take to alleviate their customers’ pain points?

How integrating payroll and accounting helps SMBs

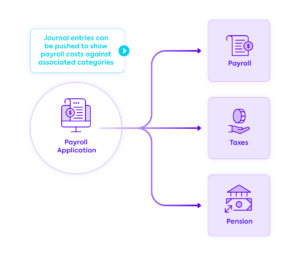

The sheer number of moving parts in the payroll process makes it a painstaking task. But by pulling accounting data directly into your payroll platform, you reduce the overall complexity and offset some of that workload. Here’s how:

1. Eliminating manual tasks ❌

As we mentioned earlier, manually inputting payroll data into their accounting platforms is one of the biggest challenges SMBs face. Providing your customers with a direct integration allows them to seamlessly reconcile data between payroll and accounting—doing away with the need for data entry. It also permits greater flexibility when it comes to payroll classification—letting payroll departments adjust payment dates or skip a payroll period, set holiday hours, and enable or disable direct deposit quickly. These changes are then reflected in all connected systems.

2. Reducing errors 🔽

In offering SMBs automated payroll reconciliation via accounting integrations, you help SMBs decrease the errors that arise from manual entry. These errors can include:

- Misclassifying employees

- Miscalculating pay

- Miscalculating taxes

An automated payroll reconciliation process also helps streamline the responsibilities of the employees that manage payroll, eliminating the steep learning curve that comes when these employees go on leave, move to a different department, or exit the company.

3. Speeding up business operations 🏃

Not having to enter data manually is a major time saver for small businesses. This is especially true in the U.S., where biweekly payroll imposes constant, recurring admin on internal teams. Automation not only alleviates this pain point but also provides your customers with a single interface through which information is shared. This means less time spent tracking down and organizing important payroll information for the different departments that may need it.

4. Improving data security 🔒

Managing multiple point-to-point data interactions creates a need for increased IT oversight. By providing your customers with integrated payroll and accounting from one platform, you help them effectively manage their data through a single point of entry—allowing them to decrease the amount of oversight necessary and improve overall data security.

5. Aggregating financial insights 📊

Seamless in-platform integrations can also help SMBs make decisions that impact business operations. For example, automatically reconciling payroll data into their accounting platform creates a single source of truth, allowing companies to see pertinent information at a glance and make informed decisions quickly to keep pace with the demands of a dynamic market. Take the pandemic as an example. Integrating your payroll platform with your customers’ accounting systems gives them the tools they need to quickly react to shifting policies and regulations and know that these changes will be reflected in their accounting software, keeping their books accurate.

How integrating HR payroll and accounting helps payroll platforms

Integrating payroll and accounting not only benefits your SMB customers; it also benefits your business—helping you create a more robust payroll platform in the process. Here’s how:

1. Increase customer acquisition 🚀

41% of businesses will not use software that doesn’t integrate with their accounting system, making payroll and accounting integrations key to securing new business. By automating manual tasks and consolidating business-critical information, you make your platform more attractive to SMBs looking to reduce the time they spend processing payroll. It also helps you create flexibility in the payroll reconciliation process, as different SMBs might reconcile payroll using different data sets. Consolidating data from multiple sources increases the types of companies you can support.

2. Drive customer retention and boost revenue 💸

Acquiring new customers is only half the equation. Retaining them is the other. Along with streamlining day-to-day processes, integrating your platform with their accounting systems has the added benefit of creating stickier relationships with your SMB customers. That’s because the more information your customers surface through your platform, the more value you’re adding and the more positive interactions you create—boosting engagement and reducing the risk of churn.

These positive interactions include:

- Increased productivity and time-saving gains.

- Increased platform usage.

- Increased data visibility and insights.

By integrating payroll and accounting, you’re effectively placing your platform at the heart of the SMB operation—creating indispensable value and increasing retention.

But exactly how should you go about the integration process?

Why building integrations isn’t always better

When integrating HR payroll with accounting platforms, some providers choose to build their integrations in-house. However, there are many potential pitfalls that can eat away at your resources and negatively impact your main product offering, such as:

Fragmented markets

With so many accounting platforms available, building in-house requires a thorough knowledge of the market and your customers’ SMB tech stack. You’ll ultimately have to prioritize some integrations over others, which can lead to churn if some customers’ preferred platform isn’t immediately supported. And because not every SMB reconciles payroll the same way, there’s often a need for flexibility with regard to what data points your integration pulls in across sources and how these fields are mapped and standardized across the data model—a complex task for a first-time integration.

Maintaining integrations at scale

While your in-house team may be able to handle building a single integration to a single accounting platform, things get complicated once you start introducing additional integrations. Your dev team will have to manage API updates and deal with edge cases across multiple integrations to ensure a seamless user experience.

Part of ongoing maintenance, edge cases are bugs or errors that affect a small group of users. Accounting for and solving edge cases can take away resources that would otherwise be spent on upgrading your main product offering.

Data standardization

Different APIs represent data differently. When building an in-house integration, your internal dev team must account for these differences and create a unique data model— mapping each data attribute against the API to surface information in a standardized format. Something as basic as creating consistency across dates and currencies can turn into a complex, time-consuming process for each system your team wants to integrate. Adding functionality to address new use cases or customer pain points also presents a challenge, as your team will have to update the data model with each new feature.

API limitations

Not all APIs are created equal. Some APIs might not be publicly available or restrict what data partners can access. There can also be non-technological complexities like platforms that charge for access to their API or require non-disclosure agreements before giving access.

How Codat simplifies integration

Codat takes the complexity out of building integrations. You won’t have to worry about standardization or creating unique data models, as our developers have done the work for you. We also handle the ongoing maintenance of our integrations, meaning your team can dedicate more time to building out your platform rather than building out and maintaining an extensive library of integrations.

Codat also helps you accelerate time to market for multiple integrations. Rather than spending time and resources integrating with just a single accounting platform, building directly to Codat provides connectivity to all major platforms—a task that can take years to complete in-house. With connections to major accounting platforms like QuickBooks, Xero, Sage, Dynamics 365, and more, Codat makes it easy to provide seamless payroll and accounting automation—letting your customers post detailed HR and benefits information with the click of a button.

Find out how Codat’s integrations optimize the SMB HR experience, helping you attract and retain customers.