Banks can gain a competitive edge by increasing operational efficiency, leveraging customer data in new ways, and adopting more value-adding services.

Much has changed in the financial sector in recent years, especially when it comes to serving small to mid-sized businesses (SMBs).

Recently, competition for this valuable market has been fierce, with banks increasingly having to compete not only with each other, but with emerging fintechs and neobanks as well as tech superpowers for the highest-value customers.

Despite the recent collapse of Silicon Valley Bank and others, today’s recessionary landscape—particularly rising interest rates and dwindling venture capital funds— actually provides banks with a competitive advantage. Industry experts predict that this macro environment will provide the perfect conditions for banks to “reassert themselves as the rightful owners of banking.”

But, to ride the wave of opportunity, banks must match, if not surpass, the high standards of service, user experience, and value established by fintechs. That means adopting new strategies to drive both market growth and product expansion.

In this post, we lay out the top three areas banks can seize upon to meet the moment and reassert their dominance in the business banking market, including:

- Increasing operational efficiency

- Leveraging customer data in new ways

- Adopting more value-adding services

1. Increasing operational efficiency

With loan default rates on the rise and high-quality applications declining, reducing cost-to-income ratio is front of mind for financial institutions across the world. Achieving this typically involves closing branches, discontinuing low-margin product lines, and slashing office expenses.

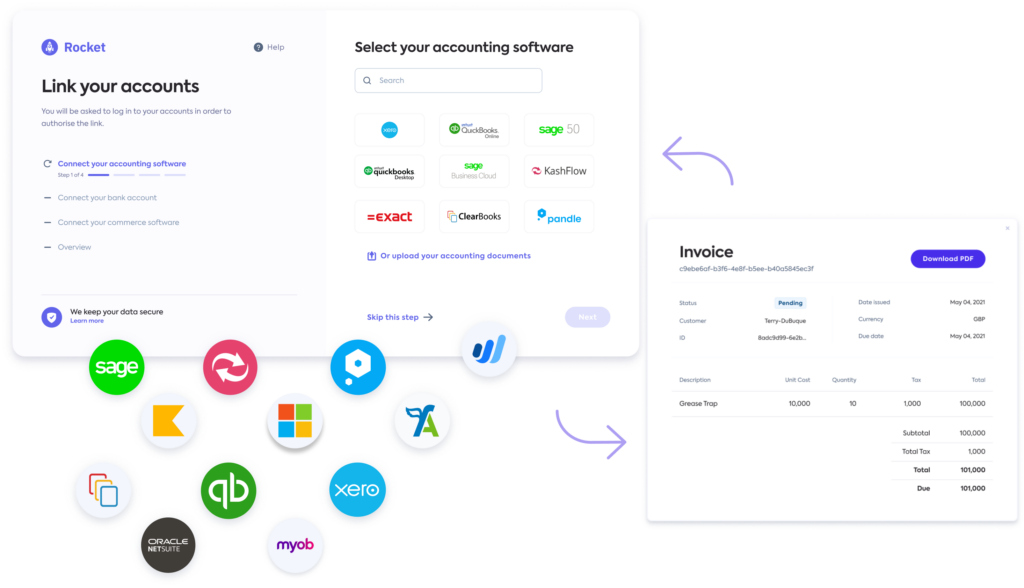

However, by embracing connectivity to integrate with customers’ accounting systems, financial institutions stand to increase profitability across multiple fronts dramatically:

- By driving efficiency during onboarding and underwriting, reducing the direct costs incurred while collecting, processing, and evaluating application data, and making a credit decision

- By ensuring ongoing data access during loan servicing, reducing the direct costs incurred while managing borrower relationships and maintaining existing accounts

APIs can integrate a bank’s platform directly with an SMB customer’s accounting system, automating the flow of financial data, eliminating needless human errors, and slashing credit decisioning paperwork and risk.

In concrete terms, that can reduce a bank’s underwriting time and costs by as much as 25% and their servicing time and costs by 10%, resulting in a 1.95x total increase in return on equity.

2. Leveraging customer data in new ways

Banks have access to more customer data than ever before. The problem? It’s often fragmented and isolated between distinct departments and divisions, making it incredibly difficult to use or extract any real value from it. This lack of a single source of truth limits a bank’s ability to build deeper and more profitable relationships with its customers.

To overcome this challenge, banks need to lean on API technology to integrate with their customers’ different systems, pull verified business data from multiple sources in real time, and ultimately bring all that data together in one place.

The real value in introducing this technology is the ability to “collect information once and use it repeatedly.” In addition to significantly reducing underwriting and servicing costs, relationship managers can use the data to gain a more holistic understanding of their customers and become trusted and ultimately indispensable financial advisors, minimizing the likelihood of churn.

Deeper insights allow banks to identify more cross-sell and upsell opportunities and even launch new products like cash flow forecasting tools, dynamic financial dashboards, and carbon footprint calculators. And with more context on each business, these products can be offered precisely when and where they are required.

Discover how Virgin Money uses API technology to offer automated financial wellness solutions for businesses. Watch the video below or read the full story here.

3. Adopting more value-adding services

According to research by BetterCloud, organizations use an average of 130 different apps apiece. But software overload is real, and 40% of surveyed professionals reported having recently consolidated their tech stack, purging redundant or extraneous apps from their platform and distributing their business between a narrower set of third-party providers.

Banks are in a prime position to take advantage of this trend by embedding themselves deeper into the SMB’s day-to-day operations and ultimately fostering stickier relationships. But, to secure the central spot in their customers’ consolidated tech stacks, banks will need to offer solutions to their biggest pain points.

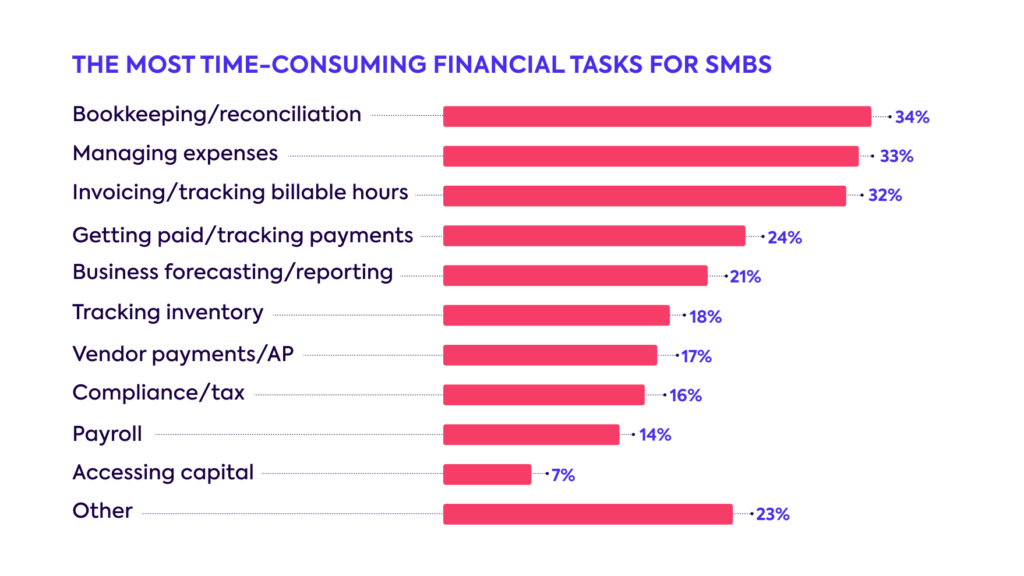

In our recent survey, SMBs listed bookkeeping/reconciliation, expense management, and invoicing as their most time-consuming tasks. As a result, banks that streamline these processes through products like bill pay automation will become an indispensable part of their customers’ tech stack.

The bottom line

The current economic conditions place banks in the perfect position to regain the SMB market ground they’ve lost to fintechs in recent years, and the ability to deliver on efficiency, experience, and connectivity will be a critical factor in their success.

By increasing operational efficiency, leveraging customer data in new ways, and adopting more value-adding services, they can make the most of the opportunities presented by the current economic environment.

Codat helps banks thrive

Codat empowers banks to build the financial solutions of tomorrow with turnkey accounting, banking, and commerce integrations and real-time small business data.

To learn more about our platform and solutions, get in touch with a member of our team—or sign up for a free account, to try them out for yourself.