Fintechs that move money for business customers can help remove barriers to adoption and increase customer retention by becoming a supported bank feed in customers’ accounting software.

However, as they are not registered banks, fintechs have traditionally not been afforded the access required to build this form of familiar, “bank-like” integration. With Codat’s new Bank Feeds API, innovative financial products can show up in accounting software in the way their customers expect.

One example is Arc, a fintech that partners with banks to provide a range of services to startups, including treasury management and revenue-based financing. As CTO Raven Jiang explains,

“We offer customers deposit accounts that serve as the core of how they run their business and manage their finances. It is critical for our customers to be able to sync that data to their accounting systems and manage their books.

Working with Codat has helped us with growth by supporting a list of accounting systems that we would otherwise not be able to work with, and it has also helped us get to market faster with an integrated and automated solution.”

What are bank feeds?

“Bank feeds are the greatest thing that’s ever happened.”

That was the verdict of one accountant we spoke to at a recent industry event sponsored by Intuit, Sage, Xero, and other accounting software vendors. It is a sentiment reflected across the industry. After all, 61% of small business users report they would stop using or switch their accounting software if the feature was taken away.

Bank feeds are a simple proposition with clear value. Automate uploading a bank statement into accounting software. Save time on a mundane data upload task that is a necessary prerequisite for getting started with the real work of accounting.

Why are bank feeds important?

All the leading cloud accounting products give users the ability to upload bank statements automatically from the majority of the major banks. In many cases, this feature relies on some form of Open Banking technology. Accounting software vendors partner with Open Banking providers who can help link accounting software to major bank APIs.

There are 33 million small businesses in the United States. According to our data, around 60% use some form of cloud accounting software. Of these, roughly half are automatically syncing their bank statements to this software (source: Codat survey of 348 small businesses, 2023).

That means there are 10 million small businesses in the United States saving around eight hours every month thanks to bank feeds. That is just short of one billion hours every year freed up for higher-value work, with another two billion on the table.

How should fintechs think about bank feeds?

Bank feeds are a small business productivity success story. However, there is a problem. Small businesses today use non-bank providers for a range of bank-like activities.

Fintech has spent the last couple of decades unbundling the bank. Where small businesses traditionally received card acceptance services from a bank, many now use software-first alternatives like Square and Stripe. Where small businesses traditionally sought working capital loans and credit from banks, many now access capital from digital non-bank lenders like Pipe and Wayflyer and use credit cards issued by fintechs like Jeeves and Capital on Tap.

18% have access to business loans from online lenders, while only 15% have access to working capital loans from a bank

PYMNTS study of 509 US small businesses with “brick and mortar” locations

Fintechs like Melio and Glean are changing how small businesses pay suppliers, while Gusto has transformed how they pay employees. Even the core of small business relationship banking, advisory services, is being transformed by a wide range of business analytics and cashflow forecasting software.

| Accounting integrations | |

| Without bank feeds | With bank feeds |

| Users can only connect from within the fintech’s app, the fintech’s brand name is not available alongside the list of banks in the user’s accounting software | Users can connect from within their accounting software, searching for the fintech’s brand name in a drop down list in the same way they would for their primary bank |

| Can create metadata-rich entries in the general ledger but must reconcile against a statement uploaded manually | Reconciliation is truly a checkbox exercise that takes minutes, integration can automate uploading a statement of transactions and the creation of general ledger entries |

| Monthly or quarterly schedule for closing the books means there is limited visibility in accounting software of the current balances across credit cards, payments, and other accounts | Can see balances in accounting software throughout the month – reducing the need to switch between tools |

Whenever these products move money, they create a reporting burden for the customer. Finance teams have become used to easing this reporting burden with a bank feed, an automated upload of the statement of transactions to their accounting software.

While almost all of this money movement ultimately runs on the banking system (via partner banks and banking-as-a-service layers), the user experience is entirely abstracted from it. This means that the systems currently in place for linking small business banking activities to accounting software are missing the familiar bank feed feature.

Which fintechs need to provide bank feeds support for their customers?

Lots of fintechs have great integrations for a range of accounting software, but they lack access to the resources, APIs, and partnerships required to provide the familiar “bank-like” experience to which small businesses are accustomed.

| Key reasons for requiring bank feed support | |

| Primary deposit account (e.g., business checking account) | Table stakes feature that speeds up bank reconciliation when closing the books. The “real work” of accounting cannot begin without this information in place. |

| Credit cards | Lets users see the card balance in accounting software throughout the month, speeds up expense management bookkeeping workflows, and closing the books. |

| Payments service | Makes it easy to reconcile payouts to the primary bank account with the sales and fee transactions from the relevant period. |

| Foreign exchange services | Provides a single point of reporting visibility of balances across accounts in different currencies. |

The user demand is clear. While bank feeds are commonly available for bank accounts, they are increasingly prevalent for credit cards and payment services. In our survey, we found that of businesses with between 10 and 250 employees who use accounting software, 68% have an integration between their business bank account and their accounting system, 55% have the same in place for their credit card, and 61% for payment services.

What is Codat’s Bank Feeds API?

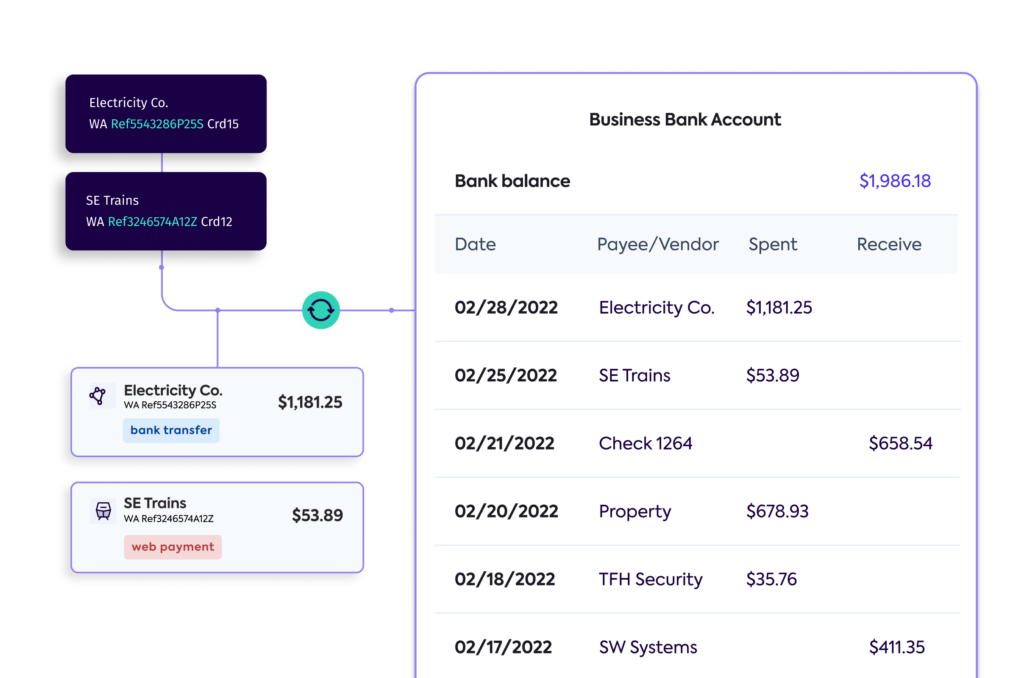

Bank Feeds API lets fintechs provide this “table stakes” form of accounting software integration.

Previously when building accounting integrations, fintechs have only had access to APIs that enable them to integrate with the general ledger rather than show up as a bank feed option in the same way as a checking or credit card account provided by a major bank.

With Bank Feeds API, this has changed. Fintechs can deliver a familiar “bank-like” experience and automate the upload of statements of transactions that the general ledger gets reconciled against. Customers receive a more complete accounting automation experience, save time closing the books, and further reduce manual error.

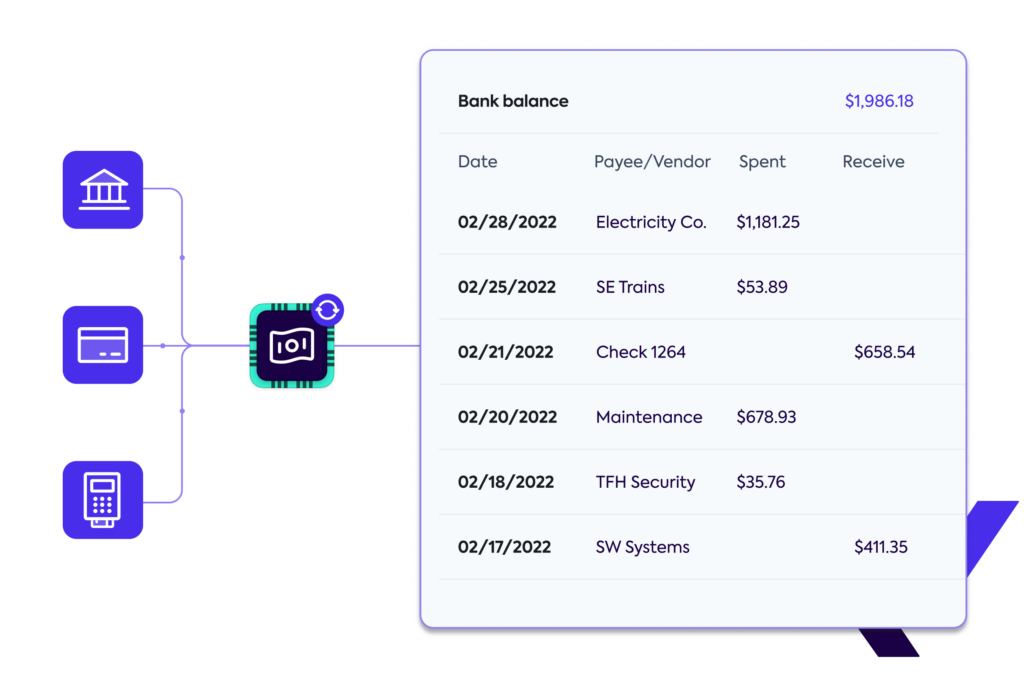

Development is easier too. Bank Feeds API abstracts away many of the differences between accounting software platforms, so that fintechs have a single point of integration to become a supported option in the bank feeds feature of QuickBooks Online, Xero, Sage Intacct, Sage Business Cloud, and more.

Codat also supports clients through the partnership process, ensuring that accounting software platforms are happy that our clients are implementing these integrations in line with requirements and best practices.

As a mission-critical part of small business financial workflows, bank feeds require a high degree of reliability. Fintechs of whatever size can now provide this level of service even when syncing large volumes of transactional data. The core Codat infrastructure on which Bank Feeds API is built is used every day to connect tens of thousands of small businesses to hundreds of fintechs, as well as some of the world’s largest banks and payments companies.

Fintechs know that integrating deeper into their customers’ financial stack is crucial to long-term customer value. They also know that adoption and usage rely on providing all the best parts of familiar commercial banking with a 10x better user experience. As it is a critical part of financial reporting, being a supported provider in the bank feed of accounting software creates confidence, convenience, and customer stickiness.

You can learn more about the benefits of using Codat’s Bank Feeds API here. You can also register for a free account to begin exploring our platform for yourself—or reach out to one of our data experts to get your questions answered.