Our research reveals 3 major barriers to financial access that can be tackled through integrations.

Small and medium-sized businesses (SMBs) in the US rely on credit to drive all aspects of their operations, from general cash flow to payroll to acquisitions. 65% of them intend to apply for credit in 2023, according to Codat’s recent survey of 490 business decision-makers. Credit is such a lifeline for SMBs that neither past loan rejections nor an unfavorable economic climate will deter them from applying.

Yet, our research demonstrates that many SMBs are unable to access the basic capital they need.

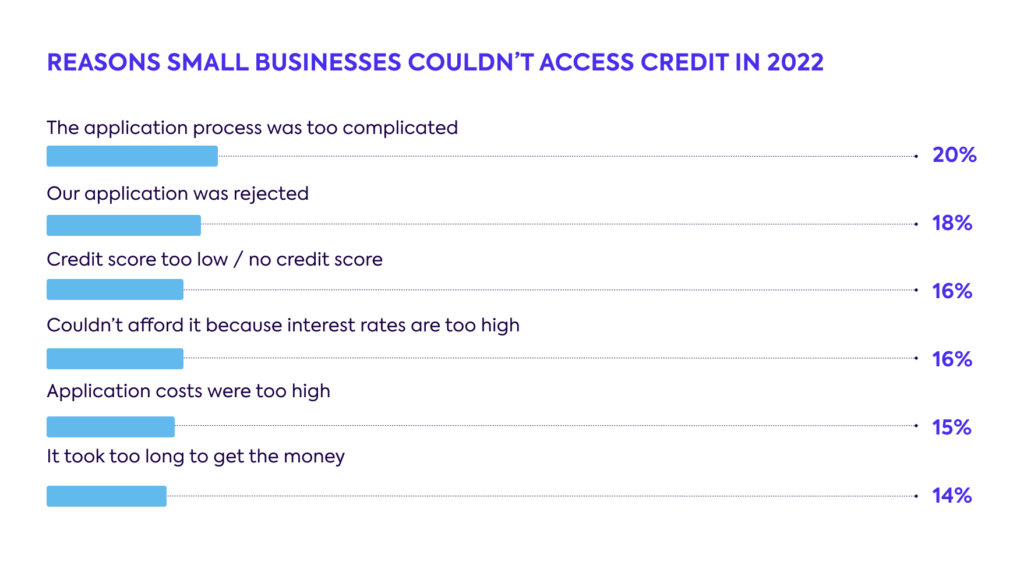

21% of those we spoke to wanted credit in 2022 but couldn’t get it. Excluding those with a low credit score, 13.7% of surveyed businesses—the equivalent of nearly 4.5 million companies when scaled to the total US market—fell short due to limitations in the lending system, including overly complex applications, high costs, and outdated decisioning processes.

You can download the full report here.

Based on these findings, how can today’s banks address the substantial SMB credit gap?

1. Simplifying the application process

Among the 21% of surveyed SMBs who were unable to secure funding in 2022, 20% said specifically that the application process was too complicated.

One surefire way to address this complexity is to reduce the number of steps needed by the small business to complete the application by enabling them to share data directly from the financial system they use.

Let’s consider the number of steps involved for a small business where the lender does not offer this option.

The lender has requested the last 3 months of bank statements and profit and loss statements for last year and the year to date. The business owner has several bank accounts, and so first must track down the online banking login details for two separate portals, find the option to download a PDF statement, and then repeat that 6 times. They attach the 6 files to an email or to an online portal and start thinking about how to get the profit and loss statement. Usually, the business owner only logs into QuickBooks to upload her receipts, so this requires a phone call to the Accountant to check she’s got all the right information…you get the picture.

It’s no wonder that 76% of businesses end up abandoning a financial product or service they signed up for during the onboarding stage.

2. Accelerating time to capital

The blocker for 14% of SMBs who couldn’t access credit, still potentially up to 950,000 American businesses, was the length of time it takes to get the money. It’s not uncommon for it to take 90 to 120 days to onboard a new SMB customer, largely due to inefficient, manual processing on the side of the bank. Given 34% of would-be borrowers we spoke to said they needed the money to plug day-to-day cash flow shortfalls, it’s no wonder this delay led them to seek out solutions elsewhere.

Digital data collection doesn’t just shortcut the number of steps for the applicant. By putting in place integrations to SMB financial software, providers can drop a number of low-value, manual steps on their own side.

For example, when a financial statement is received in PDF form, a Relationship Manager usually has to plug each of the key numbers into another piece of software or an Excel spreadsheet to calculate the ratios needed to make a decision. Assuming there is no difficulty in interpreting the business’s accounting records and which costs and revenue should fall into which category, that may take 10 minutes for one financial statement.

With an average of 4 statements needed per application across 100 applications in a month, that’s 400 hours each month spent keying in data.

With integrations into accounting systems on the other hand, data can be piped directly into loan management systems in the format needed. For example, Codat is directly integrated with providers like nCino, and uses machine learning to automatically assign an account category, completely bypassing the need for manual data entry.

Beyond the time it takes to actually key in the information, these process changes lead to fewer errors, fewer hours manually checking compliance data and requesting/reviewing additional documents for businesses that don’t pass a given confidence threshold.

3. Approving more loans without compromising on risk

The average loan approval rate at large US banks is currently hovering around a low 13.8%. For smaller banks (those with less than $10 million in assets under management) and alternative lenders, it creeps up to just 19.1% and 24.7%, respectively.

Not all businesses are creditworthy. But many of the most common reasons given for loans to be rejected, like a ‘thin credit file’ or ‘the business not being in operation for long enough,’ indicate a lack of data rather than an inability or unwillingness to repay.

Through integrations, banks can collect more data on customers that they wouldn’t otherwise be able to access. But more interestingly, digitization offers new means to verify the accuracy of data provided. For example, with Codat, accounting records can be cross-referenced against bank transactions, empowering providers to extend more SMB loans without putting themselves at risk.

Even after a business is onboarded, integrations can enable live, automated alerts that flag customers at risk of defaulting, violating their terms, or falling into any other suspicious activity, so banks can track and prevent any potential loss.

A promising path forward

Our survey found that most (73%) SMBs are willing to share data from their financial systems directly with banks, knowing that this will simplify the onboarding process and potentially lower both their interest rate and their time to funding.

For banks, that means using integrations is one of the easiest and most reliable ways to streamline operations, improve cost-to-income ratios, make smarter credit decisions, and expand their market—advantages that could unlock up to $13.7 billion in additional revenue.

The way to do this in a way that enhances operational efficiency, instead of introducing extra work, is to leverage turnkey integrations through a business data API provider like Codat.

For example, Codat offers standardized accounting, banking, and commerce integrations at scale without requiring banks to build or maintain any of the components in-house.

Take our partners at Ampla, a next-generation financing platform. Ampla uses Codat to stream data from their SMB customers’ accounting and commerce systems and automate their credit risk management program. As a result, they’ve cut their cash deployment timelines to under 48 hours while reducing overall loss rates.

Meanwhile, digital lender Playter reduced their underwriting times from 10 hours to 10 minutes with Codat’s high-quality data, allowing them to get their SMB customers funded in under a day.

Want to learn how you can serve more SMBs faster?

Check out our complete report on America’s small business credit opportunity.

If you want to learn more about our simple, powerful integrations, get in touch with a member of the Codat team—or sign up for a free account to try our platform out for yourself.