Dive into the role of iPaaS platforms in the fintech and financial industry and why a specialized API might be a better option.

Integration Platform as a Service, aka iPaaS software, is on the rise. The global market for iPaaS recently grew 30.5%, from $3.29 billion in 2022 to $4.29 billion in 2023.

As Open Banking transforms financial services, providers are increasingly looking to APIs and iPaaS solutions to gain a competitive advantage and ensure their continued relevance in the market. That’s because iPaaS streamlines how financial institutions access and use data across various systems by providing quicker integrations with minimal lift—a significant value proposition in an industry where data is often siloed.

Unarguably, iPaaS offers many benefits, from better customer experiences to greater operational efficiency. However, the value of iPaaS hinges on its ability to facilitate access to useful APIs. In this article, we dive into iPaaS software—what it is, its benefits, and its role in financial services—and when a specialized business data API might be a better option to streamline your operations.

What is iPaaS software?

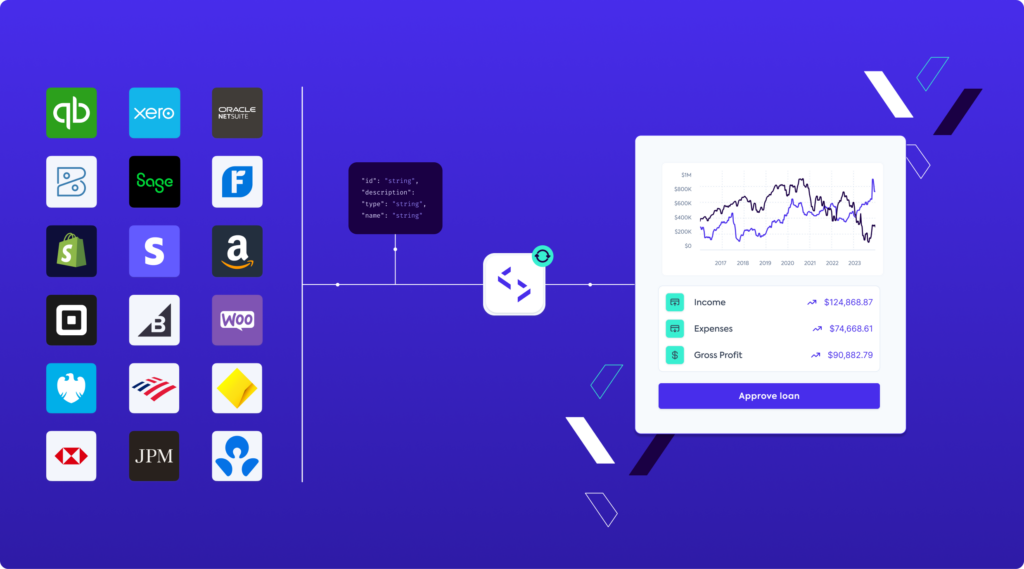

iPaaS software and workflow automation tools simplify the use of APIs for non-technical teams. These products take the public APIs of various business systems and represent them in a no-code or low-code user interface, enabling any user to easily create a simple integration by stitching together the required components. Prominent iPaaS vendors include Zapier, Workato, Prismatic, HotGlue, and others that offer a wide range of integrations with business systems.

Generally, iPaaS platforms allow companies to decrease technology-related expenses, enhance the accuracy of their data, and minimize the resources they need to dedicate to technology maintenance.

What’s the role of iPaaS software or platforms in financial services?

In financial services, iPaaS tools can connect financial institutions with the latest innovations and applications within the industry. For example, a financial institution may use an iPaaS tool to integrate fintech applications into their core systems in an effort to keep up with customers’ evolving expectations without needing to build the functionality from scratch. Ultimately, iPaaS platforms remove the labor-intensive and costly process of connecting disparate systems—an issue that’s all too common among legacy systems in the finance sector.

But here’s the catch: iPaaS platforms typically excel in straightforward connection scenarios, because they’re great at automating basic tasks and creating simple workflows. However, they may not be right for sophisticated financial environments and workflows, which require detailed, custom integrations. For instance, iPaaS solutions may fall short when syncing complex accounting data across multiple platforms, where some level of data specialization and uniformity is needed.

So, while iPaaS offers a broad range of integrations, their no-code workflow orchestration often lacks the depth for advanced processes in financial services. Rising to these requirements involves a deep understanding of the financial domain, high-quality integrations, and standardized data models. This allows seamless data access from disparate systems with minimal manual input—reducing risk and facilitating informed decisions. Specialized business APIs like Codat’s Sync for Expenses, Lending API, or Bank Feeds API best meet such conditions.

So, depending on the situation, a specialized API with deep domain expertise could be exactly what your organization needs instead of iPaaS.

How does Codat compare to embedded iPaaS solutions?

As noted previously, embedded iPaaS, while useful, can’t easily handle the specialized demands of the financial sector. In these situations, deeper, domain-specific functionality gets the job done better.

Specialized APIs like Codat’s meet that need. They are indispensable in financial services because they offer rich data models fundamental to business processes.

While iPaaS solutions may offer breadth in terms of their integration capabilities, specialized APIs like Codat stand out with their strong focus on the depth of data required for advanced financial operations.

Essentially, where iPaas platforms simply makes data easier to access, Codat makes data more useful—a feat unmatched by other providers because of Codat’s unique machine-learning models trained on extensive data sources.

How Codat stands out

Lenders need to sort customers’ business financials into standard categories to calculate the key metrics that determine a loan decision—a task that goes beyond the scope of typical iPaaS software.

Lenders relying on iPaas solutions often have to resort to manual data entry, which can take upwards of 10 minutes per financial statement and increase the risk of errors. Such mistakes are time-consuming and, left unchecked, can lead to further delays and greater risk exposure.

On the flip side, the “Financial Statements” feature in Codat’s Lending API leverages machine learning to auto-categorize these statements into a standard chart of accounts, saving time and reducing mistakes.

That’s not all. Codat’s Sync for Expenses simplifies expense integrations by standardizing transaction recording across accounting platforms, implementing platform-specific rules that push expenses in the right format and category for each accounting platform—without requiring those using Codat to be accounting or IT experts. It automates transaction batching and syncing, ensuring compliance with platform rate limits and chronological ordering. To achieve the same with an iPaas provider would necessitate a custom solution.

Codat versus embedded iPaaS: a comparison

But don’t just take our word for it. In the table below, we dig into exactly how Codat offers greater value than embedded iPaaS solutions.

| Feature | Codat | Embedded iPaas |

| Integration coverage | Does not focus on the highest number of integrations or the most categories of data. Instead, it builds deep domain expertise in specific use cases and embeds this knowledge into its APIs, ensuring that products launched with Codat are feature-rich, and provide substantial value to business users. | Offers an extremely wide breadth of integrations. Embedded iPaaS may provide hundreds of connections, but they fall short in specialization and standardization. They typically add a user interface layer on top of freely available public APIs, which results in superficial data connectivity. |

| Use case-specific solutions | Focuses on in-depth industry expertise for specific use cases to develop its APIs. | Adopts a one-size-fits-all strategy, shifting much of the complexity to the customer. Lacking cross-domain expertise, such as in-depth accounting knowledge, these integrations may not meet specific use case requirements. |

| Developer experience and API management features | Manages rate limits, pushes updates asynchronously for reliability, handles auth token refreshes, and provides detailed, contextual error messaging. | Does not manage underlying rate limits consistently. Push updates and token refresh policies vary depending on the behavior of underlying APIs. Error messaging tends to be limited. |

| Standardization | Goes beyond basic normalization provided by iPaaS, offering a deeper layer of standardization and functioning as a one-to-many solution. | Do not standardize, focusing more on the quantity of data connections rather than addressing complex needs that require in-depth functionality. Workflow definition is required for each platform individually. |

| Integration quality | Includes all necessary endpoints for comprehensive integrations with popular SMB accounting platforms like Xero, QBO, QBD, NetSuite, and Intacct, among others, along with eCommerce and PoS systems such as Amazon, Shopify, and WooCommerce, to name a few. | Provides numerous platform options but lacks the necessary endpoints and standardization for creating effective products. |

Codat offers data integration built for financial needs

At Codat, we’re not just about giving you access to financial data to make decisions; we’re focused on why you need to access that data in the first place. We’ll help you draw actionable insights to do great work. Codat’s APIs are made to meet the financial services industry’s nuanced integration needs while reducing data silos.

Want to dig into our APIs or learn more about how Codat tackles connectivity? Don’t hesitate to reach out to our team. You can also sign up for a free account to see Codat in action.

FAQs

What is the best iPaaS vendor?

Gartner has identified numerous iPaaS providers. However, the best integration solution for your organization depends on your industry and unique business needs. Ideally, you’d want a solution that works with all your systems to support a seamless flow of information.

How does iPaaS work?

iPaaS is a cloud-based solution that connects fragmented software systems, allowing business customers to embrace data integration and workflow automation without specialized coding knowledge. In other words, iPaaS software acts as a bridge for easy exchange of information between diverse business systems.

What are the benefits of iPaaS platforms?

In general, iPaaS platforms streamline system integrations, remove the need to code, and facilitate data orchestration–boosting efficiency and scalability compared to building integrations in-house.

What is iPaaS and SaaS?

iPaaS is an acronym for integration platform as a service, whereas SaaS stands for software as a service.