In the wake of recent disruptions, new account applications are pouring in for banks—but are their onboarding experiences ready to capture this new business?

It’s certainly been a tumultuous few weeks in the world of business banking. The unfortunate collapse of Silicon Valley Bank (SVB) has sent shock waves throughout the industry, and the fallout is expected to result in significant, long-term changes to the banking landscape as we know it.

One immediate shift that is taking place at an unprecedented rate involves SMBs diversifying their accounts across multiple financial institutions to minimize their counterparty risk, leading to big banks experiencing a sudden influx of new applications. In fact, Federal Reserve data revealed that deposits at the top 25 banks in America increased by $120 billion in the week following SVB’s collapse.

This emerging trend presents a clear growth opportunity for large banks. But, for many, one obstacle stands in the way: the onboarding experience.

In this post, we explore how inefficient onboarding experiences hold banks back—and how direct integrations and real-time, automated data access can help them streamline their application processes, accelerate their time to revenue, and seize on a new wave of business opportunities.

The problem: Onboarding at banks is typically slow, repetitive, and needlessly complex

It’s not uncommon for it to take 90 to 120 days to onboard a new business customer. These long timelines are the result not only of unavoidable and extensive compliance requirements like KYB and AML checks, but of, inefficient manual data collection processes and redundant paperwork that can lead to endless back-and-forths with a new applicant and drawn-out delays. This article focuses on actionable ways you can improve the latter.

For business owners, submitting and resubmitting the same documents to open a new bank account—and then waiting months for a status update—is a source of ongoing frustration. In fact, 75% find the bank onboarding process so tedious that they abandon their application altogether.

Inefficient onboarding processes don’t just impact customers—banks suffer, too.

Bank teams waste countless hours and resources manually collecting and entering customer data, which can lead to avoidable human errors and omissions that put their business at risk.

What’s more, static data sets—which are often siloed across different departments—provides limited visibility and insight into their customers’ financials, impeding your ability to make fully informed decisions or to offer more proactive, personalized service.

At this point, you’re probably thinking, ‘Why don’t banks just use the SVB API to onboard previous SVB clients and obtain the data needed to carry out a liquidity test?‘ Unfortunately, following Silicon Valley Bank’s collapse, the API’s reliability was repeatedly called into question, with many financial institutions reporting difficulties in obtaining the information required to process new applications accurately. In this instance, data direct from an SMBs accounting platform can provide a powerful alternative. Read on to discover how it can be used to streamline onboarding experiences.

The solution: Optimizing onboarding with real-time business data

The simplest way to improve your onboarding experience is to boost your connectivity and integrate with the accounting platforms and other business software customers already use so that you can stream verified financial data straight from the source. That not only automates data collection and eliminates excess paperwork, but it also ensures ongoing access to granular financial insights.

Simplifying the onboarding process through superior data connectivity introduces several key benefits for banks and their customers alike, including:

Greater efficiency

- With a fully automated data flow, you can spend less time manually reviewing applications and re-entering data and more time on high-impact business tasks.

Accelerated time-to-revenue

- The faster the onboarding process, the faster you can begin extending financial services and generating revenue.

Valuable insights

- With a deeper understanding of your customers’ financial needs, you can also spot ways to upsell or cross-sell their services sooner, effortlessly unlocking new revenue streams.

Lower origination costs

- Quicker processing times mean lower operational costs, which are often passed on to customers in the form of fees. This helps you keep your product and service pricing low and to attract (and retain) a wider swath of businesses.

Fewer application errors

- With direct integrations, customer data is tapped from the primary source, so there’s no opportunity for human error, oversight, or fraud to derail an application or contribute to processing delays.

- Integrations also limit errors on the bank end as data is transferred between different departments or entered into decisioning matrices, reducing overall risk.

Higher conversion rates

- With integrations, a customer no longer has to supply hundreds of data points or track down dozens of financial documents to open an account, lowering barriers to entry and making them much more likely to convert.

- Once captured, their data can also be used to pre-populate application forms and auto-upload required documents for every new account or add-on service they want to adopt, potentially increasing their lifetime value.

More opportunities to scale

- Global banking revenues are projected to rise by 9% a year through 2025, and business customers are expected to lead the way. Banks that can onboard more businesses now will have a head start on these growth opportunities in the coming years.

Taking the next step: How do integrations work?

Most incumbent banks don’t have the technical infrastructure or internal resources to build and maintain effective integrations in-house. But today, there are simple, turnkey solutions on the market specializing in just this type of connectivity.

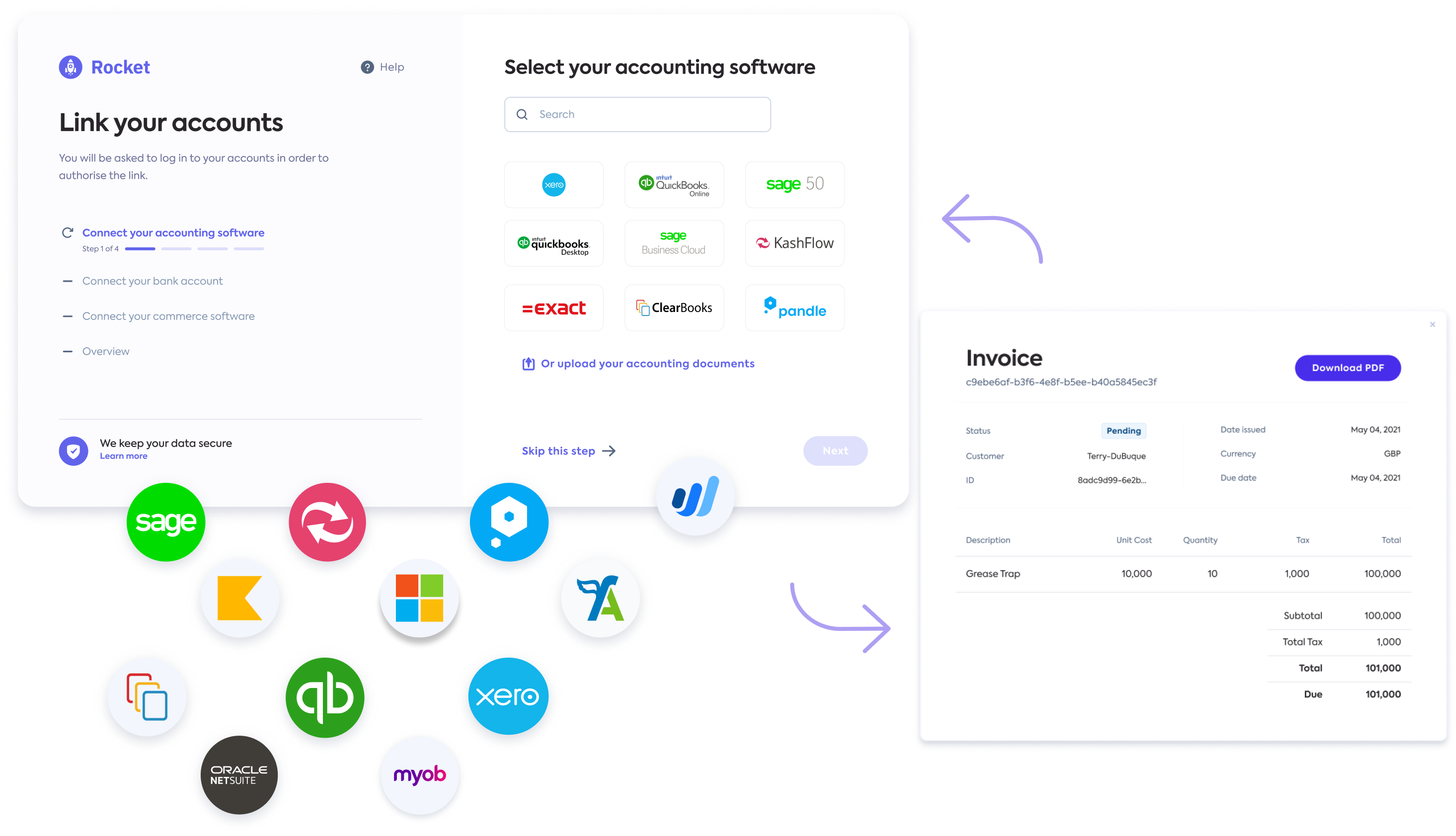

Platforms like Codat use secure API connections to enable applicants to connect their accounting software, third-party bank account(s), and/or commerce system to a bank’s digital platform.

That means, by building Codat, you get instant access to a range of integrations and in-depth financial details, so you can grow your market at scale. Codat also standardizes data outputs, so even complex, hyper-specialized fields are simplified and delivered in an easily accessible, actionable format.

With this valuable data to hand, applications can be pre-populated using company information like legal name, operating address, contact details, and tax number to speed up the onboarding process.

In addition, critical performance metrics and data points can be used to evaluate the financial health of a potential customer. For instance, with access to a small business’s other systems, you can gain visibility into all business accounts, outstanding payments and invoices, FX exposure, existing credit lines, and so much more. Below we provide some examples of the specific data points that can be used.

Interested in learning more? Get a detailed breakdown of the data points and calculations needed to transform your onboarding experience here.

Profitability 🧾

- Gross profit margin: How much money a business makes after variable sales-related costs are accounted for

- Operating profit margin: How much money a business makes after variable costs plus fixed costs like shop leases and insurance premiums are accounted for

- Net profit margin: How much money a business makes after all costs, including taxes and interest payments, are accounted for

Liquidity 💧

- Trade receivable & payable days: The average number of days it takes for a business to be paid by its debtors/to pay its creditors

- Current asset ratio: The value of a business’s current (available) assets weighed against its current liabilities

- Liquid ratio (acid test or quick ratio): The value of a business’s current (available) assets minus inventory, weighed against current liabilities. This metric is needed as inventory can be difficult to sell and is not necessarily useful for repaying debts

Solvency 💰

- Cash balances: The total amount of cash held by a business across bank accounts

- Cash runway: The remaining months of liquidity a business has without the need to raise additional funds

- Existing debt: The total reported debt a business has at a given point in time, or the sum of all relevant liabilities

- Gearing ratio: How leveraged a business is—in other words, how their short- and long-term borrowing (including hire purchases, lease commitments, etc.) compares to their equity (retained profits and share capital)

- Debt/EBITDA: The amount of income a business has available to pay down debt before covering interest, taxes, depreciation, and amortization expenses

Trends 📈

- Revenue trends: How a business’s income in a given period compares to its income in previous periods

- Cash flow trends: How a business’s cash flow in a given period compares to previous periods

- Margin trends: How a business’s profit margins in a given period compare to previous periods

By streaming these (and other) financial details in real-time via direct integrations, you can not only expedite the application and onboarding process, you can make quick, confident decisions that benefit your business and your customers—so you can attract and retain even the highest-value customers looking for a promising new partner.

How Codat can help

Codat makes it easy for banks to boost their connectivity, upgrade their onboarding experience, and drive greater efficiency and growth.

To learn more about our offerings, check out our Accounting, Banking, and Commerce data solutions—or get in touch with our team to discuss what our industry-leading integrations can do for you.