Because banking data alone just doesn’t get the job done.

Providing SMB credit services like corporate cards and business loans typically means carrying out a liquidity check to assess the amount of cash a borrower has on hand in their bank account.

Affordability assessments used to involve a series of time-consuming manual tasks—but thankfully, we’ve come a long way since the days of chasing down paper statements and manually typing transaction details into spreadsheets. Now, Open Banking technology means you can integrate with a borrower’s financial institution and stream data directly from their bank accounts into your platform, enhancing both the efficiency of your origination process and the borrower experience.

That’s great, right? There’s just one issue. SMBs today typically rely on several bank and non-bank accounts to manage and protect their money. This means that banking data alone only provides a limited view of an SMB’s financial health. If you want the full picture, you’ll need to consider other sources—like accounting data.

Trends increasing fragmentation of SMB banking (and its data)

Based on data SMBs have shared within Codat’s platform, we’ve discovered five trends that could significantly impact the reliability of banking data when it comes to gauging liquidity. Learn more about these trends below.

1. The average SMB has four distinct bank accounts 🏦

Modern SMBs have several bank accounts. In addition to a primary checking account, they may hold a high-interest savings account and a credit card account, as well as secondary payment and income checking accounts, so they can easily track their expenses and revenue. Indeed, finance experts recommend that businesses maintain a handful of accounts not only to segment their essential operations but for security and business continuity reasons, so they have auxiliary funds in place if their primary account is breached or inaccessible. The aftermath of the recent Silicon Valley Bank (SVB) collapse highlighted just how important this is.

That means if an SMB connects you to their primary bank account during the origination process, you may not be getting a complete, accurate view of all their financial activity.

They may have additional loans, credit cards, or other liabilities they’re repaying out of a secondary account, or additional funds they forgot to report on their application—leading you to approve unsuitable businesses (and put your bottom line at risk) or reject promising ones (and miss out on opportunities to drive revenue).

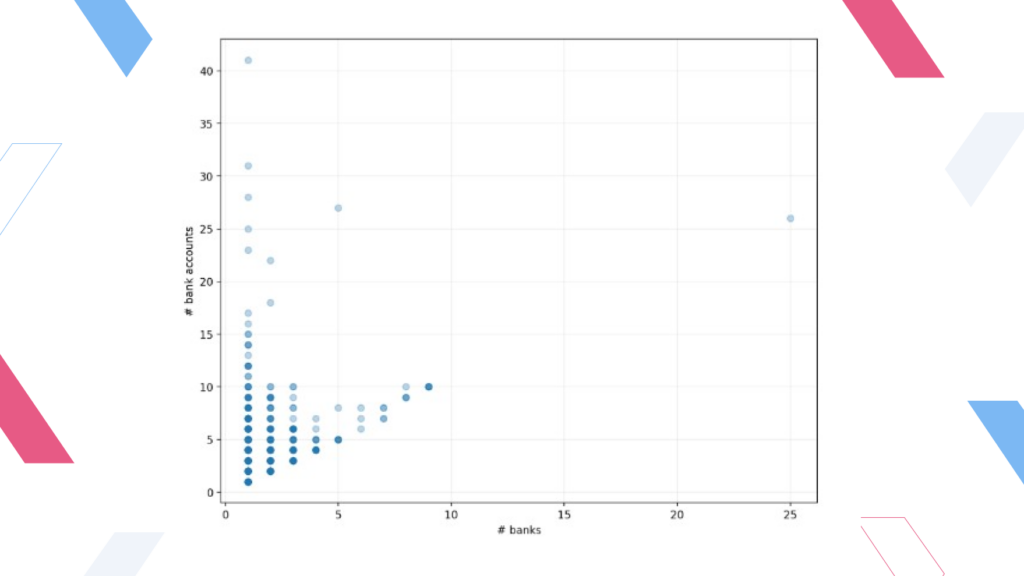

What’s more, while some SMBs may keep all of their accounts at the same bank, our research shows that’s not always the case. In fact, some of the businesses we considered have 10 accounts spread across nine different banks. In such scenarios, relying solely on banking data to assess affordability means asking businesses to log in and connect to at least nine different platforms during origination. That’s a recipe for a frustrating, friction-filled borrower experience (in the best-case scenario) and high churn rates (in the worst).

2. The number of bank accounts per SMB is increasing over time 📈

SMBs are now opening more bank accounts more quickly. Compared to just one year ago, the median number of bank accounts per business has jumped from three to four.

| Date | Median # of bank accounts |

| Today (May 2023) | 4 |

| One year ago (May 2022) | 3 |

This trend will likely accelerate following the recent Silicon Valley Bank (SVB) collapse, as SMBs move to minimize counterparty risk by diversifying their accounts across different financial institutions and alternative saving vehicles.

Unfortunately, that means that problems with fragmented banking data—along with the onboarding challenges that ensue—will only get worse before they get any better. For instance, although an SMB may have shared its bank accounts through Open Banking, it may still have other liquidity accounts, like a money market fund, that aren’t included in the shared information.

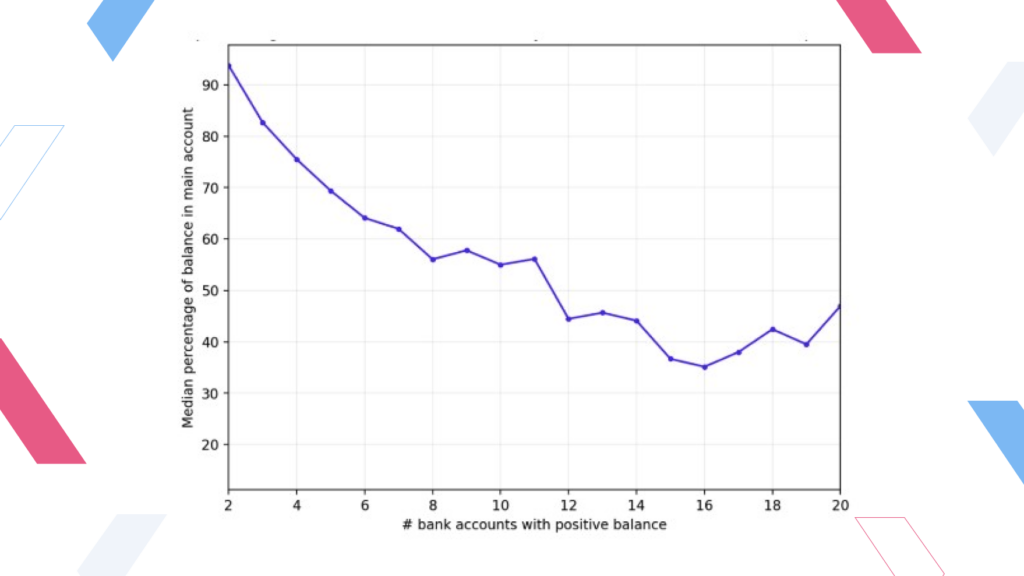

3. On average, SMBs with multiple bank accounts keep just 78% of their balance in their primary account 💰

Almost a quarter (22%) of a business’s liquid assets are typically spread across several secondary accounts. That means, if you’re relying on a single set of banking data to assess creditworthiness, your underwriting algorithm is regularly overlooking a sizable share of their cash balance.

By consistently underestimating the liquidity of your customers, you’re ultimately leaving good money on the table. You’re losing out on potential profits by turning away good customers and driving them toward your competitors, who have a more advanced risk assessment approach.

As a result, you’re likely rejecting promising applications based on insufficient funds that actually exist while also missing out on opportunities to extend higher credit limits and boost your returns.

This is another problem that’s poised to escalate over time. The more bank accounts a business has, the smaller the percentage of funds they keep in their primary account. That means, as SMBs continue to diversify their holdings, their primary account will provide an increasingly less accurate valuation of their finances—and you’ll get increasingly less accurate insights from analyzing it.

4. Even smaller businesses have multiple bank accounts 🏪

You may be tempted to assume that only bigger businesses have multiple bank accounts—that is, that SMBs tend to open additional accounts only as their revenue grows and their operations become more complex. If that were the case, you’d really only need to worry about the breadth of banking data for applicants above a certain size.

But there’s no clear correlation between a company’s size and the number of bank accounts. On the contrary, smaller businesses diversify their accounts at nearly the same rate as larger enterprises.

That means, if you’re only relying on banking data to make SMB credit decisions, you need to put in extra effort across all applicants to ensure you’re taking every bank account and liquid asset into consideration, or you risk having key data points fall through the cracks.

5. Account diversification is especially prevalent in the US 🌎

While there’s no significant correlation between a business’s size and the number of bank accounts it holds, there are notable differences when it comes to geographical location. Specifically, SMBs in the US tend to hold more bank accounts than those in the UK.

This suggests that you need to be vigilant when expanding your credit services to new regional markets—particularly in the US—as different banking habits in your new area of operation may affect your ability to adequately assess applicants’ liquidity.

It’s also worth noting that for international businesses with bank accounts in multiple geographies, it’s unlikely you’ll be able to connect to each bank account via a single Open Banking provider. However, integrating with the business’s accounting platform of choice will provide access to all of this information via a single connection.

How accounting data paints a fuller picture

Unlike Open Banking data alone, accounting data lets you verify how many bank accounts an SMB has, as well as the total revenue held in each one. That means you can connect to a business’s accounting software once and get a quick, comprehensive view of their total financial and transactional activity—without requiring them to log into each and every account via an Open Banking platform.

This is especially helpful for SMBs that may fail to pass an initial financial check and need a more thorough evaluation. If they have already linked their accounting software, no additional information will need to be requested, which saves substantial time and resources when processing their application.

Moreover, accounting platforms provide more extensive data sets, that can offer granular insights into a business’s liquidity. This includes attributes such as:

| Attribute | Description | Value |

| Trade receivable days | Average number of days it takes for a business to be paid by its debtors | (Trade receivables value / sales) * 365 |

| Trade payable days | Average number of days it takes for a business to pay its creditors | (Trade payables value / cost of sales, or annual purchases) * 365 |

| Inventory turnover | Average number of days it takes for a business to turn over its inventory | (Average inventory value / cost of sales) * 365 |

| Current asset ratio | Value of current/available assets weighed against current liabilities | (Current assets / current liabilities) |

| Liquid ratio (acid test or quick ratio) | Value of current/available assets, minus inventory, weighed against liabilities. This value is important, as inventory can be hard to sell and convert to cash. | (Current assets – inventory) / current liabilities) |

Collecting more granular data points means you gain a deeper understanding of your borrowers’ overall financial health, which can help you make smarter, faster credit decisions, streamline your origination and onboarding processes, and reduce your overall risk, all while lowering your operational costs.

Are SMBs actually willing to share their accounting data?

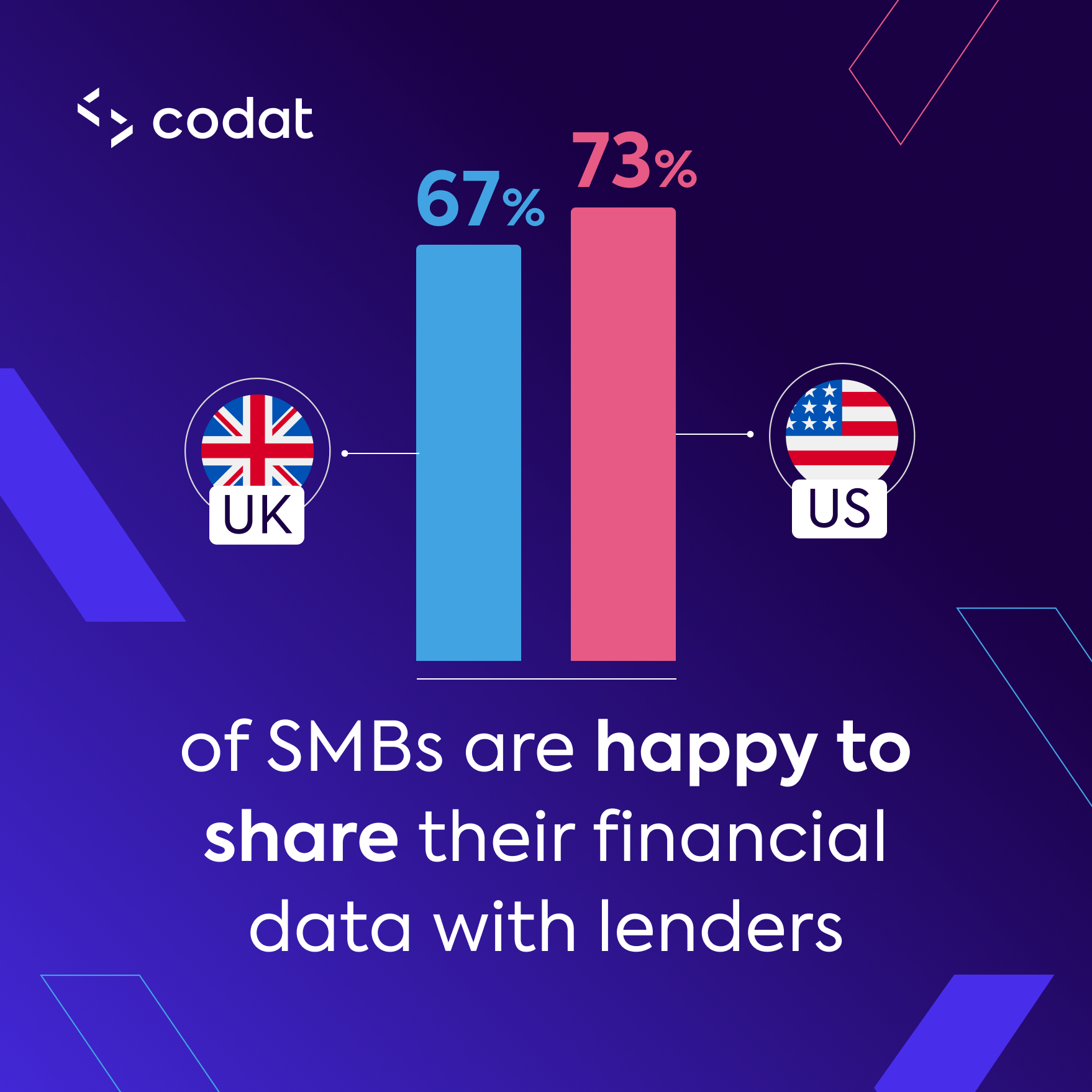

In a nutshell, yes. 73% of US-based SMBs would be happy to share their financial data with lenders in exchange for a faster, easier application process and more affordable credit products. In the UK, 67% of businesses are willing to do the same, and that number jumps exponentially as a business grows—to 90% for those with more than 10 employees, and to 96% for those with more than 50.

Why are businesses so motivated to share their financial data? Among other incentives, the SMBs we surveyed reported that they’re interested in the better interest rates (27%), faster and more convenient credit access (24%), and lower application costs (22%) that only accounting integrations can provide.

That’s the benefit for them. For you, automated, integrated accounting data means you can:

- Confidently expand your market

- Build next-level financial solutions

- Improve your borrower engagement and retention rates

- Optimize your cost-to-income ratio

- Better position your business to weather a challenging economic climate

But don’t just take our word for it. We spoke to Martin McCann, CEO & Co-Founder of Trade Ledger, to get their take on things.

“Accounting data is crucial in assessing the liquidity of all businesses, regardless of size. With the quality of data now available, lenders can provide personalized working capital products at scale and even adjust funding availability automatically during periods of growth or downturn, all without increasing risk or headcount.”

Martin McCann, CEO & Co-Founder of Trade Ledger

How Codat supports your business

With Codat, you can build just once to our platform and instantly unlock access to all of the accounting, banking, and commerce data you need to make smarter, faster credit decisions—regardless of the software your SMB customers are using.

To learn more about how we help banks, lenders, and fintechs enhance their underwriting, read up on our Lending API. You can also register for a free account to begin exploring our platform for yourself—or reach out to one of our data experts to get your questions answered.